Alex is currently considering to invest his money in one of the companies between Company A and Company B. The summarized final accounts of the companies for their last completed financial year are as follows: (refer to the images) Required: a. Calculate the following ratios for Company A and Company B. State clearly the formulae used for each ratio: i. Gross Profit Margin ii. Net Profit Margin iii. Inventory Turnover Period (days)

Alex is currently considering to invest his money in one of the companies between Company A and Company B. The summarized final accounts of the companies for their last completed financial year are as follows: (refer to the images) Required: a. Calculate the following ratios for Company A and Company B. State clearly the formulae used for each ratio: i. Gross Profit Margin ii. Net Profit Margin iii. Inventory Turnover Period (days)

Managerial Accounting: The Cornerstone of Business Decision-Making

7th Edition

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Chapter15: Financial Statement Analysis

Section: Chapter Questions

Problem 63P: Mike Sanders is considering the purchase of Kepler Company, a firm specializing in the manufacture...

Related questions

Question

Alex is currently considering to invest his money in one of the companies between

Company A and Company B. The summarized

last completed financial year are as follows: (refer to the images)

Required:

a. Calculate the following ratios for Company A and Company B. State clearly the

formulae used for each ratio:

i. Gross Profit Margin

ii. Net Profit Margin

iii. Inventory Turnover Period (days)

iv. Receivables Collection Period (days)

v. Payables Payment Period (days)

vi.

vii. Quick Ratio

b. Comment on each of the ratios calculated in part (a) above.

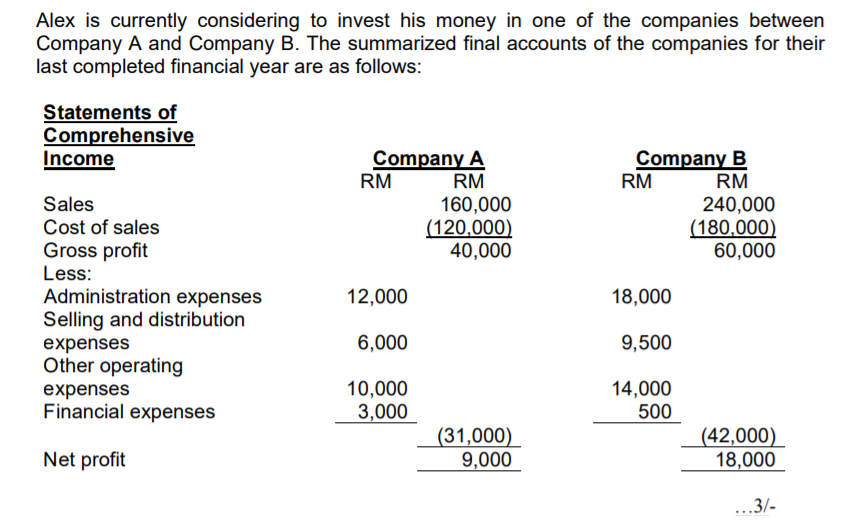

Transcribed Image Text:Alex is currently considering to invest his money in one of the companies between

Company A and Company B. The summarized final accounts of the companies for their

last completed financial year are as follows:

Statements of

Comprehensive

Income

Company A

RM

RM

Company B

RM

RM

Sales

160,000

(120,000)

40,000

240,000

(180,000)

60,000

Cost of sales

Gross profit

Less:

Administration expenses

Selling and distribution

12,000

18,000

6,000

9,500

expenses

Other operating

expenses

Financial expenses

10,000

3,000

14,000

500

(31,000)

9,000

(42,000)

18,000

Net profit

..3/-

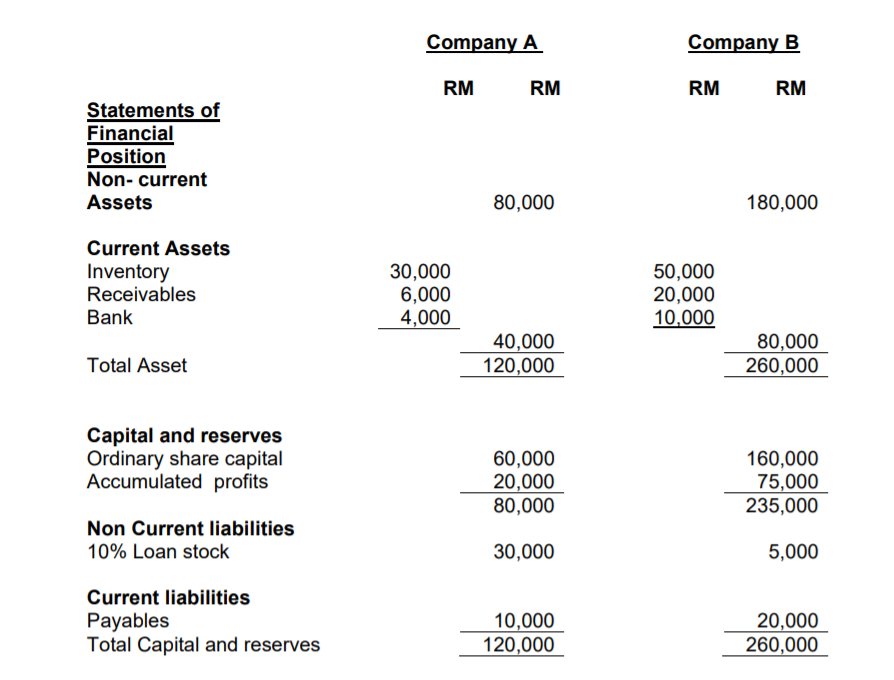

Transcribed Image Text:Company A

Company B

RM

RM

RM

RM

Statements of

Financial

Position

Non- current

Assets

80,000

180,000

Current Assets

Inventory

Receivables

30,000

6,000

4,000

50,000

20,000

10,000

Bank

40,000

120,000

80,000

260,000

Total Asset

Capital and reserves

Ordinary share capital

Accumulated profits

60,000

20,000

80,000

160,000

75,000

235,000

Non Current liabilities

10% Loan stock

30,000

5,000

Current liabilities

Payables

Total Capital and reserves

10,000

20,000

120,000

260,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning