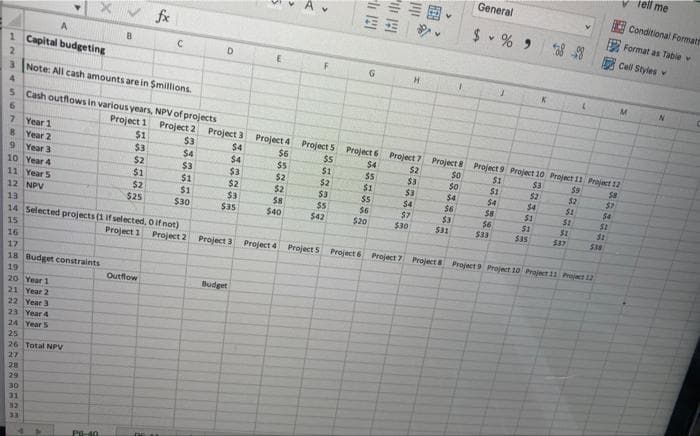

Using the attached template answer the following question. (Note that the data from P06_40.xlsx is already in the excel sheet) You are given a group of possible investment projects for your company’s capital. For each project, you are given the NPV the project would add to the firm, as well as the cash outflow required by each project during each year. Given the information in the file P06_40.xlsx, determine the investments that maximize the firm’s NPV. The firm has $25 million available during each of the next five years. All numbers are in millions of dollars.

Using the attached template answer the following question. (Note that the data from P06_40.xlsx is already in the excel sheet) You are given a group of possible investment projects for your company’s capital. For each project, you are given the NPV the project would add to the firm, as well as the cash outflow required by each project during each year. Given the information in the file P06_40.xlsx, determine the investments that maximize the firm’s NPV. The firm has $25 million available during each of the next five years. All numbers are in millions of dollars.

Practical Management Science

6th Edition

ISBN:9781337406659

Author:WINSTON, Wayne L.

Publisher:WINSTON, Wayne L.

Chapter7: Nonlinear Optimization Models

Section7.6: Models For Rating Sports Teams

Problem 28P

Related questions

Question

100%

Using the attached template answer the following question. (Note that the data from P06_40.xlsx is already in the excel sheet)

You are given a group of possible investment projects for your company’s capital. For each project, you are given the

Transcribed Image Text:LE3458122322258

1 Capital budgeting

7 Year 1

8 Year 2

Year 3

10 Year 4

11 Year 5

12 NPV

16

17

18 Budget constraints

19

20 Year 1

21 Year 2

A

22 Year 3

23 Year 4

24 Year 5

27

Note: All cash amounts are in $millions.

29

Cash outflows in various years, NPV of projects

Project 1

$1

26 Total NPV

30

x ✓ fx

14 Selected projects (1 if selected, 0 if not)

Þ

B

PG-40

555552

$3

$2

$1

$2

C

Outflow

DR A

Project 2 Project 3 Project 4

$3

$4

$4

$4

555555

$3

$1

$1

$30

D

Project 1 Project 2 Project 3

$3

$2

$3

$35

Budget

E

*******

$6

$5

$2

$2

$8

$40

******

$1

$2

$3

$5

- 12

Project 5 Project 6 Project 7 Project 8 Project 9 Project 10 Project 11 Project 12

$5

$2

$0

$9

$8

$42

G

**555*

$4

$5

$1

H

$5

$6

$20

55555

$3

$3

$4

$7

$30

$0

$4

$6

$3

$31

General

$%9

$1

$1

$4

265333E

$8

$33

$6

fun.cc5

$3

$2

$4

$1

$35

$1

538-28

$2

$1

$1

$1

$37

Project 4 Project 5 Project 6 Project 7 Project 8 Project 9 Project 10 Project 11 Project 12

$7

54

$2

$1

538

M

Tell me

Conditional Formatt

Format as Table

Cell Styles

N

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 4 images

Recommended textbooks for you

Practical Management Science

Operations Management

ISBN:

9781337406659

Author:

WINSTON, Wayne L.

Publisher:

Cengage,

Practical Management Science

Operations Management

ISBN:

9781337406659

Author:

WINSTON, Wayne L.

Publisher:

Cengage,