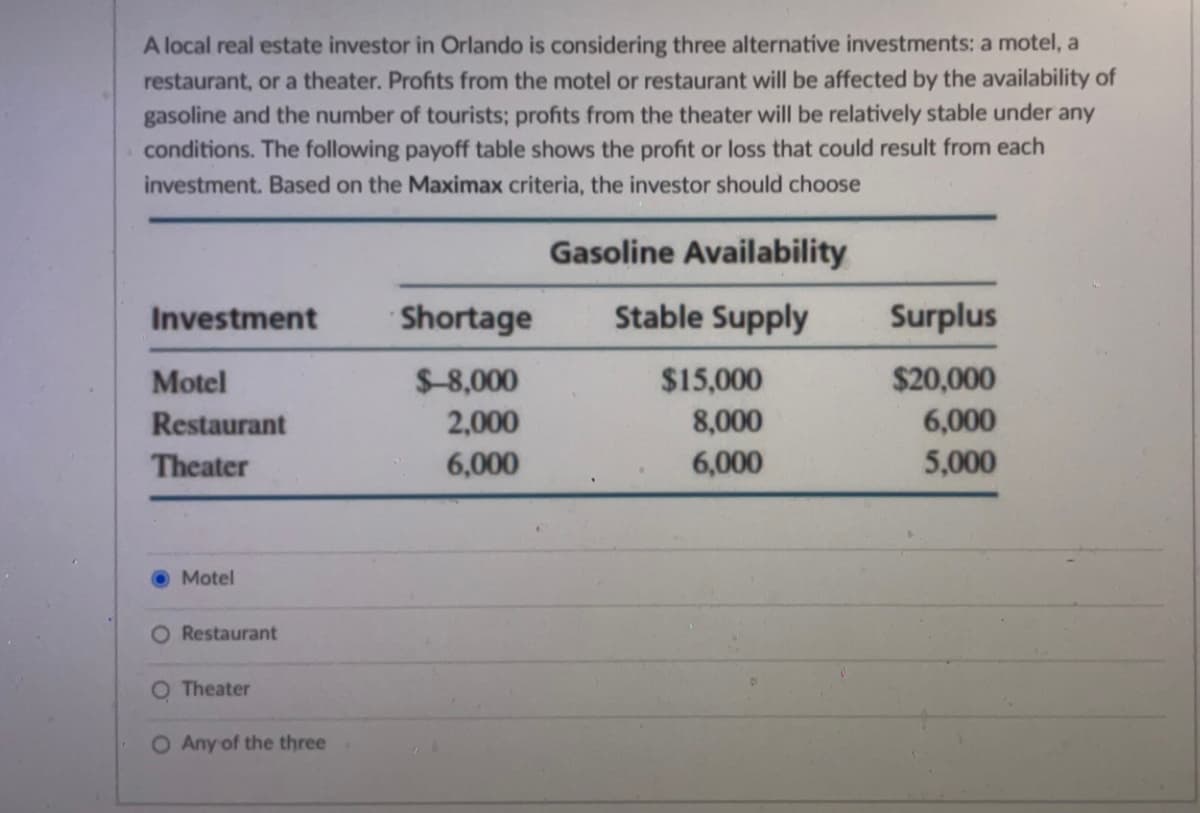

For the Orlando real estate investment problem, assume the probabilities for the gasoline shortage, stable supply and surplus are .5, .3 and .2, then compute the expected payoff of choosing theater, it is (type number only, no decimals, no dollar sign)

Q: 1. A manager wants to determine the number of containers to use for incoming parts for a kanban…

A: The detailed solution is given in Step 2.

Q: James Beerd bakes cheesecakes and Black Forest cakes. During any month, he can bake at most 65…

A:

Q: 1. Job is on a low cholesterol diet. During lunch at the LST canteen, he always chooses between two…

A: Given data is Pasta Tofu Required per month Proteins 8g 16g 180g Carbohydrates 55g 38g 930…

Q: Each supplier has a limited capacity in terms of the total number of components it can supply.…

A: Find the Given details below: Given details: Component Supplier 1 2 3 Production plan 1…

Q: Using the provided template, show the steps to get the solution. During each four-hour period, the…

A: Objective Functions and Constraints: Based on the given details, the objective…

Q: The manager of the Petroco Service Station wants to forecast the demand for unleaded gasoline next…

A: Given data:

Q: The aim of the objective function for Kevin should be to Maximize/Minimize the objective value?

A: Linear programming is a mathematical technique that is also used in operations management…

Q: Mid-West Publishing Company publishes college textbooks. The company operates an 800 telephone…

A: The question is related to the Probability. The details are given regarding the same.

Q: d Angela Pasaic spent e Southwest. While at the ey made use of their co Opened their plant in Ne…

A: 1) Linear programming formulation: Decision variables X be the number of batches of larger and…

Q: CASE 2. "The Possibility"Restaurant Angela Fox and Zooey Caulfield were food and nutrition majors at…

A:

Q: Identify two action item you intend to take forward into the workplace.

A: Business management can be stated as the collaboration and the arrangement of the business…

Q: A company produces two types of tables, T1 and T2. It takes 2 hours to produce the parts of one unit…

A:

Q: Required: 3. Identify and explain the shadow prices for each of the resource constraints. 4. Which…

A: Linear programming is a mathematical technique that is also used in operations management…

Q: You have been selected as a postgraduate student to be a part of a conference with your President…

A: Operation management in an organization plays an important role because it helps higher authorities…

Q: CASE 2. "The Possibility"Restaurant Angela Fox and Zooey Caulfield were food and nutrition majors at…

A: Objective Functions and Constraints: Based on the given details, the objective…

Q: Question 4 Sunny Tailors has been asked to make three different types of wedding suits for separate…

A:

Q: a) Is this a balanced problem? b) Obtain the initial tableau for the transportation problem

A: The transportation model is used to calculate the minimum cost of the route by selecting different…

Q: 1. Compute the throughput time. (Round your answer to 1 decimal place.) 2. Compute the manufacturing…

A: Production is the process in which inputs are combined to have the required output. It includes a…

Q: What is the difference between power and authority? Is it possible for a person to have formal…

A: Power: Power can be stated as the capability or prospects or potential of a person to impact or…

Q: Discuss ANY FOUR (4) important supply chain processes and provide examples.

A: A supply chain system is a web between an organization and distributors to deliver finished goods to…

Q: 2. Two suppliers of products are available to supply the needs of four supermarkets. Each supplier…

A: Find the Given details below: Given details: From To Super Market A Super Market B Super…

Q: Required: Find the maximum value for profits and the number of materials produced from televisions…

A: Linear programming is a mathematical technique that is also used in operations management…

Q: a. Define the variables used and formulate the linear programming model for this problem..

A: Linear programming is a mathematical technique that is also used in operations management…

Q: A trucking firm handles four commodities for a particular distributor. Total shipments for the…

A:

Q: CASE 2. "The Possibility"Restaurant Angela Fox and Zooey Caulfield were food and nutrition majors at…

A: Objective Functions and Constraints: Based on the given details, the objective…

Q: Discuss five (5) challenges in setting goals

A: Organizations like Summerwood Hotel today are focused upon delivering the best commodities to their…

Q: Identify three (3) Cost Drivers that may impact the costs incurred in the airline industry in the…

A: The airline industry provides transportation services through airlines to the customers in exchange…

Q: 1) Find the time to complete this project assuming the given duration of each task is constant.…

A: A network diagram related to the project shows the sequence of the task that is performed to…

Q: social responsibility bring to t

A: A rising number of customers and workers want companies to demonstrate social responsibility and…

Q: Q5: Reduce the following project activity Normal Time Cost 1-2 3 300 2-3 6 480 7 2100 8 400 4 320 5…

A: The question is related to Crashing of Project. Project Crashing deal with those situations which…

Q: ng risks? An example might

A: Project risk management is the process of identifying potential risks to a project and formulating…

Q: Discuss five benefits that come from using the principles that are applied in Network Logistics by…

A: Logistics directs the all-around process of controlling how resources are received, stored, &…

Q: For the Petroco Service Station problem, what would your excel file that shows exponentially…

A: Forecasting is a technique used to predict future outcomes on the basis of past data. In businesses…

Q: Is there a connection between supply chain KPIs and the activities that drive those data?

A: Supply chain KPIs:- Supply Chain Key Performance Indicators (KPIs) are metrics used to measure and…

Q: The Texas Consolidated Electronics Company is contemplating a research and development program…

A: As given in the question write-up, the decision variables are xi. If xi=1, the project i would be…

Q: Gillette is launching a new and improved razor for men. Market research has concluded that the…

A: Given data is Awareness rate = 80% Trial rate = 60% ACV = 80% Target market = 100,000,000 Units per…

Q: inute to check a pati A doctor spends 10 r

A: Given: Receptionist takes 1min nurse takes 2mins Doctor spends 10mins staff member takes 3mins

Q: Efficient inventory management is important to a company mainly because of the position of…

A: Inventory management is described as the means and ways through which manufacturing inventory can be…

Q: 1. When is the best time to do the cycle count? and give examples of cycle count methodologies.

A: The cycle count method provides the correct amount of stock available in the warehouse. This method…

Q: The manager of a Burger Doodle franchise wants to determine how many sausage biscuits and ham…

A: Objective Functions and Constraints: Based on the given details, the objective…

Q: Inc. of trade names. However, does not manu every component used in its products. Several ures home…

A: Given data: Producer's risk of 0.10 when Po= 0.05 Consumer's risk of 0.20 when P1 =0.30 Sample size…

Q: How might globalization be a problem for a successful national company that is intent on going…

A: Globalization refers to the process by which a company or organization expands its function,…

Q: o err? What are the different kinds of errors?

A: The term "err" represents errors. In operation management few of the normal terms used to portray…

Q: 9 438 18 482 a. Explain why an averaging technique would not be appropriate for forecasting. b. Use…

A: Forecasting is an important part of any business. It helps to predict future demand and production…

Q: n use any 5 (FIVE) quality dimensions to differentiate a product

A: To be of high quality means to be free from defects, shortages, and major variations, as well as to…

Q: If t f the Edwards production plan for the next period includes 900 units of component 1 and 700…

A: The transportation model is used to calculate the minimum cost of the route by selecting different…

Q: As the assistant manager of a restaurant, how many servers will you need given the following…

A: Given data: Demand = 91 dinners per hour Server target utilization = 90 % = 0.90 Service rate per…

Q: ntries on a 24/7 basis. Often these executives do not have a deep cultural or social understanding…

A: Communication is fundamental for navigation and arranging. It empowers the administration to get…

Q: What is ABC Classification?

A: For companies that deal with large volumes of inventory, it’s useful to find a method to classify…

Q: discuss the 8 principles of a Quality Management Systems, utilising practical examples for each…

A: Total Quality Management often called TQM can be stated as the management technique based on the…

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 5 images

- Seas Beginning sells clothing by mail order. An important question is when to strike a customer from the companys mailing list. At present, the company strikes a customer from its mailing list if a customer fails to order from six consecutive catalogs. The company wants to know whether striking a customer from its list after a customer fails to order from four consecutive catalogs results in a higher profit per customer. The following data are available: If a customer placed an order the last time she received a catalog, then there is a 20% chance she will order from the next catalog. If a customer last placed an order one catalog ago, there is a 16% chance she will order from the next catalog she receives. If a customer last placed an order two catalogs ago, there is a 12% chance she will order from the next catalog she receives. If a customer last placed an order three catalogs ago, there is an 8% chance she will order from the next catalog she receives. If a customer last placed an order four catalogs ago, there is a 4% chance she will order from the next catalog she receives. If a customer last placed an order five catalogs ago, there is a 2% chance she will order from the next catalog she receives. It costs 2 to send a catalog, and the average profit per order is 30. Assume a customer has just placed an order. To maximize expected profit per customer, would Seas Beginning make more money canceling such a customer after six nonorders or four nonorders?A project faces uncertainty about the number of users of the service to be provided. It might be 10, 20, or 40 with probabilities 0.3, 0.5, and 0.2, respectively. There are two options, A and B. Under option A, the value per user is $10. Under option B, the value per user is $5 with probability 0.4 and otherwise $20. Assume the number of users and the value per user under option A are independent. Option A costs $100 and option B costs $250. a. Set up the table b. What are the expected values for each option? c. What is the value of perfect information before the decision is made? d. Suppose the decision maker could, for a price, determine whether value per user would be 5 or 20 under option B, tough you would learn nothing about the number of users. What is the value of that information?A small strip-mining coal company is trying to decide whether it should purchase or lease a new clamshell. If purchased, the “shell” will cost $152,500 and is expected to have a $50,000 salvage value after 6 years. Alternatively, the company can lease a clamshell for only $16,000 per year, but the lease payment will have to be made at the beginning of each year. If the clamshell is purchased, it will be leased to other strip-mining companies whenever possible, an activity that is expected to yield revenues of $9,000 per year. If the company’s MARR is 13% per year, should the clamshell be purchased or leased on the basis of a future worth analysis? Assume the annual M&O cost is the same for both options. The future worth when purchased is $ The future worth when leased is $

- Place-Plus, a real estate development firm, is considering several alternative development projects. These include building and leasing an office park, purchasing a parcel of land, and building an office building to rent, buying and leasing a warehouse, building a strip mall, and building and selling condominiums. The financial success of these projects depends on interest rate movement in the next 5 years. The various development projects and their 5-year financial return (in €1,000,000s) given that interest rates will decline, remain stable, or increase, are shown in the following image of the payoff table: a) Place-Plus is dissatisfied with the economist’s estimate of the probabilities of future interest rate movement, so it is considering having a financial consulting firm provide a report on future interest rates. The consulting firm can cite a track record which shows that 80% of the time when interest rates declined, it had predicted they would, whereas 10% of the time when…Maximus Steel plans to introduce one of three new products code-named: Wren, Hawk, and Nightingale. The marketing department indicated that the success of any product depends on the market conditions (Favorable, Neutral, or Unfavorable). The profit the company will earn also depends on the market conditions. The table below shows the probability estimated for each market condition and the profits Maximus Steel will realize within those conditions: Product Code Market Conditions Favorable P = 0.2 Neutral P = 0.7 Unfavorable P = 0.1 Wren $120,000 $70,000 ($30,000) Hawk $60,000 $40,000 $20,000 Nightingale $35,000 $30,000 $30,000 Maximus Steel is considering hiring a market research firm to do a survey to determine future market conditions. The results of the survey will indicate either positive or negative market conditions. There is a 0.60 probability of a positive report, given favorable conditions; a 0.30 probability of a positive…Maximus Steel plans to introduce one of three new products code-named: Wren, Hawk, and Nightingale. The marketing department indicated that the success of any product depends on the market conditions (Favorable, Neutral, or Unfavorable). The profit the company will earn also depends on the market conditions. The table below shows the probability estimated for each market condition and the profits Maximus Steel will realize within those conditions: Product Code Market Conditions Favorable P = 0.2 Neutral P = 0.7 Unfavorable P = 0.1 Wren $120,000 $70,000 ($30,000) Hawk $60,000 $40,000 $20,000 Nightingale $35,000 $30,000 $30,000 Part 1 Instructions: Develop the opportunity loss table and compute the expected opportunity loss for each product.

- Rand Enterprises is considering a number of investment possibilities. Specifically, each investment under consideration will draw on the capital account during each of its first three years, but in the long run, each is predicted to achieve a positive net present value (NPV). Listed here are the investment alternatives, their net present values, and their capital requirements, and all figures are in millions of dollars. In addition, the amount of capital available to the investments in each of the next three years is predicted to be $20 million, $12 million, and $20 million, respectively. Project One-PhaseExpansion Two-PhaseExpansion TestMarket AdvertisingCampaign BasicResearch PurchaseEquipment NPV 5.0 8.1 11.6 5.3 10.4 4.2 Year 1 Capital 3.6 3.0 7.2 2.4 6.0 1.2 Year 2 Capital 1.2 4.2 4.8 1.8 1.2 0.6 Year 3 Capital 4.8 4.2 6.0 2.2 4.8 1.1 In addition, the following constraints have to be met: a. The expansion investments are mutually exclusive and only one of…Brooke Bentley, a student in business administration, is trying to decide which management science course to take next quarter—I, II, or III. “Steamboat” Fulton, “ Death” Ray, and “Sadistic” Scott are the three management science professors who teach the courses. Brooke does not know who will teach what course. Brooke can expect a different grade in each of the courses, depending on who teaches it next quarter, as shown in the following payoff table: Professor Course Fulton Ray Scott I B D D II C B F III F A…A company is considering two options for supplying a product to three markets, Markets 1, 2, and 3, with uncertain demands. The demand in each of the three markets can be either 50 units (high demand) or 10 units (low demand). The probabilities for Market 1 to have high and low demands are equal to 0.5 and 0.5, respectively. The probabilities for Market 2 to have high and low demands are equal to 0.6 and 0.4, respectively. The probabilities for Market 3 to have high and low demands are equal to 0.25 and 0.75, respectively. With the first supply option, the company will use three local warehouses, one to supply each market (the decentralized strategy). Each local warehouse will keep 28 units of inventory. (Therefore, the total inventory under the first supply option is equal to 84 units.) With the second supply option, the company will use a central warehouse to supply the three markets (the centralized strategy). The central warehouse will keep 84 units of inventory (so that the two…

- Michael is the marketing executive of SHOPEE and he is planning to launch the 2.2.22 online SALE through price discounts, either 40% off or 20% off. He also learned that SHOPEE closest competitor LAZADA , is planning to promote also a 2.22.22 online SALE with price discounts , either 50% off or 30% off. If SHOPEE launches the 40% off, it will gain nothing. If LAZADA launches the 50% off or gain 8,000,000 if LAZADA launches the 30% off. If SHOPEE launches the 20% off, it will lose 2,000,000 if LAZADA launches the 50% off or lose 5,000,000 if LAZADA launches the 30% off. 1.Which strategy is dominated by SHOPEE depending on strategy of LAZADA? A. 50% OFF B. 40% OFF C. 20% OFF D. 30% OFF E. NONE 2.What should be the strategy of LAZADA? A. 50% OFF B. 40% OFF C. 30% OFF D. 20% OFFA firm that plans to expand its product line must decide whether to build a small or a large facilityto produce the new products. If it builds a small facility and demand is low, the net present valueafter deducting for building costs will be $400,000. If demand is high, the firm can either maintainthe small facility or expand it. Expansion would have a net present value of $450,000, and maintaining the small facility would have a net present value of $50,000.If a large facility is built and demand is high, the estimated net present value is $800,000. If demandturns out to be low, the net present value will be – $10,000.The probability that demand will be high is estimated to be .60, and the probability of low demandis estimated to be .40.a. Analyze using a tree diagram.A firm that plans to expand its product line must decide whether to build a small or a large facilityto produce the new products. If it builds a small facility and demand is low, the net present valueafter deducting for building costs will be $400,000. If demand is high, the firm can either maintainthe small facility or expand it. Expansion would have a net present value of $450,000, and maintaining the small facility would have a net present value of $50,000.If a large facility is built and demand is high, the estimated net present value is $800,000. If demandturns out to be low, the net present value will be – $10,000.The probability that demand will be high is estimated to be .60, and the probability of low demandis estimated to be .40. 1- Compute the EVPI 2- Determine the range over which each alternative would be best in terms of the value of P ( low demand )