Using the data above, give the journal entries required to record each of the following cases. (Each situation is independent.) To obtain additional cash, Martinez factors without recourse $29,200 of accounts receivable with Stills Finance. The finance charge is 12% of the amount factored. 1. To obtain a 1-year loan of $57,500, Martinez pledges $71,400 of specific receivable accounts to Crosby Financial. The finance charge is 8% of the loan; the cash is received and the accounts turned over to Crosby Financial. 2. 3. The company wants to maintain the Allowance for Doubtful Accounts at 7% of gross accounts receivable. 4. Based on an aging analysis, an allowance of $5,717 should be reported. Assume the allowance has a credit balance of $998.

Using the data above, give the journal entries required to record each of the following cases. (Each situation is independent.) To obtain additional cash, Martinez factors without recourse $29,200 of accounts receivable with Stills Finance. The finance charge is 12% of the amount factored. 1. To obtain a 1-year loan of $57,500, Martinez pledges $71,400 of specific receivable accounts to Crosby Financial. The finance charge is 8% of the loan; the cash is received and the accounts turned over to Crosby Financial. 2. 3. The company wants to maintain the Allowance for Doubtful Accounts at 7% of gross accounts receivable. 4. Based on an aging analysis, an allowance of $5,717 should be reported. Assume the allowance has a credit balance of $998.

College Accounting, Chapters 1-27

23rd Edition

ISBN:9781337794756

Author:HEINTZ, James A.

Publisher:HEINTZ, James A.

Chapter16: Accounting For Accounts Receivable

Section: Chapter Questions

Problem 9SPA: UNCOLLECTIBLE ACCOUNTSPERCENTAGE OF SALES AND PERCENTAGE OF RECEIVABLES At the completion of the...

Related questions

Question

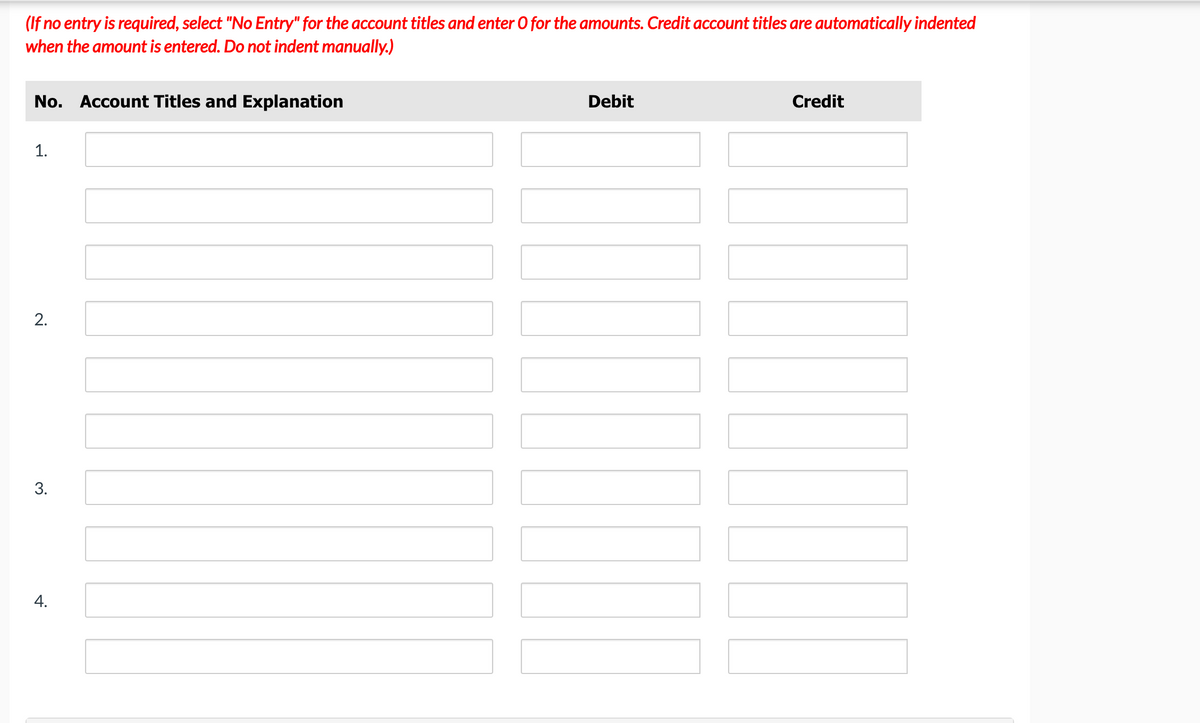

Transcribed Image Text:(If no entry is required, select "No Entry" for the account titles and enter O for the amounts. Credit account titles are automatically indented

when the amount is entered. Do not indent manually.)

No. Account Titles and Explanation

Debit

Credit

1.

3.

4.

2.

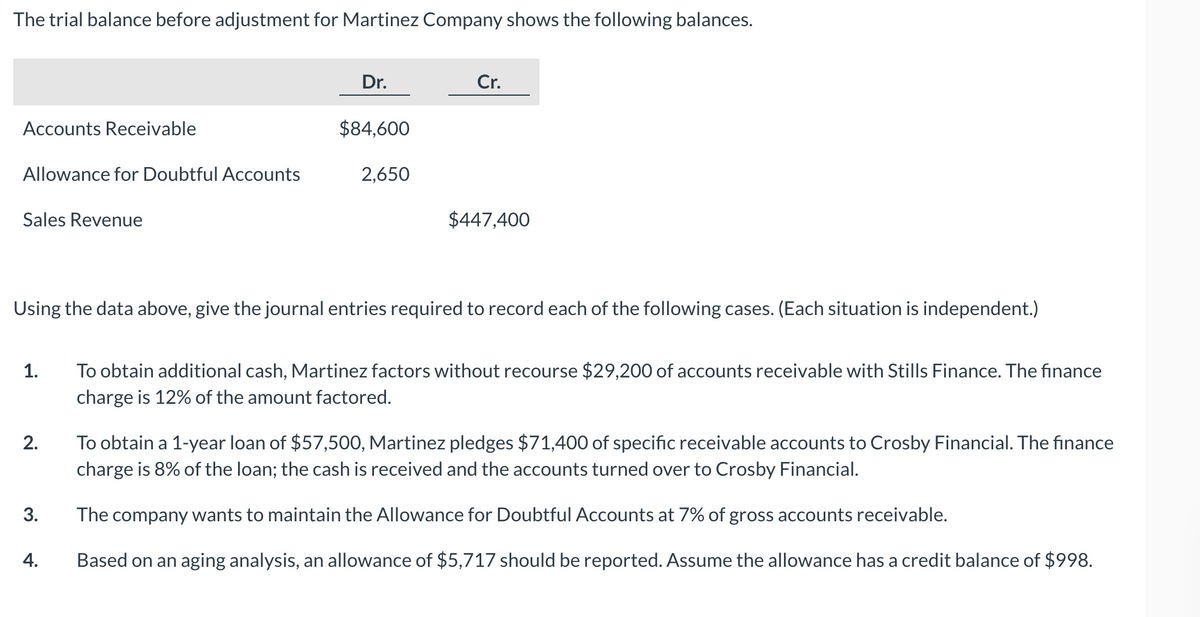

Transcribed Image Text:The trial balance before adjustment for Martinez Company shows the following balances.

Dr.

Cr.

Accounts Receivable

$84,600

Allowance for Doubtful Accounts

2,650

Sales Revenue

$447,400

Using the data above, give the journal entries required to record each of the following cases. (Each situation is independent.)

1.

To obtain additional cash, Martinez factors without recourse $29,200 of accounts receivable with Stills Finance. The finance

charge is 12% of the amount factored.

2.

To obtain a 1-year loan of $57,500, Martinez pledges $71,400 of specific receivable accounts to Crosby Financial. The finance

charge is 8% of the loan; the cash is received and the accounts turned over to Crosby Financial.

The company wants to maintain the Allowance for Doubtful Accounts at 7% of gross accounts receivable.

4.

Based on an aging analysis, an allowance of $5,717 should be reported. Assume the allowance has a credit balance of $998.

3.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Recommended textbooks for you

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College