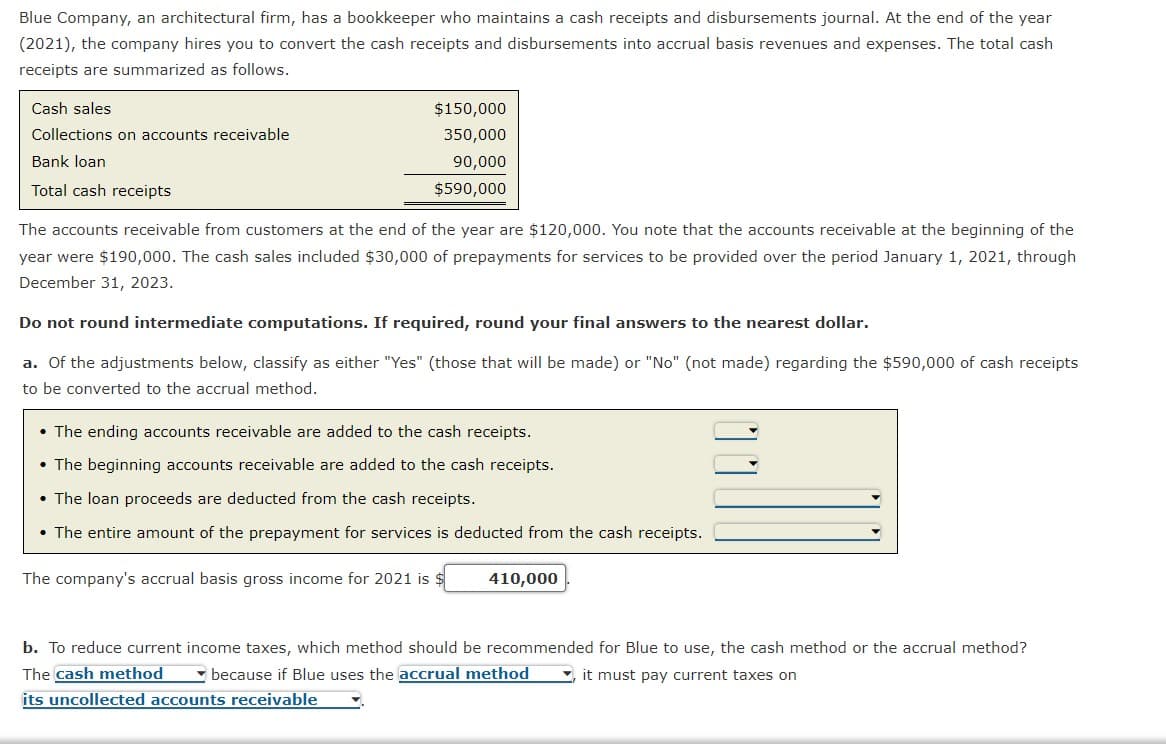

Blue Company, an architectural firm, has a bookkeeper who maintains a cash receipts and disbursements journal. At the end of the year (2021), the company hires you to convert the cash receipts and disbursements into accrual basis revenues and expenses. The total cash receipts are summarized as follows. Cash sales $150,000 Collections on accounts receivable 350,000 Bank loan 90,000 Total cash receipts $590,000 The accounts receivable from customers at the end of the year are $120,000. You note that the accounts receivable at the beginning of the year were $190,000. The cash sales included $30,000 of prepayments for services to be provided over the period January 1, 2021, through December 31, 2023. Do not round intermediate computations. If required, round your final answers to the nearest dollar. a. Of the adjustments below, classify as either "Yes" (those that will be made) or "No" (not made) regarding the $590,000 of cash receipts to be converted to the accrual method. • The ending accounts receivable are added to the cash receipts. • The beginning accounts receivable are added to the cash receipts. • The loan proceeds are deducted from the cash receipts. • The entire amount of the prepayment for services is deducted from the cash receipts. The company's accrual basis gross income for 2021 is 410,000

Blue Company, an architectural firm, has a bookkeeper who maintains a cash receipts and disbursements journal. At the end of the year (2021), the company hires you to convert the cash receipts and disbursements into accrual basis revenues and expenses. The total cash receipts are summarized as follows. Cash sales $150,000 Collections on accounts receivable 350,000 Bank loan 90,000 Total cash receipts $590,000 The accounts receivable from customers at the end of the year are $120,000. You note that the accounts receivable at the beginning of the year were $190,000. The cash sales included $30,000 of prepayments for services to be provided over the period January 1, 2021, through December 31, 2023. Do not round intermediate computations. If required, round your final answers to the nearest dollar. a. Of the adjustments below, classify as either "Yes" (those that will be made) or "No" (not made) regarding the $590,000 of cash receipts to be converted to the accrual method. • The ending accounts receivable are added to the cash receipts. • The beginning accounts receivable are added to the cash receipts. • The loan proceeds are deducted from the cash receipts. • The entire amount of the prepayment for services is deducted from the cash receipts. The company's accrual basis gross income for 2021 is 410,000

Chapter18: Accounting Periods And Methods

Section: Chapter Questions

Problem 46P: Blue Company, an architectural firm, has a bookkeeper who maintains a cash receipts and...

Related questions

Question

a.

Transcribed Image Text:Blue Company, an architectural firm, has a bookkeeper who maintains a cash receipts and disbursements journal. At the end of the year

(2021), the company hires you to convert the cash receipts and disbursements into accrual basis revenues and expenses. The total cash

receipts are summarized as follows.

Cash sales

$150,000

Collections on accounts receivable

350,000

Bank loan

90,000

Total cash receipts

$590,000

The accounts receivable from customers at the end of the year are $120,000. You note that the accounts receivable at the beginning of the

year were $190,000. The cash sales included $30,000 of prepayments for services to be provided over the period January 1, 2021, through

December 31, 2023.

Do not round intermediate computations. If required, round your final answers to the nearest dollar.

a. Of the adjustments below, classify as either "Yes" (those that will be made) or "No" (not made) regarding the $590,000 of cash receipts

to be converted to the accrual method.

• The ending accounts receivable are added to the cash receipts.

• The beginning accounts receivable are added to the cash receipts.

• The loan proceeds are deducted from the cash receipts.

• The entire amount of the prepayment for services is deducted from the cash receipts.

The company's accrual basis gross income for 2021 is $

410,000

b. To reduce current income taxes, which method should be recommended for Blue to use, the cash method or the accrual method?

The cash method

its uncollected accounts receivable

- because if Blue uses the accrual method

it must pay current taxes on

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage