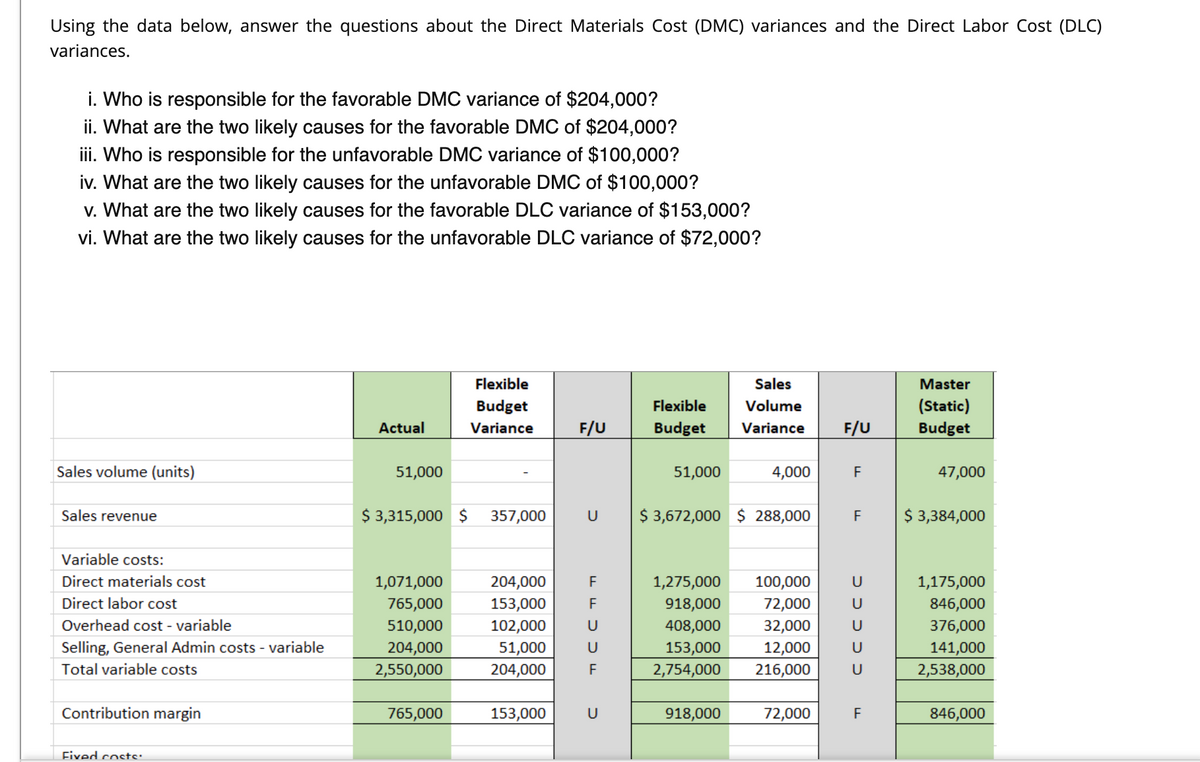

Using the data below, answer the questions about the Direct Materials Cost (DMC) variances and the Direct Labor Cost (DLC) variances. i. Who is responsible for the favorable DMC variance of $204,000? ii. What are the two likely causes for the favorable DMC of $204,000? iii. Who is responsible for the unfavorable DMC variance of $100,000? iv. What are the two likely causes for the unfavorable DMC of $100,000? v. What are the two likely causes for the favorable DLC variance of $153,000? vi. What are the two likely causes for the unfavorable DLC variance of $72,000? Flexible Sales Master Budget Flexible Volume (Static) Actual Variance F/U Budget Variance F/U Budget Sales volume (units) 51,000 51,000 4,000 F 47,000 Sales revenue $ 3,315,000 $ 357,000 $ 3,672,000 $ 288,000 $ 3,384,000 U F Variable costs: Direct materials cost 1,071,000 204,000 F 1,275,000 100,000 U 1,175,000 Direct labor cost 765,000 153,000 F 918,000 72,000 U 846,000 Overhead cost - variable 510,000 102,000 U 408,000 153,000 32,000 U 376,000 Selling, General Admin costs - variable Total variable costs 204,000 2,550,000 141,000 2,538,000 51,000 U 12,000 204,000 F 2,754,000 216,000 U Contribution margin 765,000 153,000 U 918,000 72,000 846,000 Ciuad se.

Using the data below, answer the questions about the Direct Materials Cost (DMC) variances and the Direct Labor Cost (DLC) variances. i. Who is responsible for the favorable DMC variance of $204,000? ii. What are the two likely causes for the favorable DMC of $204,000? iii. Who is responsible for the unfavorable DMC variance of $100,000? iv. What are the two likely causes for the unfavorable DMC of $100,000? v. What are the two likely causes for the favorable DLC variance of $153,000? vi. What are the two likely causes for the unfavorable DLC variance of $72,000? Flexible Sales Master Budget Flexible Volume (Static) Actual Variance F/U Budget Variance F/U Budget Sales volume (units) 51,000 51,000 4,000 F 47,000 Sales revenue $ 3,315,000 $ 357,000 $ 3,672,000 $ 288,000 $ 3,384,000 U F Variable costs: Direct materials cost 1,071,000 204,000 F 1,275,000 100,000 U 1,175,000 Direct labor cost 765,000 153,000 F 918,000 72,000 U 846,000 Overhead cost - variable 510,000 102,000 U 408,000 153,000 32,000 U 376,000 Selling, General Admin costs - variable Total variable costs 204,000 2,550,000 141,000 2,538,000 51,000 U 12,000 204,000 F 2,754,000 216,000 U Contribution margin 765,000 153,000 U 918,000 72,000 846,000 Ciuad se.

Managerial Accounting: The Cornerstone of Business Decision-Making

7th Edition

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Chapter9: Profit Planning And Flexible Budgets

Section: Chapter Questions

Problem 20MCQ: A firm comparing the actual variable costs of producing 10,000 units with the total variable costs...

Related questions

Question

Please answer the following questions using this chart.

Transcribed Image Text:Using the data below, answer the questions about the Direct Materials Cost (DMC) variances and the Direct Labor Cost (DLC)

variances.

i. Who is responsible for the favorable DMC variance of $204,000?

ii. What are the two likely causes for the favorable DMC of $204,000?

iii. Who is responsible for the unfavorable DMC variance of $100,000?

iv. What are the two likely causes for the unfavorable DMC of $100,000?

v. What are the two likely causes for the favorable DLC variance of $153,000?

vi. What are the two likely causes for the unfavorable DLC variance of $72,000?

Flexible

Sales

Master

Budget

Flexible

Volume

(Static)

Actual

Variance

F/U

Budget

Variance

F/U

Budget

Sales volume (units)

51,000

51,000

4,000

47,000

Sales revenue

$ 3,315,000 $ 357,000

U

$ 3,672,000 $ 288,000

$ 3,384,000

F

Variable costs:

Direct materials cost

1,071,000

204,000

1,275,000

100,000

1,175,000

Direct labor cost

765,000

153,000

F

918,000

72,000

846,000

Overhead cost - variable

510,000

102,000

408,000

32,000

376,000

Selling, General Admin costs - variable

204,000

2,550,000

51,000

204,000

153,000

2,754,000

12,000

216,000

141,000

2,538,000

Total variable costs

F

U

Contribution margin

765,000

153,000

U

918,000

72,000

846,000

Fixed costs:

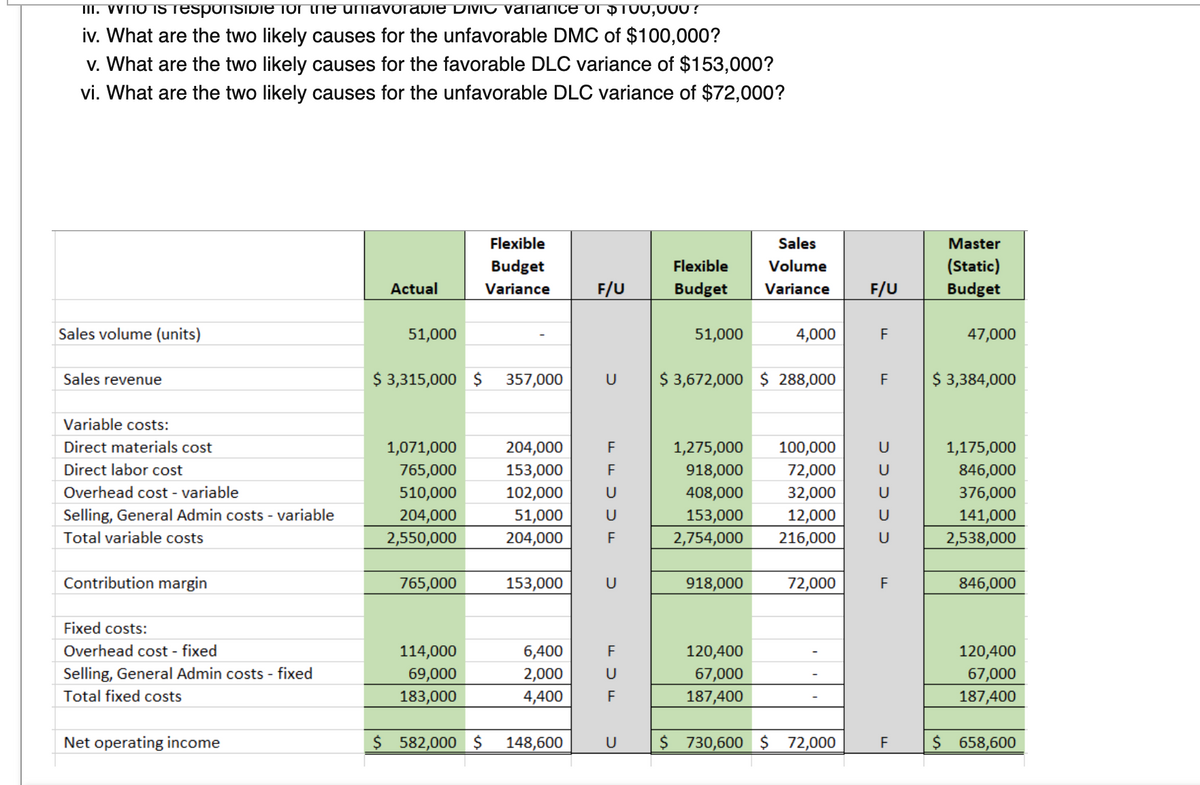

Transcribed Image Text:TII. VVNO IS responsibiIe for the uniavorabie DMC vanance of pT00,000 ?

iv. What are the two likely causes for the unfavorable DMC of $100,000?

v. What are the two likely causes for the favorable DLC variance of $153,000?

vi. What are the two likely causes for the unfavorable DLC variance of $72,000?

Flexible

Sales

Master

Budget

Flexible

Volume

(Static)

Actual

Variance

F/U

Budget

Variance

F/U

Budget

Sales volume (units)

51,000

51,000

4,000

47,000

Sales revenue

$ 3,315,000 $ 357,000

U

$ 3,672,000 $ 288,000

$ 3,384,000

F

Variable costs:

Direct materials cost

1,071,000

204,000

F

1,275,000

100,000

1,175,000

Direct labor cost

765,000

153,000

F

918,000

72,000

846,000

Overhead cost - variable

102,000

408,000

510,000

204,000

2,550,000

32,000

376,000

153,000

2,754,000

Selling, General Admin costs - variable

51,000

U

12,000

216,000

141,000

2,538,000

Total variable costs

204,000

Contribution margin

765,000

153,000

U

918,000

72,000

F

846,000

Fixed costs:

Overhead cost - fixed

114,000

6,400

F

120,400

120,400

Selling, General Admin costs - fixed

69,000

2,000

4,400

U

67,000

187,400

67,000

187,400

Total fixed costs

183,000

Net operating income

$ 582,000 $

148,600

U

$ 730,600 $ 72,000

$ 658,600

ככככ כ

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College