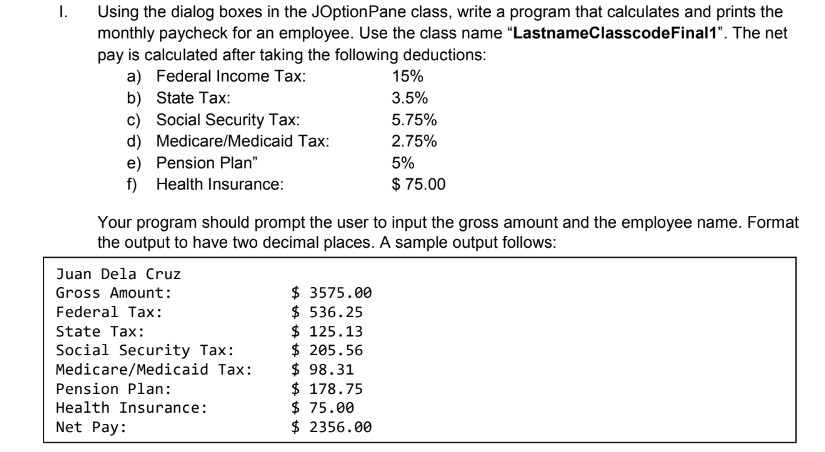

Using the dialog boxes in the JOptionPane class, write a program that calculates and prints the monthly paycheck for an employee. Use the class name "LastnameClasscodeFinal1". The net pay is calculated after taking the following deductions: a) Federal Income Tax: b) State Tax: c) Social Security Tax: 15% 3.5% 5.75% d) Medicare/Medicaid Tax: e) Pension Plan" f) Health Insurance: 2.75% 5% $ 75.00 Your program should prompt the user to input the gross amount and the employee name. Format the output to have two decimal places. A sample output follows:

Using the dialog boxes in the JOptionPane class, write a program that calculates and prints the monthly paycheck for an employee. Use the class name "LastnameClasscodeFinal1". The net pay is calculated after taking the following deductions: a) Federal Income Tax: b) State Tax: c) Social Security Tax: 15% 3.5% 5.75% d) Medicare/Medicaid Tax: e) Pension Plan" f) Health Insurance: 2.75% 5% $ 75.00 Your program should prompt the user to input the gross amount and the employee name. Format the output to have two decimal places. A sample output follows:

C++ Programming: From Problem Analysis to Program Design

8th Edition

ISBN:9781337102087

Author:D. S. Malik

Publisher:D. S. Malik

Chapter11: Inheritance And Composition

Section: Chapter Questions

Problem 6PE

Related questions

Question

helpp me

Transcribed Image Text:1.

Using the dialog boxes in the JOptionPane class, write a program that calculates and prints the

monthly paycheck for an employee. Use the class name "LastnameClasscodeFinal1". The net

pay is calculated after taking the following deductions:

a) Federal Income Tax:

b) State Tax:

c) Social Security Tax:

15%

3.5%

5.75%

d) Medicare/Medicaid Tax:

e) Pension Plan"

f) Health Insurance:

2.75%

5%

$ 75.00

Your program should prompt the user to input the gross amount and the employee name. Format

the output to have two decimal places. A sample output follows:

Juan Dela Cruz

$ 3575.00

$ 536.25

$ 125.13

$ 205.56

$ 98.31

$ 178.75

$ 75.00

$ 2356.00

Gross Amount:

Federal Tax:

State Tax:

Social Security Tax:

Medicare/Medicaid Tax:

Pension Plan:

Health Insurance:

Net Pay:

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, computer-science and related others by exploring similar questions and additional content below.Recommended textbooks for you

C++ Programming: From Problem Analysis to Program…

Computer Science

ISBN:

9781337102087

Author:

D. S. Malik

Publisher:

Cengage Learning

EBK JAVA PROGRAMMING

Computer Science

ISBN:

9781337671385

Author:

FARRELL

Publisher:

CENGAGE LEARNING - CONSIGNMENT

C++ for Engineers and Scientists

Computer Science

ISBN:

9781133187844

Author:

Bronson, Gary J.

Publisher:

Course Technology Ptr

C++ Programming: From Problem Analysis to Program…

Computer Science

ISBN:

9781337102087

Author:

D. S. Malik

Publisher:

Cengage Learning

EBK JAVA PROGRAMMING

Computer Science

ISBN:

9781337671385

Author:

FARRELL

Publisher:

CENGAGE LEARNING - CONSIGNMENT

C++ for Engineers and Scientists

Computer Science

ISBN:

9781133187844

Author:

Bronson, Gary J.

Publisher:

Course Technology Ptr

EBK JAVA PROGRAMMING

Computer Science

ISBN:

9781305480537

Author:

FARRELL

Publisher:

CENGAGE LEARNING - CONSIGNMENT