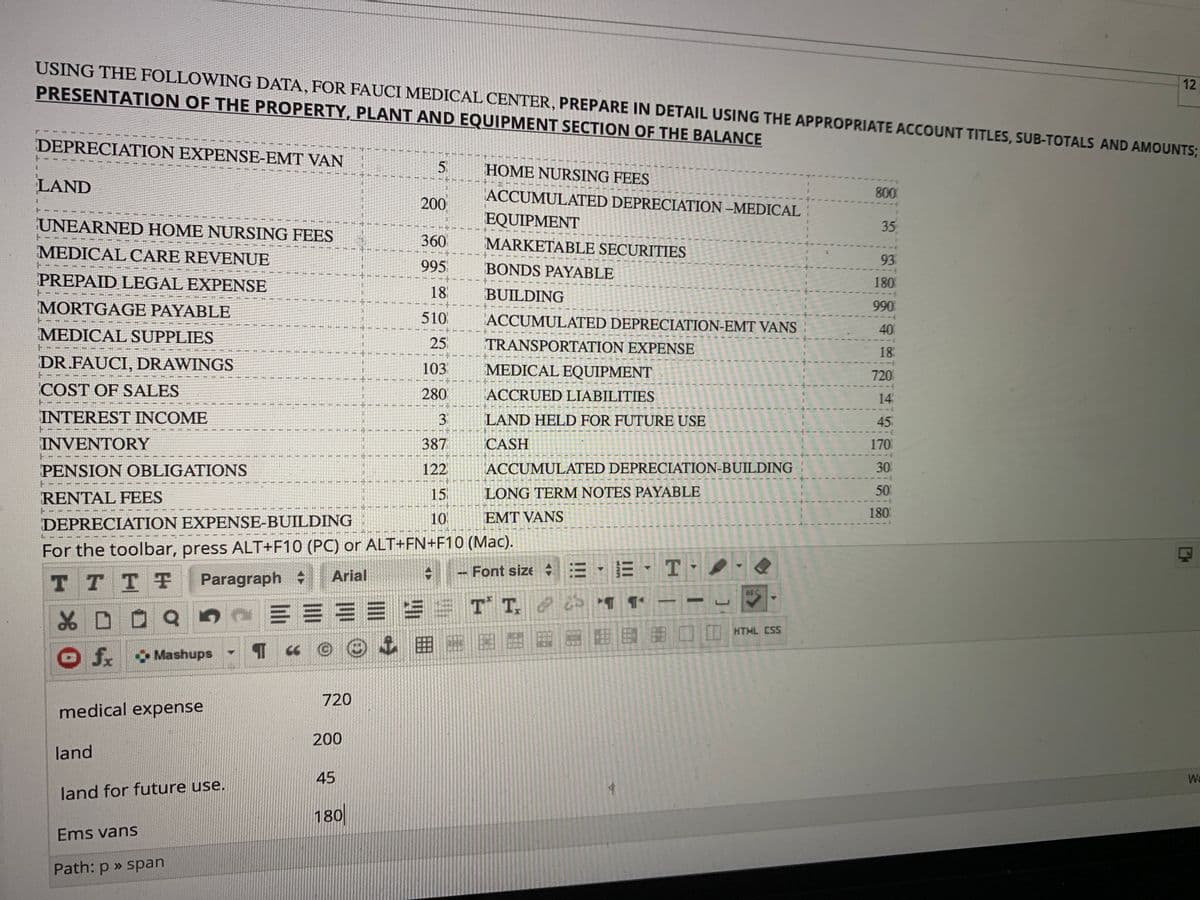

USING THE FOLLOWING DATA, FOR FAUCI MEDICAL CENTER, PREPARE IN DETAIL USING THE APPROPRIATE ACCOUNT TITLES, SUB-TOTALS AND AMOU PRESENTATION OF THE PROPERTY, PLANT AND EQUIPMENT SECTION OF THE BALANCE DEPRECIATION EXPENSE-EMT VAN 5. HOME NURSING FEES LAND 800 ACCUMULATED DEPRECIATION –MEDICAL EQUIPMENT 200 UNEARNED HOME NURSING FEES 35 MEDICAL CARE REVENUE 360 MARKETABLE SECURITIES 93 995 BONDS PAYABLE PREPAID LEGAL EXPENSE 180 18 BUILDING MORTGAGE PAYABLE ----- MEDICAL SUPPLIES 990 510 ACCUMULATED DEPRECIATION-EMT VANS 40 25 TRANSPORTATION EXPENSE 18 DR.FAUCI, DRAWINGS 103 MEDICAL EQUIPMENT 720 ---- COST OF SALES ---- 280 ACCRUED LIABILITIES 14 INTEREST INCOME LAND HELD FOR FUTURE USE 45 INVENTORY 387 CASH 170 PENSION OBLIGATIONS 122 ACCUMULATED DEPRECIATION-BUILDING 30 RENTAL FEES 15 LONG TERM NOTES PAYABLE 50 180 DEPRECIATION EXPENSE-BUILDING 10 EMT VANS For the toolbar, press ALT+F10 (PC) or ALT+FN+F10 (Mac).

USING THE FOLLOWING DATA, FOR FAUCI MEDICAL CENTER, PREPARE IN DETAIL USING THE APPROPRIATE ACCOUNT TITLES, SUB-TOTALS AND AMOU PRESENTATION OF THE PROPERTY, PLANT AND EQUIPMENT SECTION OF THE BALANCE DEPRECIATION EXPENSE-EMT VAN 5. HOME NURSING FEES LAND 800 ACCUMULATED DEPRECIATION –MEDICAL EQUIPMENT 200 UNEARNED HOME NURSING FEES 35 MEDICAL CARE REVENUE 360 MARKETABLE SECURITIES 93 995 BONDS PAYABLE PREPAID LEGAL EXPENSE 180 18 BUILDING MORTGAGE PAYABLE ----- MEDICAL SUPPLIES 990 510 ACCUMULATED DEPRECIATION-EMT VANS 40 25 TRANSPORTATION EXPENSE 18 DR.FAUCI, DRAWINGS 103 MEDICAL EQUIPMENT 720 ---- COST OF SALES ---- 280 ACCRUED LIABILITIES 14 INTEREST INCOME LAND HELD FOR FUTURE USE 45 INVENTORY 387 CASH 170 PENSION OBLIGATIONS 122 ACCUMULATED DEPRECIATION-BUILDING 30 RENTAL FEES 15 LONG TERM NOTES PAYABLE 50 180 DEPRECIATION EXPENSE-BUILDING 10 EMT VANS For the toolbar, press ALT+F10 (PC) or ALT+FN+F10 (Mac).

Financial Accounting

15th Edition

ISBN:9781337272124

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Carl Warren, James M. Reeve, Jonathan Duchac

Chapter10: Long-term Assets: Fixed And Intangible

Section: Chapter Questions

Problem 1PA: The following payments and receipts are related to land, land improvements, and buildings acquired...

Related questions

Question

Transcribed Image Text:USING THE FOLLOWING DATA, FOR FAUCI MEDICAL CENTER, PREPARE IN DETAIL USING THE APPROPRIATE ACCOUNT TITLES, SUB-TOTALS AND AMOUNTS;

12

PRESENTATION OF THE PROPERTY, PLANT AND EQUIPMENT SECTION OF THE BALANCE

DEPRECIATION EXPENSE-EMT VAN

5

HOME NURSING FEES

LAND

ACCUMULATED DEPRECIATION -MEDICAL

800

200

EQUIPMENT

MARKETABLE SECURITIES

UNEARNED HOME NURSING FEES

35

360

MEDICAL CARE REVENUE

93

995

BONDS PAYABLE

PREPAID LEGAL EXPENSE

180

18

BUILDING

MORTGAGE PAYABLE

990

510

ACCUMULATED DEPRECIATION-EMT VANS

MEDICAL SUPPLIES

40

25

TRANSPORTATION EXPENSE

18

DR.FAUCI, DRAWINGS

103

MEDICAL EQUIPMENT

720

COST OF SALES

280

ACCRUED LIABILITIES

14

INTEREST INCOME

3

LAND HELD FOR FUTURE USE

45

INVENTORY

387

CASH

170

PENSION OBLIGATIONS

122

ACCUMULATED DEPRECIATION-BUILDING

30

RENTAL FEES

15

LONG TERM NOTES PAYABLE

50

10

EMT VANS

180

DEPRECIATION EXPENSE-BUILDING

For the toolbar, press ALT+F10 (PC) or ALT+FN+F10 (Mac).

Font size E

= - E · T -

T TTT

Paragraph

Arial

ABC

三= == =

田

T T.

f. Mashups

720

medical expense

200

land

45

Wo

land for future use.

180

Ems vans

Path: p » span

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning