On January 1, 2019 Zhavy Co. leased office furniture from Cherry Co. under operating lease. Payments on the will be made as follows: December 31, 2019 230,000 December 31, 2020 250,000 December 31, 2021 270,000 As an inducement to enter the lease, CHERRY CO. granted ZHAVY CO. the first six months of the lease rent-free. SINAG also paid the following: Initial direct cost 100,000 Security deposit 50,000 Lease Bonus 60,000 Insurance and Maintenance cost 25,000 What amount of rental income should be reported in the income statement of CHERRY CO. for the year ended December 31, 2019?

On January 1, 2019 Zhavy Co. leased office furniture from Cherry Co. under operating lease. Payments on the will be made as follows: December 31, 2019 230,000 December 31, 2020 250,000 December 31, 2021 270,000 As an inducement to enter the lease, CHERRY CO. granted ZHAVY CO. the first six months of the lease rent-free. SINAG also paid the following: Initial direct cost 100,000 Security deposit 50,000 Lease Bonus 60,000 Insurance and Maintenance cost 25,000 What amount of rental income should be reported in the income statement of CHERRY CO. for the year ended December 31, 2019?

Chapter1: Financial Statements And Business Decisions

Section: Chapter Questions

Problem 1Q

Related questions

Question

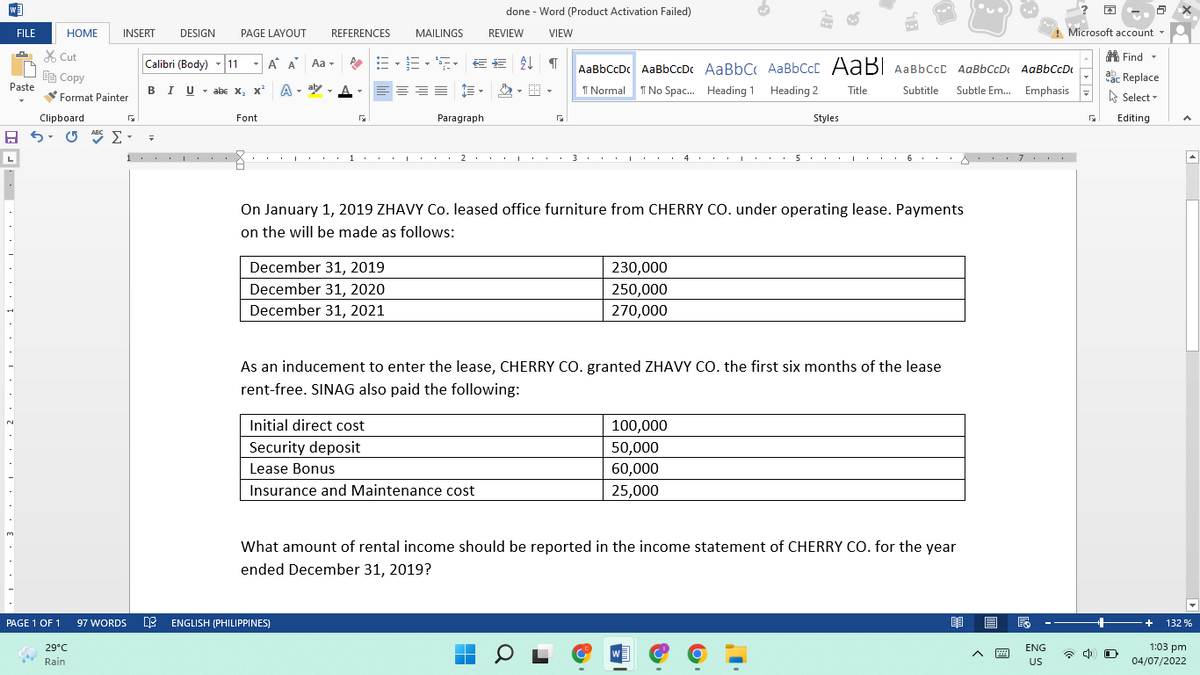

On January 1, 2019 Zhavy Co. leased office furniture from Cherry Co. under operating lease. Payments on the will be made as follows:

|

December 31, 2019 |

230,000 |

|

December 31, 2020 |

250,000 |

|

December 31, 2021 |

270,000 |

As an inducement to enter the lease, CHERRY CO. granted ZHAVY CO. the first six months of the lease rent-free. SINAG also paid the following:

|

Initial direct cost |

100,000 |

|

Security deposit |

50,000 |

|

Lease Bonus |

60,000 |

|

Insurance and Maintenance cost |

25,000 |

What amount of rental income should be reported in the income statement of CHERRY CO. for the year ended December 31, 2019?

Transcribed Image Text:done - Word (Product Activation Failed)

FILE

HOME

INSERT

DESIGN

PAGE LAYOUT

REFERENCES

MAILINGS

REVIEW

VIEW

Microsoft account -

X Cut

A Find -

Calibri (Body)

11

-

A A Aa -

AaBbCcDc AaBbccDc AaBbC AaBbCcC AaB| AaBbCcc AaBbCcD AaBbCcDt

Ee Copy

ac Replace

Paste

BIU - abe X, x

A - aly - A

I Normal

I No Spac. Heading 1 Heading 2

Subtitle

Subtle Em. Emphasis

Title

Format Painter

A Select -

Clipboard

Font

Paragraph

Styles

Editing

ABC

L

1

1.. .

3

4 .. .I.

...A . . . 7 . .

On January 1, 2019 ZHAVY Co. leased office furniture from CHERRY CO. under operating lease. Payments

on the will be made as follows:

December 31, 2019

230,000

December 31, 2020

December 31, 2021

250,000

270,000

As an inducement to enter the lease, CHERRY CO. granted ZHAVY CO. the first six months of the lease

rent-free. SINAG also paid the following:

Initial direct cost

100,000

Security deposit

50,000

Lease Bonus

60,000

Insurance and Maintenance cost

25,000

3.

What amount of rental income should be reported in the income statement of CHERRY CO. for the year

ended December 31, 2019?

PAGE 1 OF 1

E ENGLISH (PHILIPPINES)

97 WORDS

+

132 %

29°C

ENG

1:03 pm

W

Rain

US

04/07/2022

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,

Accounting Information Systems

Accounting

ISBN:

9781337619202

Author:

Hall, James A.

Publisher:

Cengage Learning,

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,

Accounting Information Systems

Accounting

ISBN:

9781337619202

Author:

Hall, James A.

Publisher:

Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis…

Accounting

ISBN:

9780134475585

Author:

Srikant M. Datar, Madhav V. Rajan

Publisher:

PEARSON

Intermediate Accounting

Accounting

ISBN:

9781259722660

Author:

J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:

McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:

9781259726705

Author:

John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:

McGraw-Hill Education