Using the same begging portion of the above problem --A cotton buyer will be making a purchase of cotton on March 1. The buyer recognizes the potential price risk in the market and chooses to h purchase without over hedging. The appropriate futures contract is trading at $0.80/pound. His ex -$0.03/pound. Now consider: On March 1, the cotton buyer purchases 265,000 pounds of cotton in the cash market at a price of appropriate futures contract is trading at $0.72/pound.

Using the same begging portion of the above problem --A cotton buyer will be making a purchase of cotton on March 1. The buyer recognizes the potential price risk in the market and chooses to h purchase without over hedging. The appropriate futures contract is trading at $0.80/pound. His ex -$0.03/pound. Now consider: On March 1, the cotton buyer purchases 265,000 pounds of cotton in the cash market at a price of appropriate futures contract is trading at $0.72/pound.

Chapter21: Risk Management

Section: Chapter Questions

Problem 4P

Related questions

Question

pls solve this ques required urgently give you many upvotes

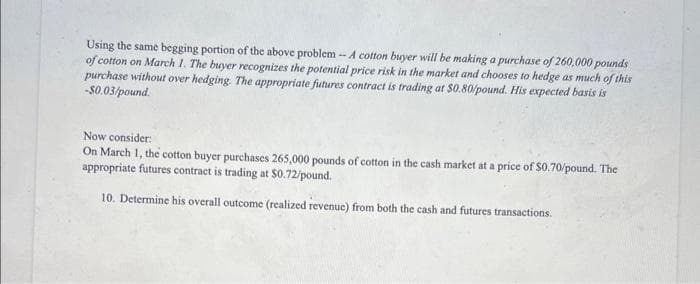

Transcribed Image Text:Using the same begging portion of the above problem -- A cotton buyer will be making a purchase of 260,000 pounds

of cotton on March 1. The buyer recognizes the potential price risk in the market and chooses to hedge as much of this

purchase without over hedging. The appropriate futures contract is trading at $0.80/pound. His expected basis is

-$0.03/pound.

Now consider:

On March 1, the cotton buyer purchases 265,000 pounds of cotton in the cash market at a price of $0.70/pound. The

appropriate futures contract is trading at $0.72/pound.

10. Determine his overall outcome (realized revenue) from both the cash and futures transactions.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT