e yea ase wa ments

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter18: Accounting For Income Taxes

Section: Chapter Questions

Problem 4MC: Prior to and during 2019, Shadrach Company reported tax depreciation at an amount higher than the...

Related questions

Question

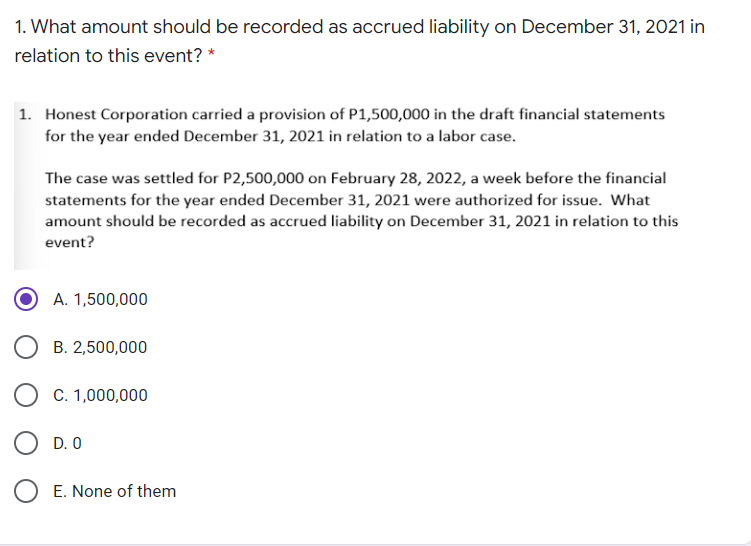

Transcribed Image Text:1. What amount should be recorded as accrued liability on December 31, 2021 in

relation to this event? *

1. Honest Corporation carried a provision of P1,500,000 in the draft financial statements

for the year ended December 31, 2021 in relation to a labor case.

The case was settled for P2,500,000 on February 28, 2022, a week before the financial

statements for the year ended December 31, 2021 were authorized for issue. What

amount should be recorded as accrued liability on December 31, 2021 in relation to this

event?

A. 1,500,000

B. 2,500,000

C. 1,000,000

D. 0

O E. None of them

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT