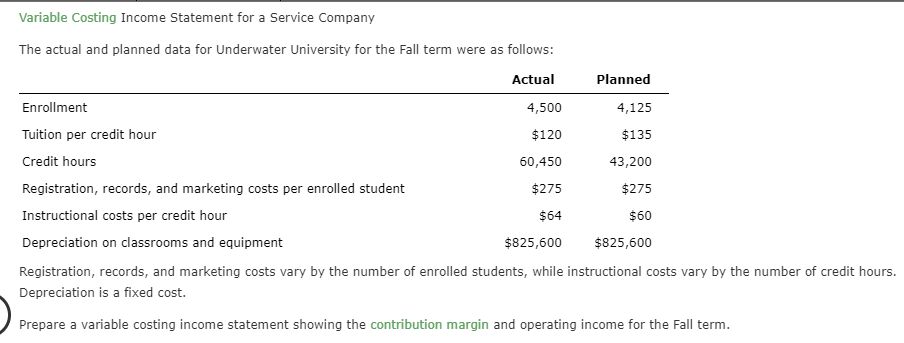

Variable Costing Income Statement for a Service Company The actual and planned data for Underwater University for the Fall term were as follows: Actual Planned Enrollment 4,500 4,125 Tuition per credit hour $120 $135 Credit hours 43,200 60,450 Registration, records, and marketing costs per enrolled student $275 $275 Instructional costs per credit hour $60 $64 Depreciation on classrooms and equipment $825,600 $825,600 Registration, records, and marketing costs vary by the number of enrolled students, while instructional costs vary by the number of credit hours. Depreciation is a fixed cost. Prepare a variable costing income statement showing the contribution margin and operating income for the Fall term. Underwater University Variable Costing Income Statement For the Fall Term Revenue Variable costs: Registration, records, and marketing costs Instructional costs Total variable costs Contribution margin Depreciation on classrooms and equipment Operating income

Variable Costing Income Statement for a Service Company The actual and planned data for Underwater University for the Fall term were as follows: Actual Planned Enrollment 4,500 4,125 Tuition per credit hour $120 $135 Credit hours 43,200 60,450 Registration, records, and marketing costs per enrolled student $275 $275 Instructional costs per credit hour $60 $64 Depreciation on classrooms and equipment $825,600 $825,600 Registration, records, and marketing costs vary by the number of enrolled students, while instructional costs vary by the number of credit hours. Depreciation is a fixed cost. Prepare a variable costing income statement showing the contribution margin and operating income for the Fall term. Underwater University Variable Costing Income Statement For the Fall Term Revenue Variable costs: Registration, records, and marketing costs Instructional costs Total variable costs Contribution margin Depreciation on classrooms and equipment Operating income

Managerial Accounting

15th Edition

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:Carl Warren, Ph.d. Cma William B. Tayler

Chapter7: Variable Costing For Management

analysis

Section: Chapter Questions

Problem 18E: Variable costing income statement for a service company The actual and planned data for Underwater...

Related questions

Question

Transcribed Image Text:Variable Costing Income Statement for a Service Company

The actual and planned data for Underwater University for the Fall term were as follows:

Actual

Planned

Enrollment

4,500

4,125

Tuition per credit hour

$120

$135

Credit hours

43,200

60,450

Registration, records, and marketing costs per enrolled student

$275

$275

Instructional costs per credit hour

$60

$64

Depreciation on classrooms and equipment

$825,600

$825,600

Registration, records, and marketing costs vary by the number of enrolled students, while instructional costs vary by the number of credit hours.

Depreciation is a fixed cost.

Prepare a variable costing income statement showing the contribution margin and operating income for the Fall term.

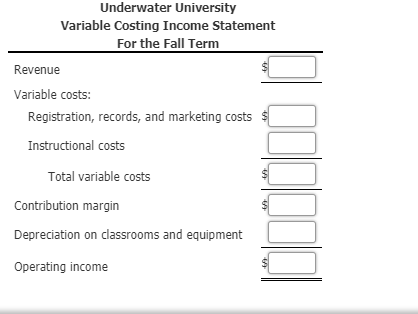

Transcribed Image Text:Underwater University

Variable Costing Income Statement

For the Fall Term

Revenue

Variable costs:

Registration, records, and marketing costs

Instructional costs

Total variable costs

Contribution margin

Depreciation on classrooms and equipment

Operating income

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 5 steps with 4 images

Recommended textbooks for you

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Essentials of Business Analytics (MindTap Course …

Statistics

ISBN:

9781305627734

Author:

Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. Anderson

Publisher:

Cengage Learning