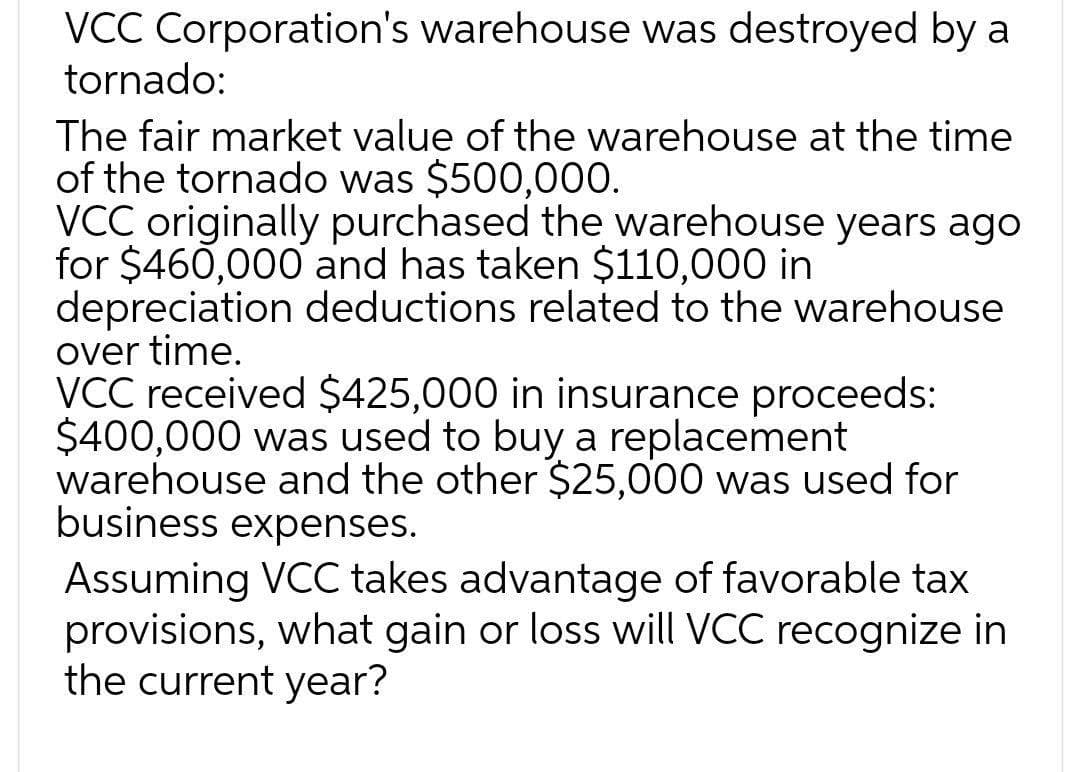

VCC Corporation's warehouse was destroyed by a tornado: The fair market value of the warehouse at the time of the tornado was $500,000. VCC originally purchased the warehouse years ago for $460,000 and has taken $110,000 in depreciation deductions related to the warehouse pver time. WCC received $425,000 in insurance proceeds: $400,000 was used to buy a replacement warehouse and the other $25,000 was used for pusiness expenses. Assuming VCC takes advantage of favorable tax provisions, what gain or loss will VCC recognize in the current year?

VCC Corporation's warehouse was destroyed by a tornado: The fair market value of the warehouse at the time of the tornado was $500,000. VCC originally purchased the warehouse years ago for $460,000 and has taken $110,000 in depreciation deductions related to the warehouse pver time. WCC received $425,000 in insurance proceeds: $400,000 was used to buy a replacement warehouse and the other $25,000 was used for pusiness expenses. Assuming VCC takes advantage of favorable tax provisions, what gain or loss will VCC recognize in the current year?

Chapter13: Property Transactions: Determination Of Gain Or Loss, Basis Considerations, And Nonta Xable Exchanges

Section: Chapter Questions

Problem 85P

Related questions

Question

Transcribed Image Text:VCC Corporation's warehouse was destroyed by a

tornado:

The fair market value of the warehouse at the time

of the tornado was $500,000.

VCC originally purchased the warehouse years ago

for $460,000 and has taken $110,000 in

depreciation deductions related to the warehouse

over time.

VCC received $425,000 in insurance proceeds:

$400,000 was used to buy a replacement

warehouse and the other $25,000 was used for

business expenses.

Assuming VCC takes advantage of favorable tax

provisions, what gain or loss will VCC recognize in

the current year?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 1 images

Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT