Murphy Fumiture purchased land, paying $60,000 cash and signing a $290,000 note payable. In addition, Murphy paid delinquent property tax of $4,000, title insurance costing $5,000, and $7,000 to level the land and remove an unwanted building. The company then constructed an office building at a cost of $350,000. It also paid $46,000 for a fence around the property, $15,000 for a sign near the entrance, and $9,000 for special lighting of the grounds. Read the reguirements Requirement 1. Determine the cost of the land, land improvements, and building. The cost of the land is

Murphy Fumiture purchased land, paying $60,000 cash and signing a $290,000 note payable. In addition, Murphy paid delinquent property tax of $4,000, title insurance costing $5,000, and $7,000 to level the land and remove an unwanted building. The company then constructed an office building at a cost of $350,000. It also paid $46,000 for a fence around the property, $15,000 for a sign near the entrance, and $9,000 for special lighting of the grounds. Read the reguirements Requirement 1. Determine the cost of the land, land improvements, and building. The cost of the land is

Chapter8: Depreciation, Cost Recovery, Amortization, And Depletion

Section: Chapter Questions

Problem 38P

Related questions

Question

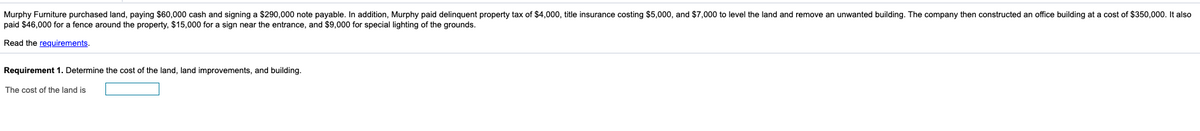

Transcribed Image Text:Murphy Furniture purchased land, paying $60,000 cash and signing a $290,000 note payable. In addition, Murphy paid delinquent property tax of $4,000, title insurance costing $5,000, and $7,000 to level the land and remove an unwanted building. The company then constructed an office building at a cost of $350,000. It also

paid $46,000 for a fence around the property, $15,000 for a sign near the entrance, and $9,000 for special lighting of the grounds.

Read the requirements.

Requirement 1. Determine the cost of the land, land improvements, and building.

The cost of the land is

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College