View Policies Current Attempt in Progress rt For its three ivestment centers, Gerrard Company accumulates the following data: II $1,900,000 $4075,000 $4,069,00 Sales Controllable margin 1,330,000 2,037,500 3,662,10 Average operating assets 5,068,000 7,993,000 12,028,00 The centers expect the following changes in the next year: (I) increase sales 14%; (II) decrease costs $376,000; (III) decrease average operating assets $491,000. Compute the expected return on investment (ROI) for each center. Assume center I has a controllable margin percentage of 70%. (Round ROI to 1 decimal place, e.g. 1.5%.) The expected return on investment

View Policies Current Attempt in Progress rt For its three ivestment centers, Gerrard Company accumulates the following data: II $1,900,000 $4075,000 $4,069,00 Sales Controllable margin 1,330,000 2,037,500 3,662,10 Average operating assets 5,068,000 7,993,000 12,028,00 The centers expect the following changes in the next year: (I) increase sales 14%; (II) decrease costs $376,000; (III) decrease average operating assets $491,000. Compute the expected return on investment (ROI) for each center. Assume center I has a controllable margin percentage of 70%. (Round ROI to 1 decimal place, e.g. 1.5%.) The expected return on investment

Survey of Accounting (Accounting I)

8th Edition

ISBN:9781305961883

Author:Carl Warren

Publisher:Carl Warren

Chapter14: Decentralized Operations

Section: Chapter Questions

Problem 14.5.3P

Related questions

Question

Transcribed Image Text:View Policies

Current Attempt in Progress

rt

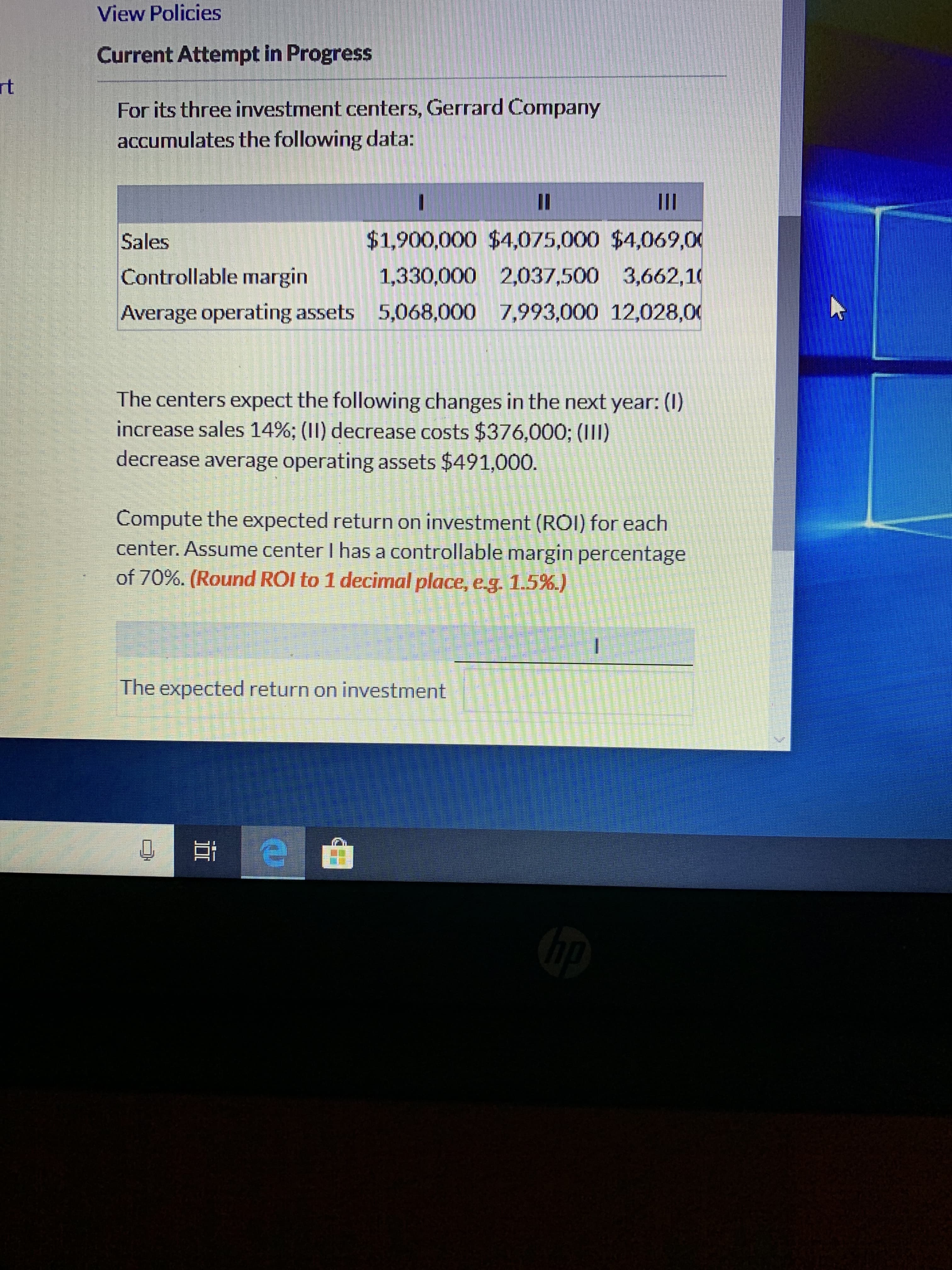

For its three ivestment centers, Gerrard Company

accumulates the following data:

II

$1,900,000 $4075,000 $4,069,00

Sales

Controllable margin

1,330,000 2,037,500 3,662,10

Average operating assets 5,068,000 7,993,000 12,028,00

The centers expect the following changes in the next year: (I)

increase sales 14%; (II) decrease costs $376,000; (III)

decrease average operating assets $491,000.

Compute the expected return on investment (ROI) for each

center. Assume center I has a controllable margin percentage

of 70%. (Round ROI to 1 decimal place, e.g. 1.5%.)

The expected return on investment

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 1 images

Recommended textbooks for you

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Accounting Information Systems

Accounting

ISBN:

9781337619202

Author:

Hall, James A.

Publisher:

Cengage Learning,

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Accounting Information Systems

Accounting

ISBN:

9781337619202

Author:

Hall, James A.

Publisher:

Cengage Learning,