Problem 1. Odette Electronics has 90 operating plants in seven southwestern states. Sales for last year were P100 million, and the statement of financial position at year-end is similar in percentage of sales to that of previous years (and this will continue in the future). All assets (including fixed assets) and current liabilities will vary directly with sales. Statement of Financial Position (in P millions) Assets Liabilities andEquity Cash.... P2 Accountspayable. .P15 Accountsreceivable. . 20 Accruedwages.. . .2 Inventory.... 23 Accruedtaxes... Currentassets.... P45 Currentliabilities.... P25 Fixedassets.... 40 Notespayable. 10 Ordinaryshares... 15 Retainedearnings... 35 Totalassets.... P85 Total liabilitiesandequity... .P85 Odette's has an after-tax profit margin of 7 percent and a dividend payout ratio of 40 percent. If sales grow by 10 percent next year, determine how much of new funds are needed to finance the growth.

Problem 1. Odette Electronics has 90 operating plants in seven southwestern states. Sales for last year were P100 million, and the statement of financial position at year-end is similar in percentage of sales to that of previous years (and this will continue in the future). All assets (including fixed assets) and current liabilities will vary directly with sales. Statement of Financial Position (in P millions) Assets Liabilities andEquity Cash.... P2 Accountspayable. .P15 Accountsreceivable. . 20 Accruedwages.. . .2 Inventory.... 23 Accruedtaxes... Currentassets.... P45 Currentliabilities.... P25 Fixedassets.... 40 Notespayable. 10 Ordinaryshares... 15 Retainedearnings... 35 Totalassets.... P85 Total liabilitiesandequity... .P85 Odette's has an after-tax profit margin of 7 percent and a dividend payout ratio of 40 percent. If sales grow by 10 percent next year, determine how much of new funds are needed to finance the growth.

Financial And Managerial Accounting

15th Edition

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:WARREN, Carl S.

Chapter21: Variable Costing For Management

analysis

Section: Chapter Questions

Problem 2MAD

Related questions

Question

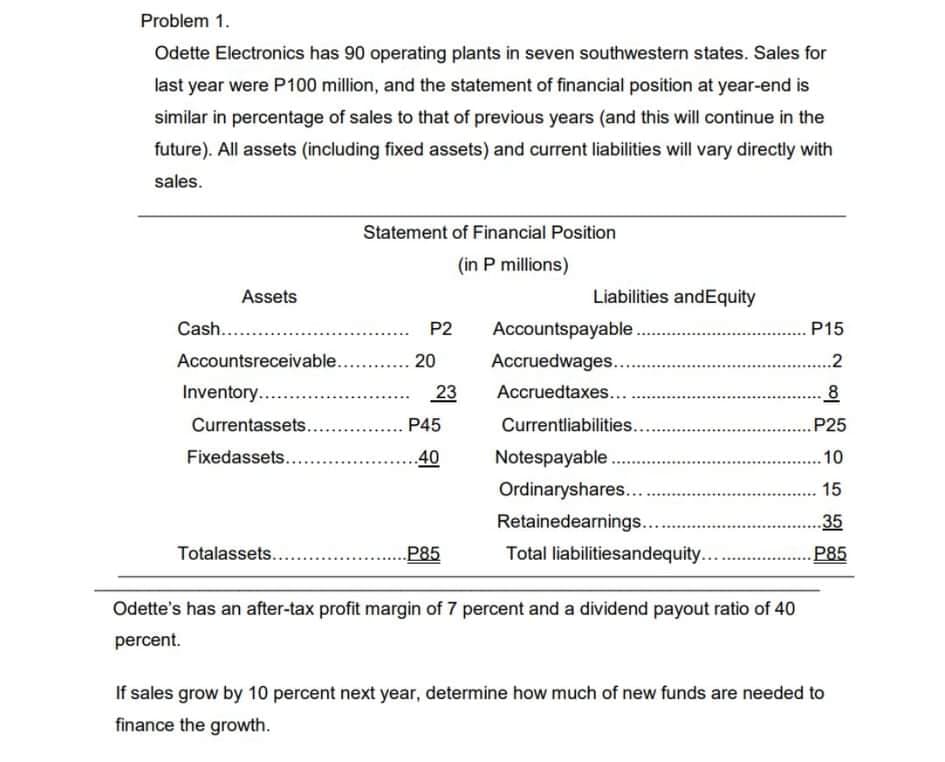

Transcribed Image Text:Problem 1.

Odette Electronics has 90 operating plants in seven southwestern states. Sales for

last year were P100 million, and the statement of financial position at year-end is

similar in percentage of sales to that of previous years (and this will continue in the

future). All assets (including fixed assets) and current liabilities will vary directly with

sales.

Statement of Financial Position

(in P millions)

Assets

Liabilities andEquity

Cash...

P2

Accountspayable

P15

Accountsreceivable...

20

Accruedwages...

..2

Inventory....

23

Accruedtaxes...

8

Currentassets..

P45

Currentliabilities...

P25

Fixedassets.....

40

Notespayable .

.10

Ordinaryshares...

. 15

Retainedearnings..

35

Totalassets...

P85

Total liabilitiesandequity...

P85

Odette's has an after-tax profit margin of 7 percent and a dividend payout ratio of 40

percent.

If sales grow by 10 percent next year, determine how much of new funds are needed to

finance the growth.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning