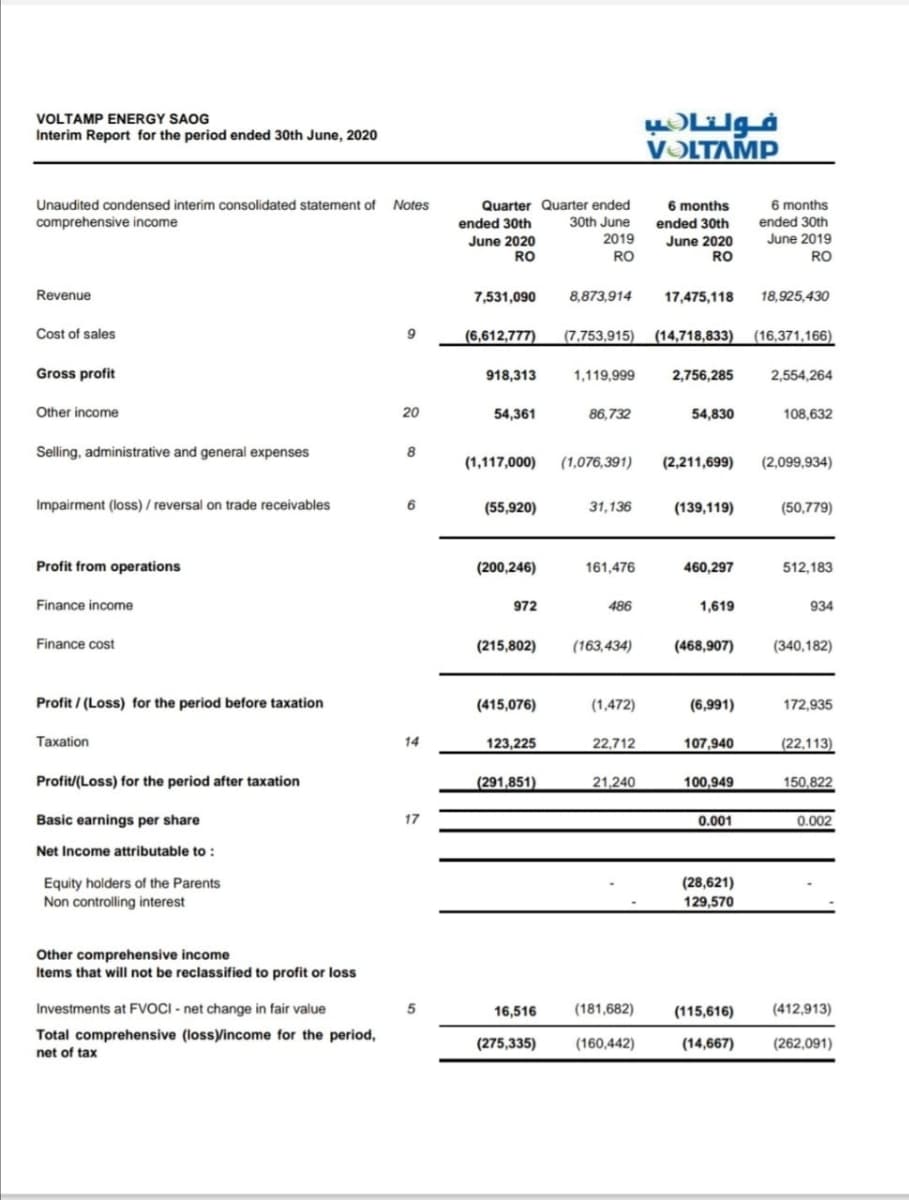

VOLTAMP ENERGY SAOG Interim Report for the period ended 30th June, 2020 VOLTAMP 6 months Quarter Quarter ended ended 30th June 2020 RO Unaudited condensed interim consolidated statement of Notes 6 months ended 30th June 2019 comprehensive income 30th June ended 30th 2019 June 2020 RO RO RO Revenue 7,531,090 8,873,914 17,475,118 18,925,430 Cost of sales 9 (6,612,777) (7,753,915) (14,718,833) (16,371,166) Gross profit 918,313 1,119,999 2,756,285 2,554,264 Other income 20 54,361 86,732 54,830 108,632 Selling, administrative and general expenses 8 (1,117,000) (1,076,391) (2,211,699) (2,099,934) Impairment (loss) / reversal on trade receivables (55,920) 31,136 (139,119) (50,779) Profit from operations (200,246) 161,476 460,297 512,183 Finance income 972 486 1,619 934 Finance cost (215,802) (163,434) (468,907) (340,182) Profit / (Loss) for the period before taxation (415,076) (1,472) (6,991) 172,935 Тахation 14 123,225 22,712 107,940 (22,113) Profit/(Loss) for the period after taxation (291,851) 21,240 100,949 150,822 Basic earnings per share 17 0.001 0.002 Net Income attributable to : Equity holders of the Parents Non controlling interest (28,621) 129,570 Other comprehensive income Items that will not be reclassified to profit or loss Investments at FVOCI - net change in fair value 16,516 (181,682) (115,616) (412,913) Total comprehensive (lossyincome for the period, (275,335) (160,442) (14,667) (262,091) net of tax

VOLTAMP ENERGY SAOG Interim Report for the period ended 30th June, 2020 VOLTAMP 6 months Quarter Quarter ended ended 30th June 2020 RO Unaudited condensed interim consolidated statement of Notes 6 months ended 30th June 2019 comprehensive income 30th June ended 30th 2019 June 2020 RO RO RO Revenue 7,531,090 8,873,914 17,475,118 18,925,430 Cost of sales 9 (6,612,777) (7,753,915) (14,718,833) (16,371,166) Gross profit 918,313 1,119,999 2,756,285 2,554,264 Other income 20 54,361 86,732 54,830 108,632 Selling, administrative and general expenses 8 (1,117,000) (1,076,391) (2,211,699) (2,099,934) Impairment (loss) / reversal on trade receivables (55,920) 31,136 (139,119) (50,779) Profit from operations (200,246) 161,476 460,297 512,183 Finance income 972 486 1,619 934 Finance cost (215,802) (163,434) (468,907) (340,182) Profit / (Loss) for the period before taxation (415,076) (1,472) (6,991) 172,935 Тахation 14 123,225 22,712 107,940 (22,113) Profit/(Loss) for the period after taxation (291,851) 21,240 100,949 150,822 Basic earnings per share 17 0.001 0.002 Net Income attributable to : Equity holders of the Parents Non controlling interest (28,621) 129,570 Other comprehensive income Items that will not be reclassified to profit or loss Investments at FVOCI - net change in fair value 16,516 (181,682) (115,616) (412,913) Total comprehensive (lossyincome for the period, (275,335) (160,442) (14,667) (262,091) net of tax

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter5: The Income Statement And The Statement Of Cash Flows

Section: Chapter Questions

Problem 19E: Interim Reporting (Appendix 5.1) Miller Company prepares quarterly and year-to-date interim reports....

Related questions

Question

Calculate the gross profit ratio and net profit ratio?

Transcribed Image Text:VOLTAMP ENERGY SAOG

Interim Report for the period ended 30th June, 2020

VƏLTAMP

Quarter Quarter ended

30th June

6 months

ended 30th

Unaudited condensed interim consolidated statement of Notes

6 months

comprehensive income

ended 30th

ended 30th

2019

June 2019

June 2020

RO

June 2020

RO

RO

RO

Revenue

7,531,090

8,873,914

17,475,118

18,925,430

Cost of sales

9

(6,612,777)

(7,753,915)

(14,718,833)

(16,371,166)

Gross profit

918,313

1,119,999

2,756,285

2,554,264

Other income

20

54,361

86,732

54,830

108,632

Selling, administrative and general expenses

8

(1,117,000)

(1,076,391)

(2,211,699)

(2,099,934)

Impairment (loss) / reversal on trade receivables

6

(55,920)

31,136

(139,119)

(50,779)

Profit from operations

(200,246)

161,476

460,297

512,183

Finance income

972

486

1,619

934

Finance cost

(215,802)

(163,434)

(468,907)

(340,182)

Profit / (Loss) for the period before taxation

(415,076)

(1,472)

(6,991)

172,935

Тахation

14

123,225

22,712

107,940

(22,113)

Profit/(Loss) for the period after taxation

(291,851)

21,240

100,949

150,822

Basic earnings per share

17

0.001

0.002

Net Income attributable to :

Equity holders of the Parents

Non controlling interest

(28,621)

129,570

Other comprehensive income

Items that will not be reclassified to profit or loss

Investments at FVOCI - net change in fair value

16,516

(181,682)

(115,616)

(412,913)

Total comprehensive (loss)/income for the period,

net of tax

(275,335)

(160,442)

(14,667)

(262,091)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning