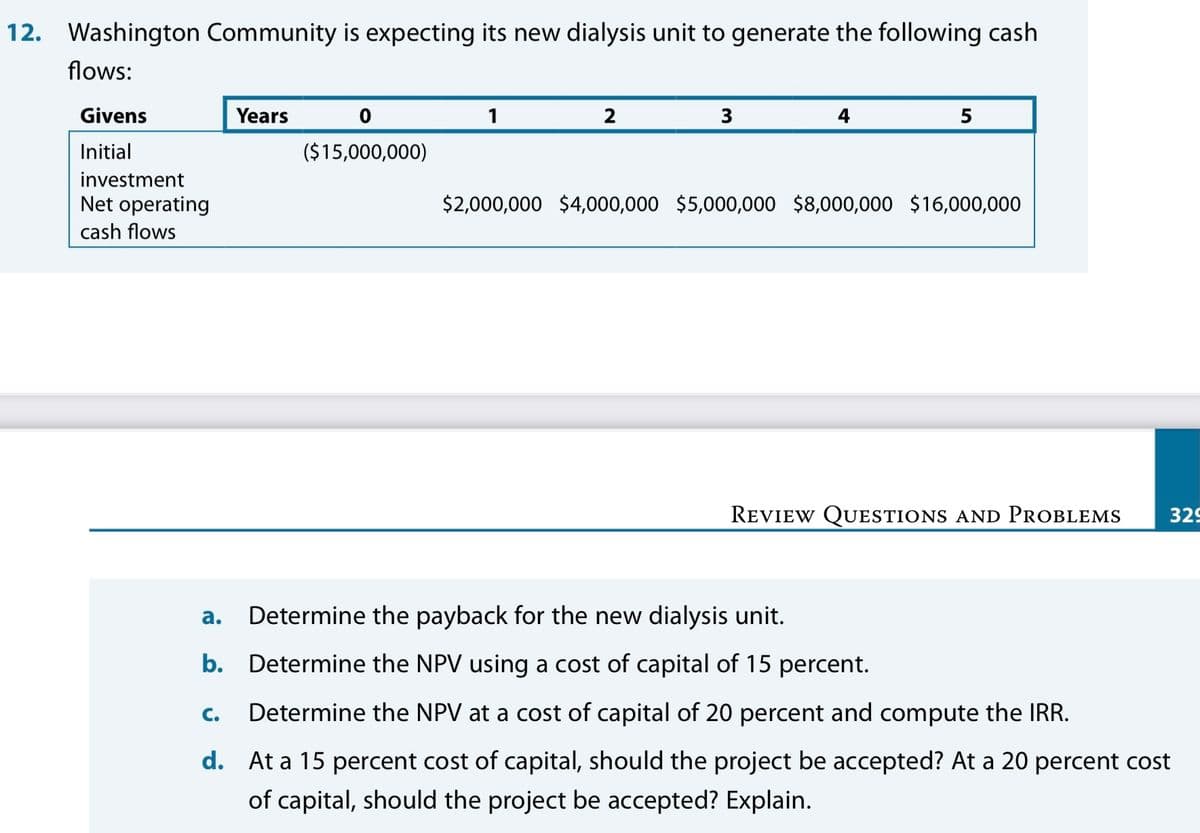

Washington Community is expecting its new dialysis unit to generate the following cash flows: Givens Years 1 3 4 Initial ($15,000,000) investment Net operating $2,000,000 $4,000,000 $5,000,000 $8,000,000 $16,000,000 cash flows REVIEW QUESTIONS AND PROBLEMS 32 а. Determine the payback for the new dialysis unit. b. Determine the NPV using a cost of capital of 15 percent. C. Determine the NPV at a cost of capital of 20 percent and compute the IRR. d. At a 15 percent cost of capital, should the project be accepted? At a 20 percent cost of capital, should the project be accepted? Explain.

Washington Community is expecting its new dialysis unit to generate the following cash flows: Givens Years 1 3 4 Initial ($15,000,000) investment Net operating $2,000,000 $4,000,000 $5,000,000 $8,000,000 $16,000,000 cash flows REVIEW QUESTIONS AND PROBLEMS 32 а. Determine the payback for the new dialysis unit. b. Determine the NPV using a cost of capital of 15 percent. C. Determine the NPV at a cost of capital of 20 percent and compute the IRR. d. At a 15 percent cost of capital, should the project be accepted? At a 20 percent cost of capital, should the project be accepted? Explain.

Managerial Economics: A Problem Solving Approach

5th Edition

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Chapter5: Investment Decisions: Look Ahead And Reason Back

Section: Chapter Questions

Problem 5.4IP

Related questions

Question

Can this be solved by hand and what are the formulas?

Transcribed Image Text:12. Washington Community is expecting its new dialysis unit to generate the following cash

flows:

Givens

Years

1

2

3

4

5

Initial

($15,000,000)

investment

Net operating

$2,000,000 $4,000,000 $5,000,000 $8,000,000 $16,000,000

cash flows

REVIEW QUESTIONS AND PROBLEMS

329

а.

Determine the payback for the new dialysis unit.

b. Determine the NPV using a cost of capital of 15 percent.

C.

Determine the NPV at a cost of capital of 20 percent and compute the IRR.

d. At a 15 percent cost of capital, should the project be accepted? At a 20 percent cost

of capital, should the project be accepted? Explain.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 5 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Recommended textbooks for you

Managerial Economics: A Problem Solving Approach

Economics

ISBN:

9781337106665

Author:

Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:

Cengage Learning

Managerial Economics: Applications, Strategies an…

Economics

ISBN:

9781305506381

Author:

James R. McGuigan, R. Charles Moyer, Frederick H.deB. Harris

Publisher:

Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:

9781337106665

Author:

Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:

Cengage Learning

Managerial Economics: Applications, Strategies an…

Economics

ISBN:

9781305506381

Author:

James R. McGuigan, R. Charles Moyer, Frederick H.deB. Harris

Publisher:

Cengage Learning