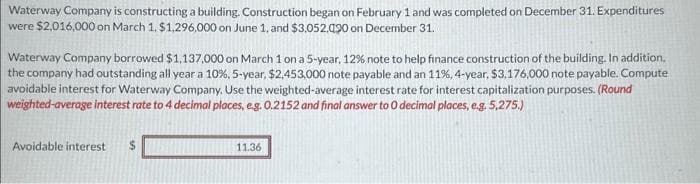

Waterway Company is constructing a building. Construction began on February 1 and was completed on December 31. Expenditures were $2,016,000 on March 1. $1.296,000 on June 1, and $3,052,090 on December 31. Waterway Company borrowed $1,137,000 on March 1 on a 5-year, 12% note to help finance construction of the building. In addition. the company had outstanding all year a 10%, 5-year, $2,453,000 note payable and an 11%, 4-year, $3,176,000 note payable. Compute avoidable interest for Waterway Company. Use the weighted-average interest rate for interest capitalization purposes. (Round weighted-average interest rate to 4 decimal places, eg. 0.2152 and final answer to 0 decimal places, e.g. 5,275.) Avoidable interest 11.36

Waterway Company is constructing a building. Construction began on February 1 and was completed on December 31. Expenditures were $2,016,000 on March 1. $1.296,000 on June 1, and $3,052,090 on December 31. Waterway Company borrowed $1,137,000 on March 1 on a 5-year, 12% note to help finance construction of the building. In addition. the company had outstanding all year a 10%, 5-year, $2,453,000 note payable and an 11%, 4-year, $3,176,000 note payable. Compute avoidable interest for Waterway Company. Use the weighted-average interest rate for interest capitalization purposes. (Round weighted-average interest rate to 4 decimal places, eg. 0.2152 and final answer to 0 decimal places, e.g. 5,275.) Avoidable interest 11.36

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter10: Property, Plant And Equipment: Acquisition And Subsequent Investments

Section: Chapter Questions

Problem 8RE

Related questions

Question

Transcribed Image Text:Waterway Company is constructing a building. Construction began on February 1 and was completed on December 31. Expenditures

were $2,016,000 on March 1. $1,296,000 on June 1, and $3,052,090 on December 31.

Waterway Company borrowed $1,137,000 on March 1 on a 5-year, 12% note to help finance construction of the building. In addition,

the company had outstanding all year a 10%, 5-year, $2,453,000 note payable and an 11%, 4-year, $3,176,000 note payable. Compute

avoidable interest for Waterway Company. Use the weighted-average interest rate for interest capitalization purposes. (Round

weighted-average interest rate to 4 decimal places, e.g. 0.2152 and final answer to 0 decimal places, e.g. 5,275.)

Avoidable interest $

11.36

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT