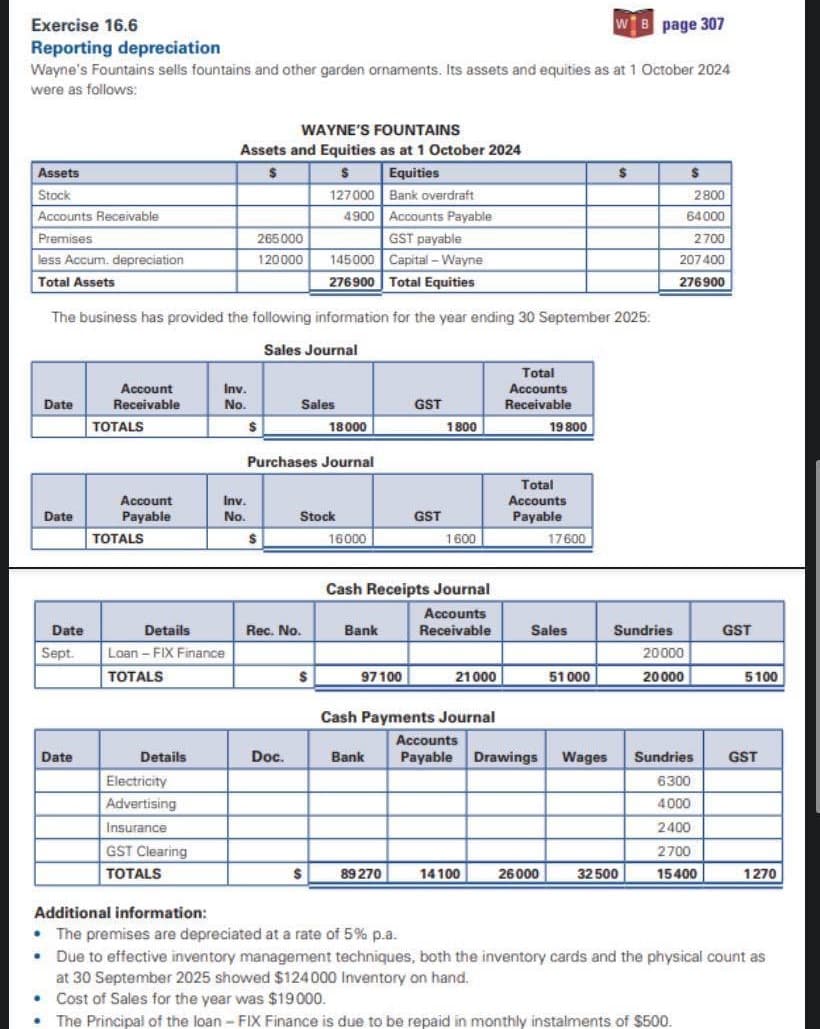

Wayne's Fountains sells fountains and other garden ornaments. Its assets and equities as at 1 October 2024 were as follows: WAYNE'S FOUNTAINS Assets and Equities as at 1 October 2024 Assets %24 Equities 127000 Bank overdraft 4900 Accounts Payable Stock 2800 Accounts Receivable 64000 Premises 265 000 GST payable 2700 less Accum. depreciation Total Assets 145000 Capital -Wayne 276900 Total Equities 120000 207400 276900 The business has provided the following information for the year ending 30 September 2025: Sales Journal Account Receivable Total Accounts Receivable Inv. Date No. Sales GST TOTALS 18000 1800 19 800 Purchases Journal Total Accounts Payable Account Inv. Date Payable No. Stock GST TOTALS 16000 1600 17600 Cash Receipts Journal Accounts Date Details Rec. No. Bank Receivable Sales Sundries GST Sept. Loan - FIX Finance 20000 TOTALS 97 100 21000 51 000 20000 5100 Cash Payments Journal Accounts Date Details Doc. Bank Payable Drawings Wages Sundries GST Electricity 6300 Advertising 4000 Insurance 2400 GST Clearing 2700 TOTALS 89 270 14 100 26000 32 500 15400 1270 Additional information: The premises are depreciated • Due to effective inventory management techniques, both the inventory cards and the physical count as at 30 September 2025 showed $124000 Inventory on hand. • Cost of Sales for the year was $19000. rate of 5% p.a. The Principal of the loan - FIX Finance is due to be repaid in monthly instalments of $500.

Wayne's Fountains sells fountains and other garden ornaments. Its assets and equities as at 1 October 2024 were as follows: WAYNE'S FOUNTAINS Assets and Equities as at 1 October 2024 Assets %24 Equities 127000 Bank overdraft 4900 Accounts Payable Stock 2800 Accounts Receivable 64000 Premises 265 000 GST payable 2700 less Accum. depreciation Total Assets 145000 Capital -Wayne 276900 Total Equities 120000 207400 276900 The business has provided the following information for the year ending 30 September 2025: Sales Journal Account Receivable Total Accounts Receivable Inv. Date No. Sales GST TOTALS 18000 1800 19 800 Purchases Journal Total Accounts Payable Account Inv. Date Payable No. Stock GST TOTALS 16000 1600 17600 Cash Receipts Journal Accounts Date Details Rec. No. Bank Receivable Sales Sundries GST Sept. Loan - FIX Finance 20000 TOTALS 97 100 21000 51 000 20000 5100 Cash Payments Journal Accounts Date Details Doc. Bank Payable Drawings Wages Sundries GST Electricity 6300 Advertising 4000 Insurance 2400 GST Clearing 2700 TOTALS 89 270 14 100 26000 32 500 15400 1270 Additional information: The premises are depreciated • Due to effective inventory management techniques, both the inventory cards and the physical count as at 30 September 2025 showed $124000 Inventory on hand. • Cost of Sales for the year was $19000. rate of 5% p.a. The Principal of the loan - FIX Finance is due to be repaid in monthly instalments of $500.

Century 21 Accounting General Journal

11th Edition

ISBN:9781337680059

Author:Gilbertson

Publisher:Gilbertson

Chapter19: Accounting For Plant Assets, Depreciation, And Intangible Assets

Section19.6: Buying Intangible Assets And Calculating Amortization Expense

Problem 1OYO

Related questions

Question

g and h with solution

Transcribed Image Text:Exercise 16.6

wB page 307

Reporting depreciation

Wayne's Fountains sells fountains and other garden ornaments. Its assets and equities as at 1 October 2024

were as follows:

WAYNE'S FOUNTAINS

Assets and Equities as at 1 October 2024

Assets

Equities

Stock

127000 Bank overdraft

2800

4900 Accounts Payable

GST payable

Accounts Receivable

64000

Premises

265000

2700

less Accum. depreciation

120000

145000 Capital - Wayne

207400

Total Assets

276900 Total Equities

276900

The business has provided the following information for the year ending 30 September 2025:

Sales Journal

Total

Accounts

Receivable

Account

Inv.

No.

Date

Receivable

Sales

GST

TOTALS

18000

1800

19 800

Purchases Journal

Total

Account

Inv.

Accounts

Date

Payable

No.

Stock

GST

Payable

TOTALS

16000

1600

17600

Cash Receipts Journal

Accounts

Receivable

Date

Details

Rec. No.

Bank

Sales

Sundries

GST

Sept.

Loan - FIX Finance

20000

TOTALS

97 100

21000

51 000

20000

5100

Cash Payments Journal

Accounts

Date

Details

Doc.

Bank

Payable

Drawings

Wages

Sundries

GST

Electricity

6300

Advertising

4000

Insurance

2400

GST Clearing

2700

TOTALS

89 270

14100

26000

32500

15400

1270

Additional information:

The premises are depreciated at a rate of 5% p.a.

• Due to effective inventory management techniques, both the inventory cards and the physical count as

at 30 September 2025 showed $124000 Inventory on hand.

• Cost of Sales for the year was $19000.

The Principal of the loan - FIX Finance is due to be repaid in monthly instalments of $500.

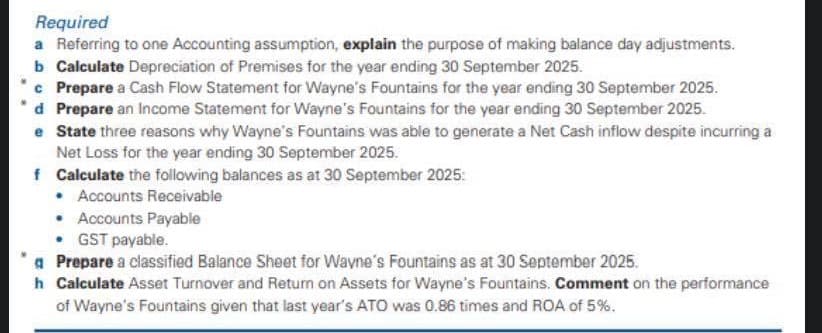

Transcribed Image Text:Required

a Referring to one Accounting assumption, explain the purpose of making balance day adjustments.

b Calculate Depreciation of Premises for the year ending 30 September 2025.

c Prepare a Cash Flow Statement for Wayne's Fountains for the year ending 30 September 2025.

d Prepare an Income Statement for Wayne's Fountains for the year ending 30 September 2025.

e State three reasons why Wayne's Fountains was able to generate a Net Cash inflow despite incurring a

Net Loss for the year ending 30 September 2025.

f Calculate the following balances as at 30 September 2025:

• Accounts Receivable

• Accounts Payable

• GST payable.

a Prepare a classified Balance Sheet for Wayne's Fountains as at 30 September 2025.

h Calculate Asset Turnover and Retum on Assets for Wayne's Fountains. Comment on the performance

of Wayne's Fountains given that last year's ATO was 0.86 times and ROA of 5%.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps with 1 images

Recommended textbooks for you

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Accounting (Text Only)

Accounting

ISBN:

9781285743615

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Accounting (Text Only)

Accounting

ISBN:

9781285743615

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:

9781285866307

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781337398169

Author:

Carl Warren, Jeff Jones

Publisher:

Cengage Learning