weekly salary. Click the icon to view the Married Persons-Weekly Payroll Period. withholding tax is $ Portion of IRS Withholding Table for Married Persons Paid Weekly MARRIED Persons-WEEKLY Payroll Period (For Wages Paid Through December 31, 2016) GED And the wages are-And the number of withholding allowances claimed i At least But less than $670 680 O 123 The amount of income tax to be withheld $4 $0 $0 $680 $50 $47 $35 $28 $20 $12 13 690 60 49 37 29 21 $0 OO

weekly salary. Click the icon to view the Married Persons-Weekly Payroll Period. withholding tax is $ Portion of IRS Withholding Table for Married Persons Paid Weekly MARRIED Persons-WEEKLY Payroll Period (For Wages Paid Through December 31, 2016) GED And the wages are-And the number of withholding allowances claimed i At least But less than $670 680 O 123 The amount of income tax to be withheld $4 $0 $0 $680 $50 $47 $35 $28 $20 $12 13 690 60 49 37 29 21 $0 OO

Chapter4: Income Tax Withholding

Section: Chapter Questions

Problem 3SSQ

Related questions

Question

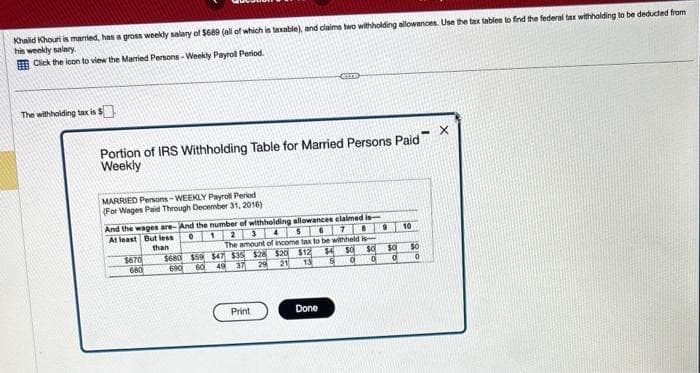

Transcribed Image Text:Khalid Khouri is married, has a gross weekly salary of $689 (all of which is taxable), and claims two withholding allowances. Use the tax tables to find the federal tax withholding to be deducted from

his weekly salary.

Click the icon to view the Married Persons-Weekly Payroll Period.

The withholding tax is $

Portion of IRS Withholding Table for Married Persons Paid

Weekly

MARRIED Persons-WEEKLY Payroll Period

(For Wages Paid Through December 31, 2016)

0 1

And the wages are-And the number of withholding allowances claimed is

5

4

2 3

At least But less

than

The amount of income tax to be withheld is

$4 SO SO

$680 $59 $47 $35 $28 $20 $12

5 d q

21 13

690 60 49 37 29

$670

680

Print

Done

9 10

$0 $0

0

0

X

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT