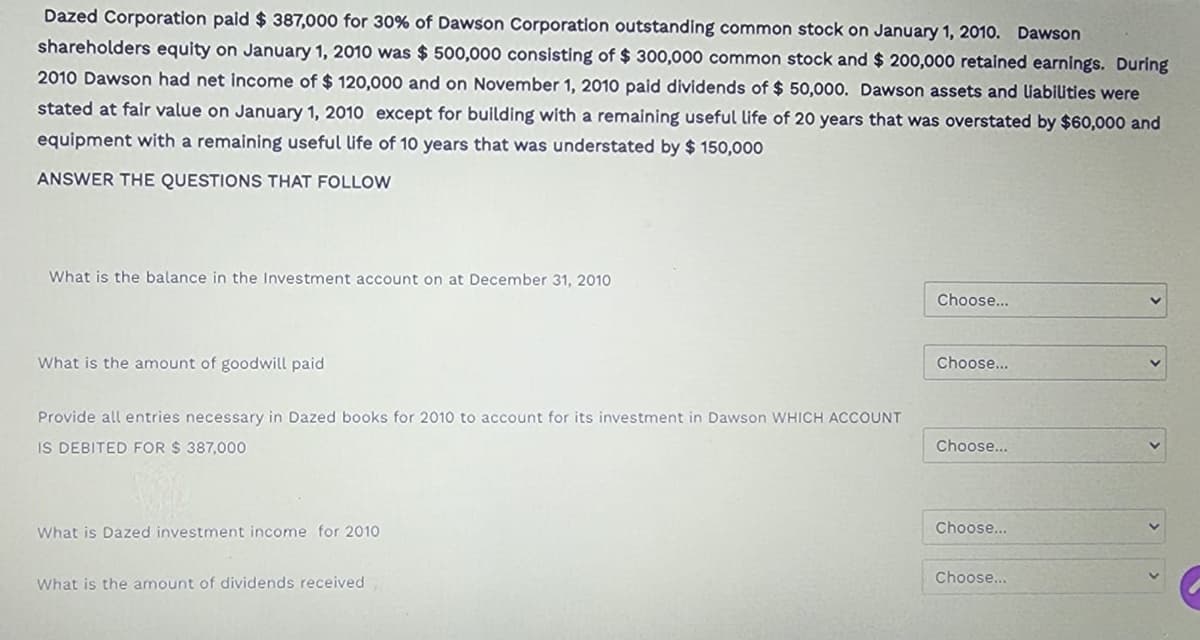

Dazed Corporation paid $ 387,000 for 30% of Dawson Corporation outstanding common stock on January 1, 2010. Dawson shareholders equity on January 1, 2010 was $ 500,000 consisting of $ 300,000 common stock and $ 200,000 retained earnings. During 2010 Dawson had net income of $ 120,000 and on November 1, 2010 paid dividends of $ 50,000. Dawson assets and liabilities were stated at fair value on January 1, 2010 except for building with a remaining useful life of 20 years that was overstated by $60,000 and equipment with a remaining useful life of 10 years that was understated by $ 150,000 ANSWER THE QUESTIONS THAT FOLLOW What is the balance in the Investment account on at December 31, 2010 What is the amount of goodwill paid Provide all entries necessary in Dazed books for 2010 to account for its investment in Dawson WHICH ACCOUNT IS DEBITED FOR $ 387,000 What is Dazed investment income for 2010 What is the amount of dividends received Choose... Choose... Choose... Choose... Choose...

Dazed Corporation paid $ 387,000 for 30% of Dawson Corporation outstanding common stock on January 1, 2010. Dawson shareholders equity on January 1, 2010 was $ 500,000 consisting of $ 300,000 common stock and $ 200,000 retained earnings. During 2010 Dawson had net income of $ 120,000 and on November 1, 2010 paid dividends of $ 50,000. Dawson assets and liabilities were stated at fair value on January 1, 2010 except for building with a remaining useful life of 20 years that was overstated by $60,000 and equipment with a remaining useful life of 10 years that was understated by $ 150,000 ANSWER THE QUESTIONS THAT FOLLOW What is the balance in the Investment account on at December 31, 2010 What is the amount of goodwill paid Provide all entries necessary in Dazed books for 2010 to account for its investment in Dawson WHICH ACCOUNT IS DEBITED FOR $ 387,000 What is Dazed investment income for 2010 What is the amount of dividends received Choose... Choose... Choose... Choose... Choose...

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter16: Retained Earnings And Earnings Per Share

Section: Chapter Questions

Problem 10MC

Related questions

Question

Transcribed Image Text:Dazed Corporation paid $ 387,000 for 30% of Dawson Corporation outstanding common stock on January 1, 2010. Dawson

shareholders equity on January 1, 2010 was $ 500,000 consisting of $ 300,000 common stock and $ 200,000 retained earnings. During

2010 Dawson had net income of $ 120,000 and on November 1, 2010 paid dividends of $ 50,000. Dawson assets and liabilities were

stated at fair value on January 1, 2010 except for building with a remaining useful life of 20 years that was overstated by $60,000 and

equipment with a remaining useful life of 10 years that was understated by $ 150,000

ANSWER THE QUESTIONS THAT FOLLOW

What is the balance in the Investment account on at December 31, 2010

What is the amount of goodwill paid

Provide all entries necessary in Dazed books for 2010 to account for its investment in Dawson WHICH ACCOUNT

IS DEBITED FOR $ 387,000

What is Dazed investment income for 2010

What is the amount of dividends received

Choose...

Choose...

Choose...

Choose...

Choose...

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 4 steps with 3 images

Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning