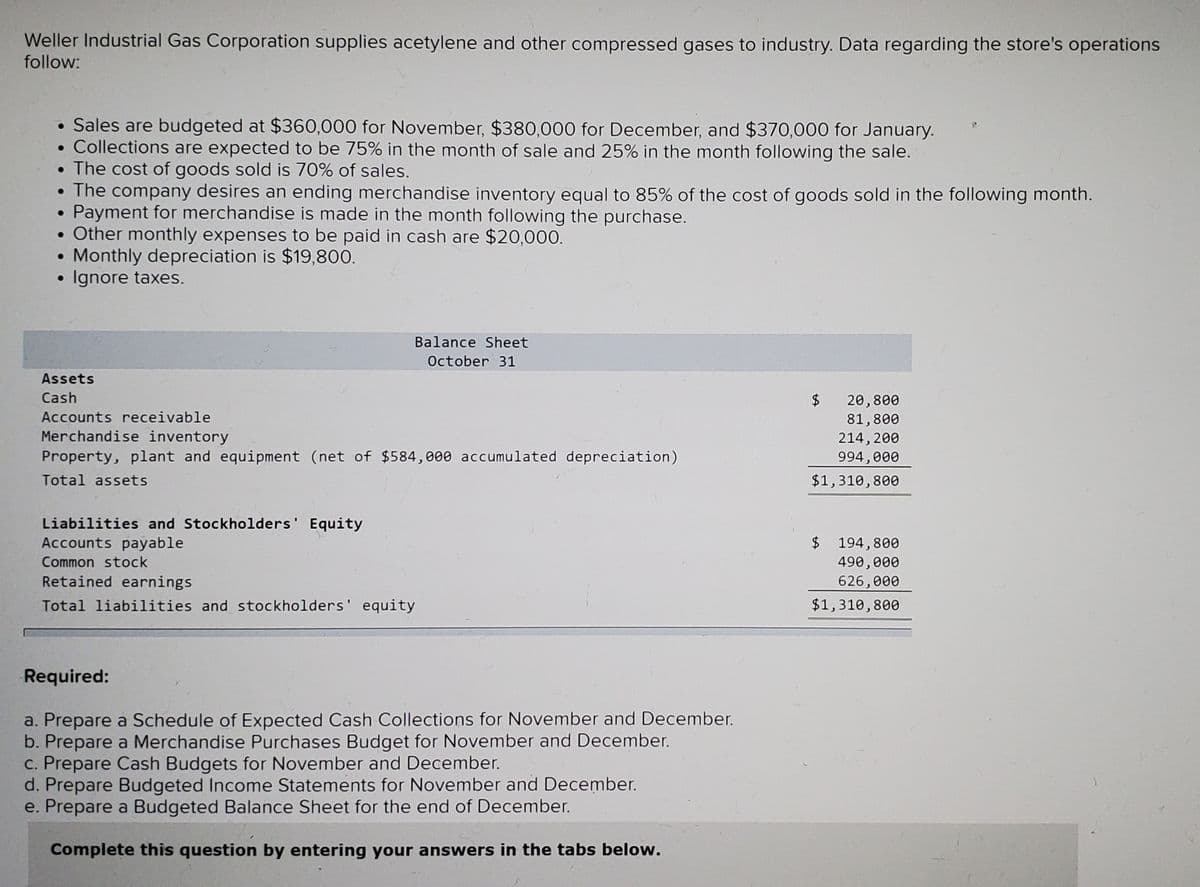

Weller Industrial Gas Corporation supplies acetylene and other compressed gases to industry. Data regarding the store's operations follow: • Sales are budgeted at $360,000 for November, $380,000 for December, and $370,000 for January. Collections are expected to be 75% in the month of sale and 25% in the month following the sale. • The cost of goods sold is 70% of sales. • The company desires an ending merchandise inventory equal to 85% of the cost of goods sold in the following month. Payment for merchandise is made in the month following the purchase. • Other monthly expenses to be paid in cash are $20,000. • Monthly depreciation is $19,800. Ignore taxes.

Weller Industrial Gas Corporation supplies acetylene and other compressed gases to industry. Data regarding the store's operations follow: • Sales are budgeted at $360,000 for November, $380,000 for December, and $370,000 for January. Collections are expected to be 75% in the month of sale and 25% in the month following the sale. • The cost of goods sold is 70% of sales. • The company desires an ending merchandise inventory equal to 85% of the cost of goods sold in the following month. Payment for merchandise is made in the month following the purchase. • Other monthly expenses to be paid in cash are $20,000. • Monthly depreciation is $19,800. Ignore taxes.

Principles of Cost Accounting

17th Edition

ISBN:9781305087408

Author:Edward J. Vanderbeck, Maria R. Mitchell

Publisher:Edward J. Vanderbeck, Maria R. Mitchell

Chapter7: The Master Budget And Flexible Budgeting

Section: Chapter Questions

Problem 1E: The sales department of Macro Manufacturing Co. has forecast sales for its single product to be...

Related questions

Question

100%

Please use the formatting provided

Transcribed Image Text:Weller Industrial Gas Corporation supplies acetylene and other compressed gases to industry. Data regarding the store's operations

follow:

Sales are budgeted at $360,000 for November, $380,000 for December, and $370,000 for January.

• Collections are expected to be 75% in the month of sale and 25% in the month following the sale.

• The cost of goods sold is 70% of sales.

• The company desires an ending merchandise inventory equal to 85% of the cost of goods sold in the following month.

Payment for merchandise is made in the month following the purchase.

Other monthly expenses to be paid in cash are $20,000.

Monthly depreciation is $19,800.

Ignore taxes.

Balance Sheet

October 31

Assets

Cash

$

20,800

81,800

214, 200

Accounts receivable

Merchandise inventory

Property, plant and equipment (net of $584,000 accumulated depreciation)

994,000

Total assets

$1,310,800

Liabilities and Stockholders' Equity

Accounts payable

$ 194,800

490,000

Common stock

Retained earnings

626,000

Total liabilities and stockholders' equity

$1,310,800

Required:

a. Prepare a Schedule of Expected Cash Collections for November and December.

b. Prepare a Merchandise Purchases Budget for November and December.

C. Prepare Cash Budgets for November and December.

d. Prepare Budgeted Income Statements for November and December.

e. Prepare a Budgeted Balance Sheet for the end of December.

Complete this question by entering your answers in the tabs below.

Transcribed Image Text:490,000

626,000

Common stock

Retained earnings

Total liabilities and stockholders' equity

$1,310,800

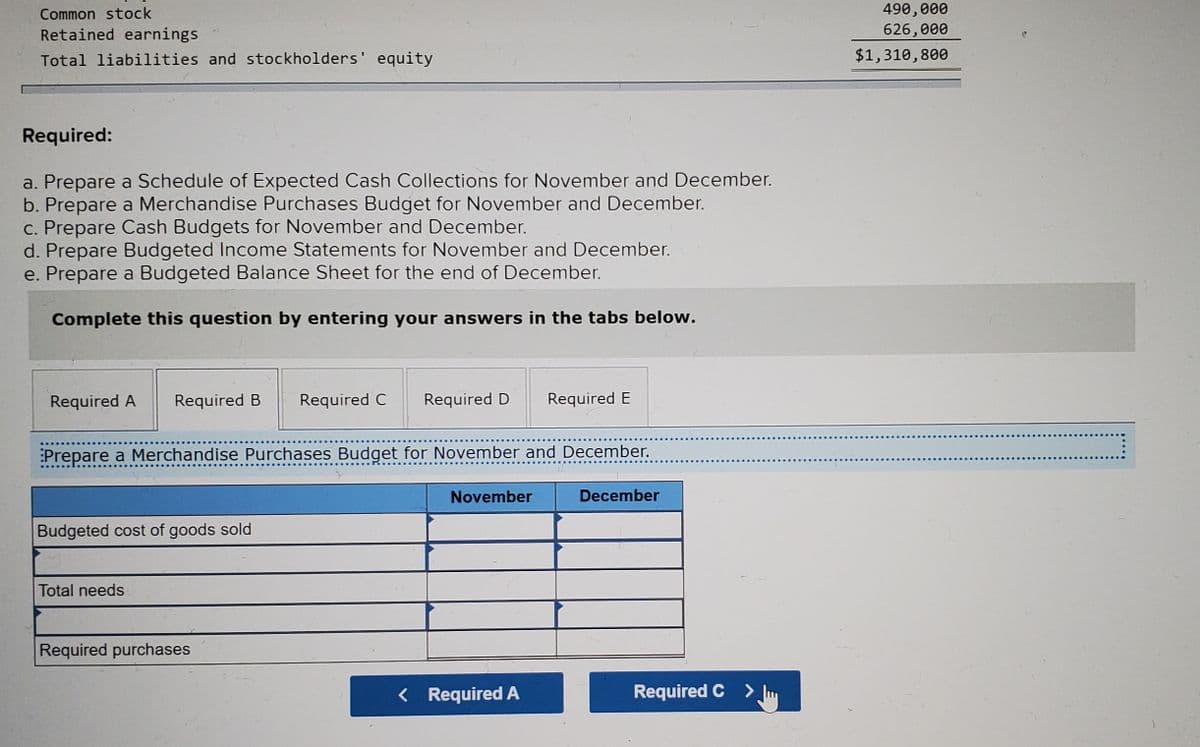

Required:

a. Prepare a Schedule of Expected Cash Collections for November and December.

b. Prepare a Merchandise Purchases Budget for November and December.

c. Prepare Cash Budgets for November and December.

d. Prepare Budgeted Income Statements for November and December.

e. Prepare a Budgeted Balance Sheet for the end of December.

Complete this question by entering your answers in the tabs below.

Required A

Required B

Required C

Required D

Required E

Prepare a Merchandise Purchases Budget for November and December.

November

December

Budgeted cost of goods sold

Total needs

Required purchases

< Required A

Required C >

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning