were restricted for research activities. During the year ended June 30, 20X9, $90,000 of the contributions were expended on research. (3) It sold investments classified in the permanently restricted class for a loss of $40,000. Dividends and interest income earned on the investments amounted to $70,

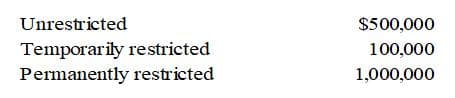

Local Services, a voluntary health and welfare organization had the following classes of net assets on July 1, 20X8, the beginning of its fiscal year:

During the year ended June 30, 20X9, the following events occurred:

(1) It purchased equipment, costing $100,000, with contributions restricted for this purpose. The contributions had been received from donors during June of 20X8.

(2) It received $130,000 of cash donations which were restricted for research activities. During the year ended June 30, 20X9, $90,000 of the contributions were expended on research.

(3) It sold investments classified in the permanently restricted class for a loss of $40,000. Dividends and interest income earned on the investments amounted to $70,000. There were no restrictions on how investment income was to be used.

(4) It received cash contributions of $200,000 from donors who did not place either time or use restrictions upon their donations.

(5) Expenses, excluding

(6) Depreciation expense for the year ended June 30, 20X9, was $80,000.

Refer to the above information. On the statement of activities for the year ended June 30, 20X9, temporarily restricted net assets:

A. increased $130,000.

B. increased $40,000.

C. decreased $100,000.

D. decreased $60,000.

Trending now

This is a popular solution!

Step by step

Solved in 3 steps