a. Purchased raw materials on credit, $220,000. b. Materials requisitions record use of the following materials for the month. $ 48,500 33,000 19,800 23,200 7,000 131,500 20,000 $ 151,500 Job 136 Job 137 Job 138 Job 139 Job 140 Total direct materials Indirect materials Total materials requisitions c. Time tickets record use of the following labor for the month. These wages were paid in cash. $ 12,200 10,700 37,700 39,200 3,400 103,200 25,500 Job 136 Job 137 Job 138 Job 139 Job 140 Total direct labor Indirect labor Total labor cost $ 128,700

a. Purchased raw materials on credit, $220,000. b. Materials requisitions record use of the following materials for the month. $ 48,500 33,000 19,800 23,200 7,000 131,500 20,000 $ 151,500 Job 136 Job 137 Job 138 Job 139 Job 140 Total direct materials Indirect materials Total materials requisitions c. Time tickets record use of the following labor for the month. These wages were paid in cash. $ 12,200 10,700 37,700 39,200 3,400 103,200 25,500 Job 136 Job 137 Job 138 Job 139 Job 140 Total direct labor Indirect labor Total labor cost $ 128,700

Principles of Cost Accounting

17th Edition

ISBN:9781305087408

Author:Edward J. Vanderbeck, Maria R. Mitchell

Publisher:Edward J. Vanderbeck, Maria R. Mitchell

Chapter4: Accounting For Factory Overhead

Section: Chapter Questions

Problem 15E: The books of Petry Products Co. revealed that the following general journal entry had been made at...

Related questions

Question

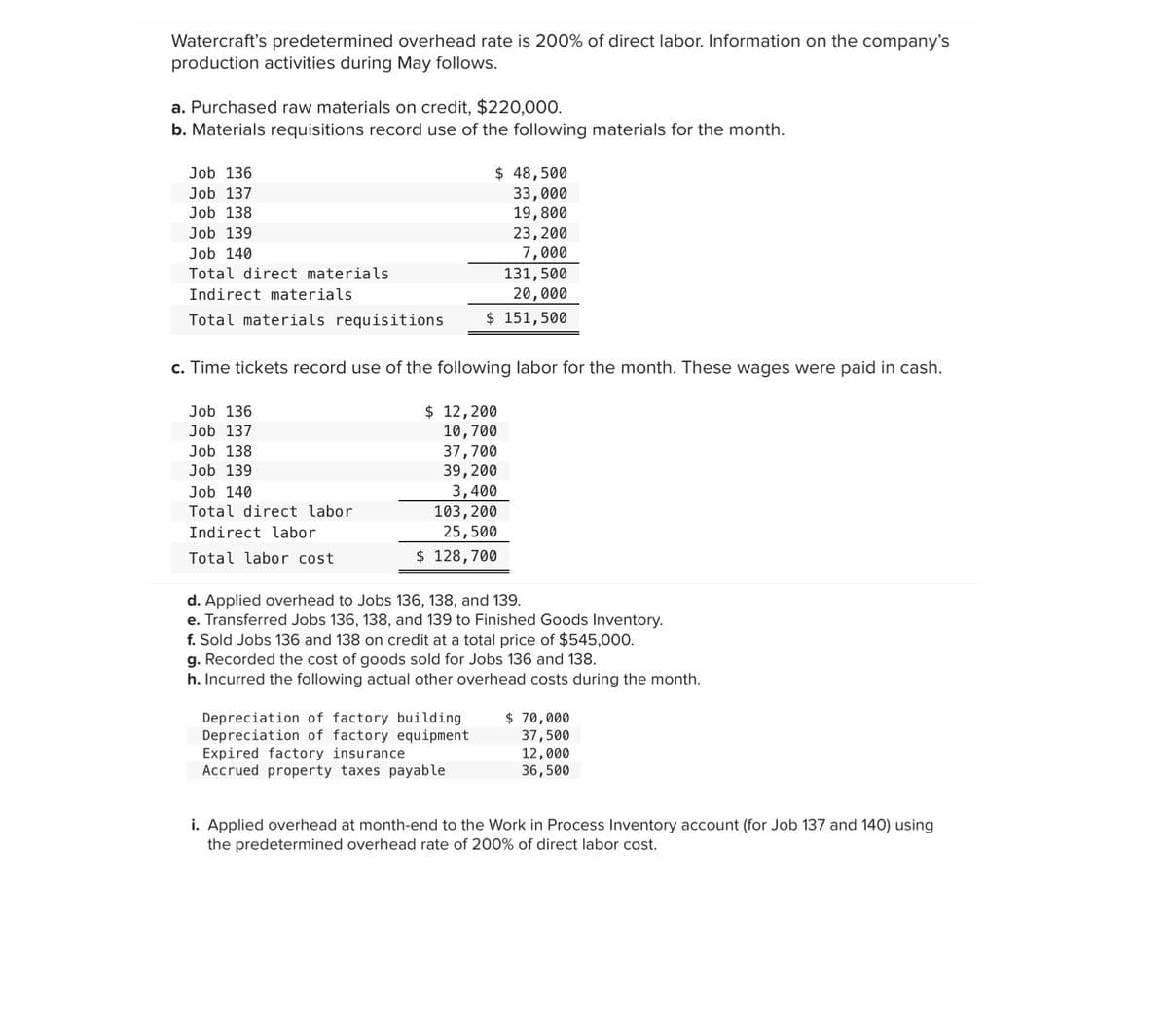

Transcribed Image Text:Watercraft's predetermined overhead rate is 200% of direct labor. Information on the company's

production activities during May follows.

a. Purchased raw materials on credit, $220,000.

b. Materials requisitions record use of the following materials for the month.

$ 48,500

33,000

19,800

23,200

7,000

131,500

20,000

$ 151,500

Job 136

Job 137

Job 138

Job 139

Job 140

Total direct materials

Indirect materials

Total materials requisitions

c. Time tickets record use of the following labor for the month. These wages were paid in cash.

$ 12,200

10,700

37,700

39,200

3,400

103,200

Job 136

Job 137

Job 138

Job 139

Job 140

Total direct labor

Indirect labor

25,500

Total labor cost

$ 128,700

d. Applied overhead to Jobs 136, 138, and 139.

e. Transferred Jobs 136, 138, and 139 to Finished Goods Inventory.

f. Sold Jobs 136 and 138 on credit at a total price of $545,000.

g. Recorded the cost of goods sold for Jobs 136 and 138.

h. Incurred the following actual other overhead costs during the month.

Depreciation of factory building

Depreciation of factory equipment

Expired factory insurance

Accrued property taxes payable

$ 70,000

37,500

12,000

36,500

i. Applied overhead at month-end to the Work in Process Inventory account (for Job 137 and 140) using

the predetermined overhead rate of 200% of direct labor cost.

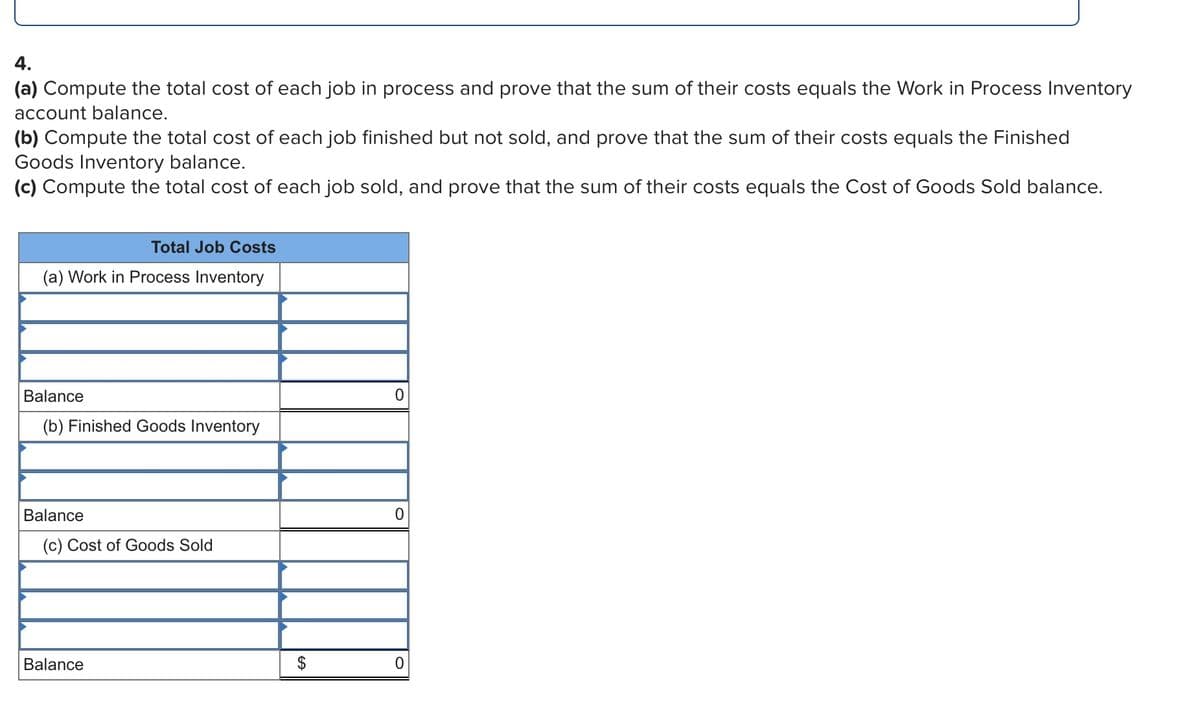

Transcribed Image Text:4.

(a) Compute the total cost of each job in process and prove that the sum of their costs equals the Work in Process Inventory

account balance.

(b) Compute the total cost of each job finished but not sold, and prove that the sum of their costs equals the Finished

Goods Inventory balance.

(c) Compute the total cost of each job sold, and prove that the sum of their costs equals the Cost of Goods Sold balance.

Total Job Costs

(a) Work in Process Inventory

Balance

(b) Finished Goods Inventory

Balance

(c) Cost of Goods Sold

Balance

$

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,