What amount of unrealized gain/loss should be shown in the 2023 statement of changes in equity? 25,233 10,982 16,883 26,455 What amount of unrealized gain/loss should be shown as component of other comprehensive income in the 2022 statement of comprehensive income? 14,393 19,340 18,500 1,222

What amount of unrealized gain/loss should be shown in the 2023 statement of changes in equity? 25,233 10,982 16,883 26,455 What amount of unrealized gain/loss should be shown as component of other comprehensive income in the 2022 statement of comprehensive income? 14,393 19,340 18,500 1,222

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter13: Investments And Long-term Receivables

Section: Chapter Questions

Problem 5RE

Related questions

Question

What amount of unrealized gain/loss should be shown in the 2023 statement of changes in equity?

25,233

10,982

16,883

26,455

What amount of unrealized gain/loss should be shown as component of other comprehensive income in the 2022 statement of comprehensive income?

14,393

19,340

18,500

1,222

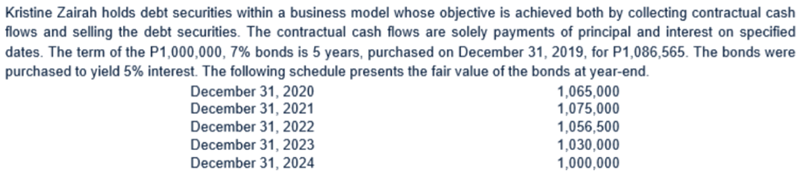

Transcribed Image Text:Kristine Zairah holds debt securities within a business model whose objective is achieved both by collecting contractual cash

flows and selling the debt securities. The contractual cash flows are solely payments of principal and interest on specified

dates. The term of the P1,000,000, 7% bonds is 5 years, purchased on December 31, 2019, for P1,086,565. The bonds were

purchased to yield 5% interest. The following schedule presents the fair value of the bonds at year-end.

1,065,000

1,075,000

1,056,500

1,030,000

1,000,000

December 31, 2020

December 31, 2021

December 31, 2022

December 31, 2023

December 31, 2024

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning