What are the correct deductions for Social Security, Medicare, and FIT?

Chapter4: Gross Income: Concepts And Inclusions

Section: Chapter Questions

Problem 57P: Charles E. Bennett, age 64, will retire next year and is trying to decide whether to begin...

Related questions

Question

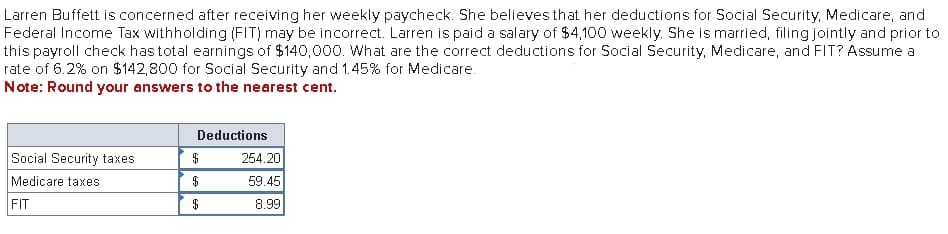

Transcribed Image Text:Larren Buffett is concerned after receiving her weekly paycheck. She believes that her deductions for Social Security, Medicare, and

Federal Income Tax withholding (FIT) may be incorrect. Larren is paid a salary of $4,100 weekly. She is married, filing jointly and prior to

this payroll check has total earnings of $140,000. What are the correct deductions for Social Security, Medicare, and FIT? Assume a

rate of 6.2% on $142,800 for Social Security and 1.45% for Medicare.

Note: Round your answers to the nearest cent.

Social Security taxes

Medicare taxes

FIT

Deductions

$

$

$

254.20

59.45

8.99

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 2 images

Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT