What are the formulas used to get the answer in dividens, addition to retained earnings, short-term debt, and long-term debt.

What are the formulas used to get the answer in dividens, addition to retained earnings, short-term debt, and long-term debt.

Corporate Financial Accounting

14th Edition

ISBN:9781305653535

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Carl Warren, James M. Reeve, Jonathan Duchac

Chapter14: Financial Statement Analysis

Section: Chapter Questions

Problem 14.6EX: Current position analysis The following data were taken from the balance sheet of Nilo Company at...

Related questions

Question

100%

What are the formulas used to get the answer in dividens, addition to

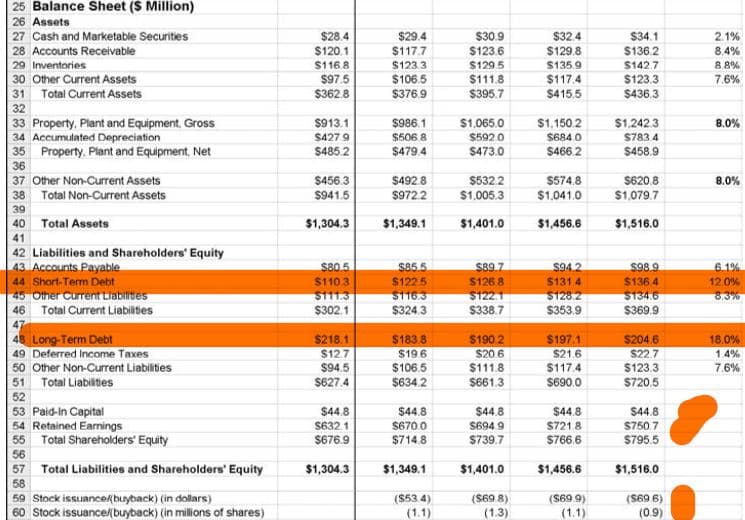

Transcribed Image Text:25 Balance Sheet ($ Million)

26 Assets

27 Cash and Marketable Securities

28 Accounts Receivable

29 Inventories

30 Other Current Assets

$28.4

$29.4

$30.9

$32.4

$34.1

2.1%

$120.1

$117.7

$123.6

$129.8

$136.2

8.4%

$116 8

$123.3

$129.5

$135.9

$142.7

8.8%

$97.5

$362.8

$106.5

$376.9

$111.8

$395.7

$123.3

$436.3

$117.4

7.6%

31 Total Current Assets

$415.5

32

33 Property, Plant and Equipment, Gross

34 Accumulated Depreciation

35 Property. Plant and Equipment, Net

36

37 Other Non-Current Assets

38 Total Non-Current Assets

$913.1

$986.1

$1,065.0

$1,150.2

$1,242.3

8.0%

$427 9

$506.8

$5920

S684.0

S783.4

$4852

$479.4

$473.0

$466.2

$458.9

$456.3

$492.8

$532.2

$574.8

$620.8

8.0%

$941.5

$972.2

$1,005.3

$1.041.0

$1,079.7

39

40 Total Assets

$1,304.3

$1,349.1

$1,401.0

$1,456.6

$1,516.0

41

42 Liabilities and Shareholders' Equity

43 Accounts Payable

44 Short-Term Debt

45 Other Current tiabilites

46 Total Current Liabilities

S98.9

S897

$126 8

s80.5

S1103

$111.3

$302.1

$85.5

$1225

S94.2

$131 4

6.1%

$136 4

12.0%

$1163

$324.3

$1221

$338.7

$128.2

$353.9

$134.6

$369.9

8.3%

48 Long-Term Debt

49 Deferred Income Taxes

50 Other Non-Current Liabilities

51 Total Liabilities

$197.1

$216

$218.1

$183.8

$190.2

$204.6

18.0%

$19.6

$106.5

S20 6

$111.8

$12.7

$22.7

$123.3

1.4%

$94.5

$117.4

7.6%

$627.4

$634.2

S661.3

S690.0

$720.5

52

53 Paid-in Capital

54 Retained Earnings

55 Total Shareholders' Equity

$44.8

$44.8

$44.8

$44.8

$44.8

S694. 9

$739.7

S632.1

$670.0

S721.8

S750 7

$676.9

$714.8

$766.6

S795.5

56

57

Total Liabilitios and Shareholders' Equity

$1,304.3

$1,349.1

$1,401.0

$1,456.6

$1,516.0

58

59 Stock issuancekbuyback) (in dollars)

60 Stock issuance(buyback) (in millions of shares)

(S53.4)

(1.1)

($69 8)

(1.3)

($69 9)

(1.1)

(S69 6)

(0.9)

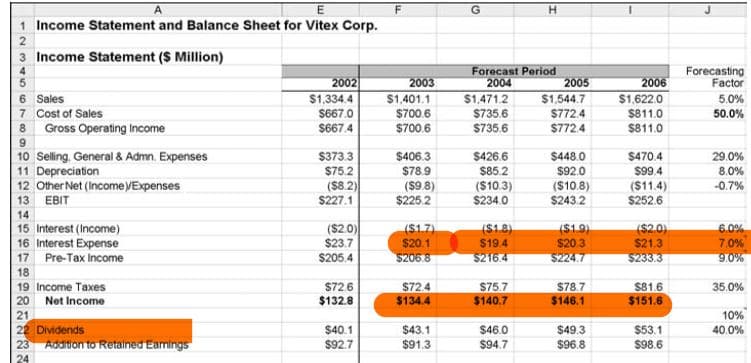

Transcribed Image Text:A

H.

1 Income Statement and Balance Sheet for Vitex Corp.

3 Income Statement ($ Million)

Forecast Period

2004

$1,471.2

Forecasting

Factor

2002

$1,334.4

$667.0

$667.4

2006

$1,622.0

$811.0

$811.0

2005

$1,544.7

6 Sales

7 Cost of Sales

8 Gross Operating Income

2003

$1,401.1

$700.6

$700.6

5.0%

S735.6

$772.4

50.0%

$735.6

$772.4

9.

10 Selling, General & Admn. Expenses

11 Depreciation

12 Other Net (IncomeVExpenses

$373.3

$406.3

$426.6

$448.0

$470.4

29.0%

$92.0

$75.2

($8.2)

$227.1

$789

(S9.8)

$225.2

$85.2

$99.4

8.0%

($10.3)

($10.8)

$243.2

($11.4)

-0.7%

13 EBIT

$234.0

$252.6

14

($2.0)

$23.7

$205.4

(S1.7)

($1.8)

($1.9)

($2.0)

6.0%

15 Interest (Income)

16 Interest Expense

17 Pre-Tax Income

$20.1

$206.8

7.0%

$20.3

$224.7

$19.4

$21,3

$216.4

$233.3

9.0%

18

$78.7

$146.1

S81.6

$151.6

19 Income Taxes

S72.6

$72.4

S75.7

35.0%

20 Net Income

21

22 Dividends

23 Adaton to Retained Eamings

$132.8

$134.4

$140.7

10%

$40.1

$43.1

$46.0

$49.3

$53.1

40.0%

$92.7

$91.3

$94.7

$96.8

$98.6

24

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:

9781337119207

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:

9781337119207

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781337398169

Author:

Carl Warren, Jeff Jones

Publisher:

Cengage Learning