What can you say about the company’s performance throughout the years? 2. What can you say about the sales performance of the company from 2008 to 2009? Research on what could have happened during that period which led to the results of your horizontal analysis?

What can you say about the company’s performance throughout the years? 2. What can you say about the sales performance of the company from 2008 to 2009? Research on what could have happened during that period which led to the results of your horizontal analysis?

Chapter1: Financial Statements And Business Decisions

Section: Chapter Questions

Problem 1Q

Related questions

Question

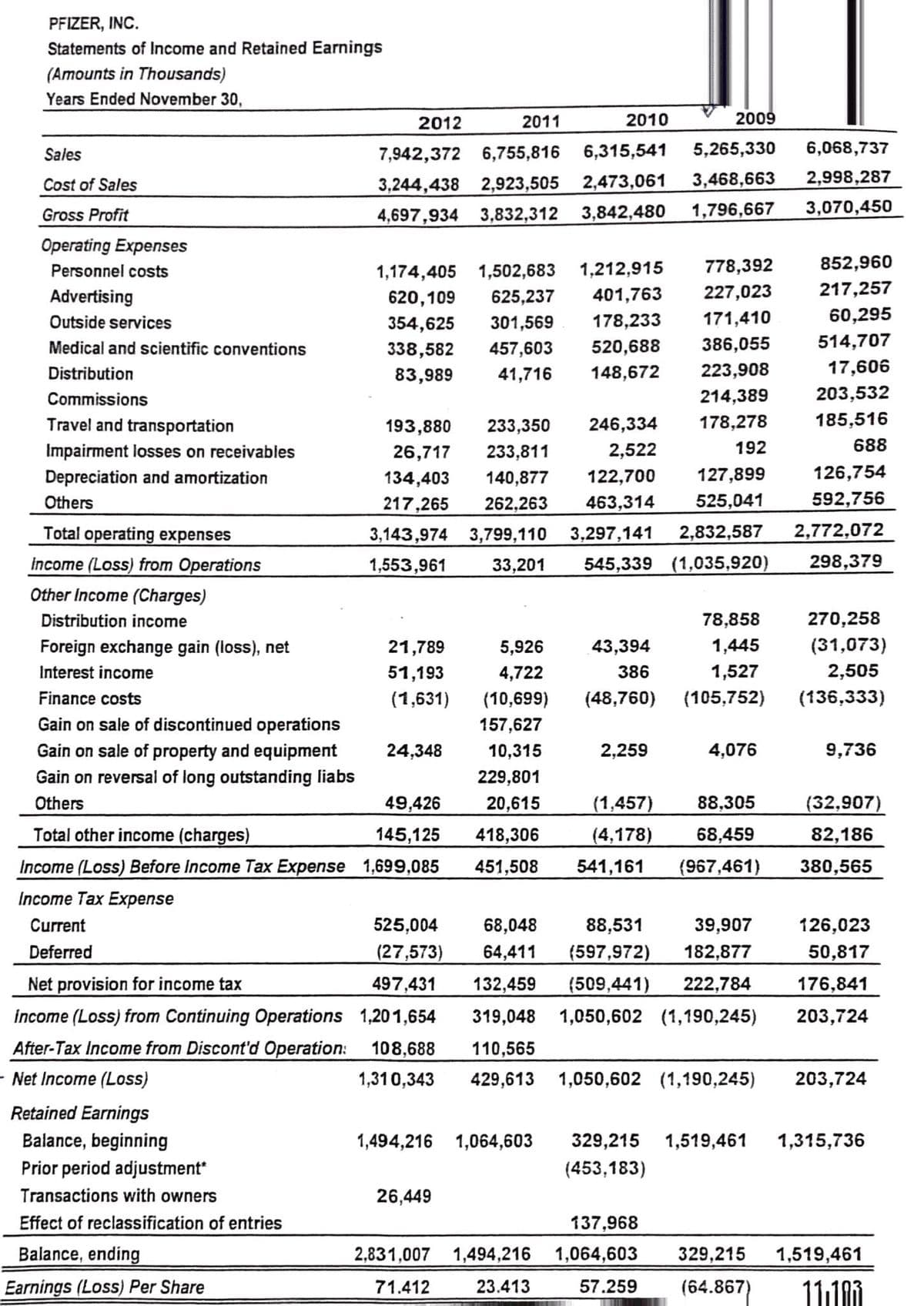

Using Pfizer’s Income Statement, perform a horizontal analysis and answer the following questions: 1. What can you say about the company’s performance throughout the years? 2. What can you say about the sales performance of the company from 2008 to 2009? Research on what could have happened during that period which led to the results of your horizontal analysis?

Transcribed Image Text:PFIZER, INC.

Statements of Income and Retained Earnings

(Amounts in Thousands)

Years Ended November 30,

2012

2011

2010

2009

Sales

7,942,372 6,755,816 6,315,541

5,265,330

6,068,737

2,998,287

3,244,438 2,923,505 2,473,061

4,697,934 3,832,312 3,842,480

Cost of Sales

3,468,663

Gross Profit

1,796,667

3,070,450

Operating Expenses

Personnel costs

1,174,405 1,502,683

1,212,915

778,392

852,960

Advertising

620,109

625,237

401,763

227,023

217,257

Outside services

354,625

301,569

178,233

171,410

60,295

Medical and scientific conventions

338,582

457,603

520,688

386,055

514,707

Distribution

83,989

41,716

148,672

223,908

17,606

Commissions

214,389

203,532

Travel and transportation

193,880

233,350

246,334

178,278

185,516

Impairment losses on receivables

26,717

233,811

2,522

192

688

Depreciation and amortization

134,403

140,877

122,700

127,899

126,754

Others

217,265

262,263

463,314

525,041

592,756

Total operating expenses

3,143,974 3,799,110

3,297,141

2,832,587

2,772,072

income (Loss) from Operations

1,553,961

33,201

545,339 (1,035,920)

298,379

Other Income (Charges)

Distribution income

78,858

270,258

Foreign exchange gain (loss), net

21,789

5,926

43,394

1,445

(31,073)

Interest income

51,193

4,722

386

1,527

2,505

Finance costs

(1,631)

(10,699)

(48,760)

(105,752)

(136,333)

Gain on sale of discontinued operations

Gain on sale of property and equipment

157,627

24,348

10,315

2,259

4,076

9,736

Gain on reversal of long outstanding liabs

229,801

Others

49,426

20,615

(1,457)

88,305

(32,907)

Total other income (charges)

145,125

Income (Loss) Before Income Tax Expense 1,699,085

418,306

(4,178)

68,459

82,186

451,508

541,161

(967,461)

380,565

Income Tax Expense

Current

525,004

68,048

88,531

39,907

126,023

Deferred

(27,573)

64,411

(597,972)

182,877

50,817

Net provision for income tax

497,431

132,459

(509,441)

222,784

176,841

İncome (Loss) from Continuing Operations 1,201,654

319,048 1,050,602 (1,190,245)

203,724

After-Tax Income from Discont'd Operation:

108,688

110,565

- Net Income (Loss)

1,310,343

429,613 1,050,602 (1,190,245)

203,724

Retained Earnings

Balance, beginning

1,494,216 1,064,603

329,215 1,519,461

1,315,736

Prior period adjustment"

(453,183)

Transactions with owners

26,449

Effect of reclassification of entries

137,968

Balance, ending

2,831,007 1,494,216 1,064,603

329,215

1,519,461

Earnings (Loss) Per Share

71.412

23.413

57.259

(64.867)

11.100

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,

Accounting Information Systems

Accounting

ISBN:

9781337619202

Author:

Hall, James A.

Publisher:

Cengage Learning,

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,

Accounting Information Systems

Accounting

ISBN:

9781337619202

Author:

Hall, James A.

Publisher:

Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis…

Accounting

ISBN:

9780134475585

Author:

Srikant M. Datar, Madhav V. Rajan

Publisher:

PEARSON

Intermediate Accounting

Accounting

ISBN:

9781259722660

Author:

J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:

McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:

9781259726705

Author:

John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:

McGraw-Hill Education