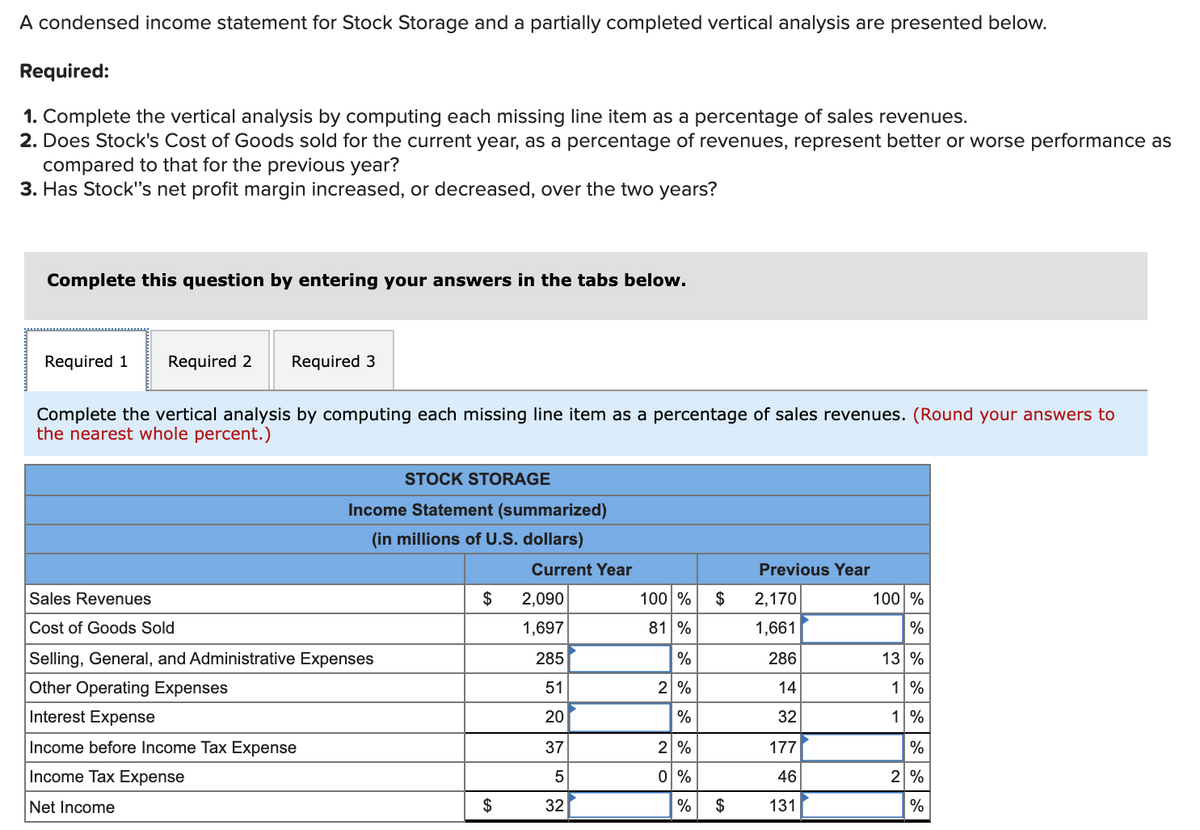

A condensed income statement for Stock Storage and a partially completed vertical analysis are presented below. Required: 1. Complete the vertical analysis by computing each missing line item as a percentage of sales revenues. 2. Does Stock's Cost of Goods sold for the current year, as a percentage of revenues, represent better or worse performance as compared to that for the previous year? 3. Has Stock"s net profit margin increased, or decreased, over the two years? Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 Complete the vertical analysis by computing each missing line item as a percentage of sales revenues. (Round your answers to the nearest whole percent.) STOCK STORAGE Income Statement (summarized) (in millions of U.S. dollars) Current Year Previous Year Sales Revenues $ 2,090 100 % $ 2,170 100 % Cost of Goods Sold 1,697 81 % 1,661 % Selling, General, and Administrative Expenses 285 286 13 % Other Operating Expenses 51 2 % 14 1% Interest Expense 20 % 32 1 % Income before Income Tax Expense 37 2 % 177 % Income Tax Expense 0 % 46 2 % Net Income $ 32 % 2$ 131

A condensed income statement for Stock Storage and a partially completed vertical analysis are presented below. Required: 1. Complete the vertical analysis by computing each missing line item as a percentage of sales revenues. 2. Does Stock's Cost of Goods sold for the current year, as a percentage of revenues, represent better or worse performance as compared to that for the previous year? 3. Has Stock"s net profit margin increased, or decreased, over the two years? Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 Complete the vertical analysis by computing each missing line item as a percentage of sales revenues. (Round your answers to the nearest whole percent.) STOCK STORAGE Income Statement (summarized) (in millions of U.S. dollars) Current Year Previous Year Sales Revenues $ 2,090 100 % $ 2,170 100 % Cost of Goods Sold 1,697 81 % 1,661 % Selling, General, and Administrative Expenses 285 286 13 % Other Operating Expenses 51 2 % 14 1% Interest Expense 20 % 32 1 % Income before Income Tax Expense 37 2 % 177 % Income Tax Expense 0 % 46 2 % Net Income $ 32 % 2$ 131

Managerial Accounting: The Cornerstone of Business Decision-Making

7th Edition

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Chapter15: Financial Statement Analysis

Section: Chapter Questions

Problem 40E: Cuneo Companys income statements for the last 3 years are as follows: Refer to the information for...

Related questions

Question

Transcribed Image Text:A condensed income statement for Stock Storage and a partially completed vertical analysis are presented below.

Required:

1. Complete the vertical analysis by computing each missing line item as a percentage of sales revenues.

2. Does Stock's Cost of Goods sold for the current year, as a percentage of revenues, represent better or worse performance as

compared to that for the previous year?

3. Has Stock"s net profit margin increased, or decreased, over the two years?

Complete this question by entering your answers in the tabs below.

Required 1

Required 2

Required 3

Complete the vertical analysis by computing each missing line item as a percentage of sales revenues. (Round your answers to

the nearest whole percent.)

STOCK STORAGE

Income Statement (summarized)

(in millions of U.S. dollars)

Current Year

Previous Year

Sales Revenues

$

2,090

100 %

$

2,170

100 %

Cost of Goods Sold

1,697

81 %

1,661

%

Selling, General, and Administrative Expenses

285

%

286

13 %

Other Operating Expenses

51

2 %

14

1%

Interest Expense

20

%

32

1 %

Income before Income Tax Expense

37

2 %

177

%

Income Tax Expense

0 %

46

2 %

Net Income

$

32

%

$

131

%

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning