What does the vertical analysis reveal for ABC corporation in terms of Implications to Financial Management

What does the vertical analysis reveal for ABC corporation in terms of Implications to Financial Management

Chapter1: Financial Statements And Business Decisions

Section: Chapter Questions

Problem 1Q

Related questions

Question

What does the vertical analysis reveal for ABC corporation in terms of Implications to

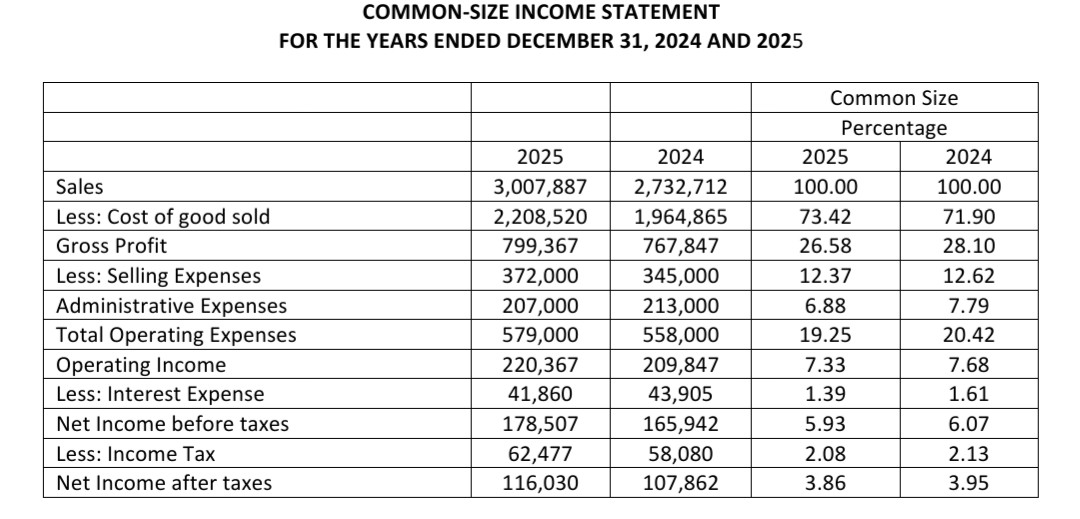

Transcribed Image Text:COMMON-SIZE INCOME STATEMENT

FOR THE YEARS ENDED DECEMBER 31, 2024 AND 2025

Common Size

Percentage

2025

2024

2025

2024

Sales

3,007,887

2,732,712

100.00

100.00

Less: Cost of good sold

2,208,520

1,964,865

73.42

71.90

Gross Profit

799,367

767,847

26.58

28.10

Less: Selling Expenses

Administrative Expenses

372,000

345,000

12.37

12.62

213,000

207,000

579,000

6.88

7.79

Total Operating Expenses

558,000

19.25

20.42

Operating Income

Less: Interest Expense

220,367

209,847

7.33

7.68

41,860

43,905

1.39

1.61

Net Income before taxes

178,507

165,942

5.93

6.07

Less: Income Tax

62,477

58,080

2.08

2.13

Net Income after taxes

116,030

107,862

3.86

3.95

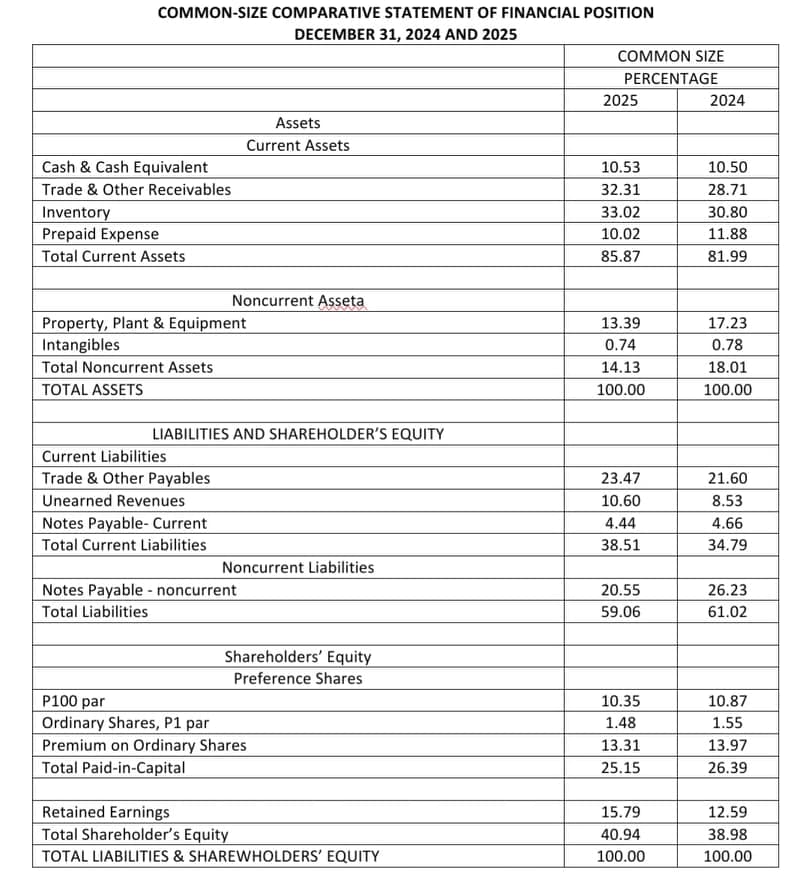

Transcribed Image Text:COMMON-SIZE COMPARATIVE STATEMENT OF FINANCIAL POSITION

DECEMBER 31, 2024 AND 2025

COMMON SIZE

PERCENTAGE

2025

2024

Assets

Current Assets

Cash & Cash Equivalent

10.53

10.50

Trade & Other Receivables

32.31

28.71

Inventory

33.02

30.80

Prepaid Expense

10.02

11.88

Total Current Assets

85.87

81.99

Noncurrent Asseta

Property, Plant & Equipment

Intangibles

13.39

17.23

0.74

0.78

Total Noncurrent Assets

14.13

18.01

TOTAL ASSETS

100.00

100.00

LIABILITIES AND SHAREHOLDER'S EQUITY

Current Liabilities

Trade & Other Payables

23.47

21.60

Unearned Revenues

10.60

8.53

Notes Payable- Current

4.44

4.66

Total Current Liabilities

38.51

34.79

Noncurrent Liabilities

Notes Payable - noncurrent

20.55

26.23

Total Liabilities

59.06

61.02

Shareholders' Equity

Preference Shares

P100 par

10.35

10.87

Ordinary Shares, P1 par

Premium on Ordinary Shares

Total Paid-in-Capital

1.48

1.55

13.31

13.97

25.15

26.39

Retained Earnings

Total Shareholder's Equity

15.79

12.59

40.94

38.98

TOTAL LIABILITIES & SHAREWHOLDERS' EQUITY

100.00

100.00

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Recommended textbooks for you

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,

Accounting Information Systems

Accounting

ISBN:

9781337619202

Author:

Hall, James A.

Publisher:

Cengage Learning,

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,

Accounting Information Systems

Accounting

ISBN:

9781337619202

Author:

Hall, James A.

Publisher:

Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis…

Accounting

ISBN:

9780134475585

Author:

Srikant M. Datar, Madhav V. Rajan

Publisher:

PEARSON

Intermediate Accounting

Accounting

ISBN:

9781259722660

Author:

J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:

McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:

9781259726705

Author:

John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:

McGraw-Hill Education