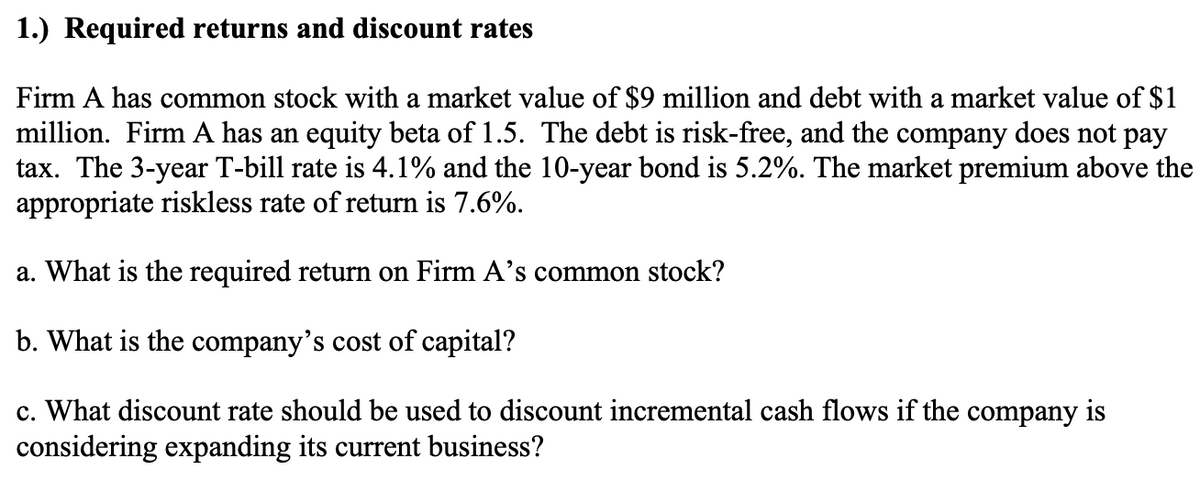

Firm A has common stock with a market value of $9 million and debt with a market value of $1 million. Firm A has an equity beta of 1.5. The debt is risk-free, and the company does not pay tax. The 3-year T-bill rate is 4.1% and the 10-year bond is 5.2%. The market premium above the appropriate riskless rate of return is 7.6%. a. What is the required return on Firm A's common stock? b. What is the company's cost of capital? c. What discount rate should be used to discount incremental cash flows if the company is considering expanding its current business?

Firm A has common stock with a market value of $9 million and debt with a market value of $1 million. Firm A has an equity beta of 1.5. The debt is risk-free, and the company does not pay tax. The 3-year T-bill rate is 4.1% and the 10-year bond is 5.2%. The market premium above the appropriate riskless rate of return is 7.6%. a. What is the required return on Firm A's common stock? b. What is the company's cost of capital? c. What discount rate should be used to discount incremental cash flows if the company is considering expanding its current business?

Cornerstones of Cost Management (Cornerstones Series)

4th Edition

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Don R. Hansen, Maryanne M. Mowen

Chapter10: Decentralization: Responsibility Accounting, Performance Evaluation, And Transfer Pricing

Section: Chapter Questions

Problem 24E: A company had WACC (weighted average cost of capital) equal to 8. % If the company pays off mortgage...

Related questions

Question

Transcribed Image Text:1.) Required returns and discount rates

Firm A has common stock with a market value of $9 million and debt with a market value of $1

million. Firm A has an equity beta of 1.5. The debt is risk-free, and the company does not pay

tax. The 3-year T-bill rate is 4.1% and the 10-year bond is 5.2%. The market premium above the

appropriate riskless rate of return is 7.6%.

a. What is the required return on Firm A's common stock?

b. What is the company's cost of capital?

c. What discount rate should be used to discount incremental cash flows if the company is

considering expanding its current business?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 5 steps

Follow-up Questions

Read through expert solutions to related follow-up questions below.

Follow-up Question

what is debt cost of capital and eqity cost of capital? I can't see it on this page.

Solution

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT