What is false about cost plus mark-up pricing? a. attempts to apply or allocate fix costs to pricing strategy b. not intuitive c. good example of value-based pricing d. vulnerable to bad sales estimates e. All are correct f. All are incorrect

What is false about cost plus mark-up pricing? a. attempts to apply or allocate fix costs to pricing strategy b. not intuitive c. good example of value-based pricing d. vulnerable to bad sales estimates e. All are correct f. All are incorrect

Managerial Accounting

15th Edition

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:Carl Warren, Ph.d. Cma William B. Tayler

Chapter11: Differential Analysis And Product Pricing

Section: Chapter Questions

Problem 19E

Related questions

Question

100%

What is false about cost plus mark-up pricing?

a. attempts to apply or allocate fix costs to pricing strategy

b. not intuitive

c. good example of value-based pricing

d. vulnerable to bad sales estimates

e. All are correct

f. All are incorrect

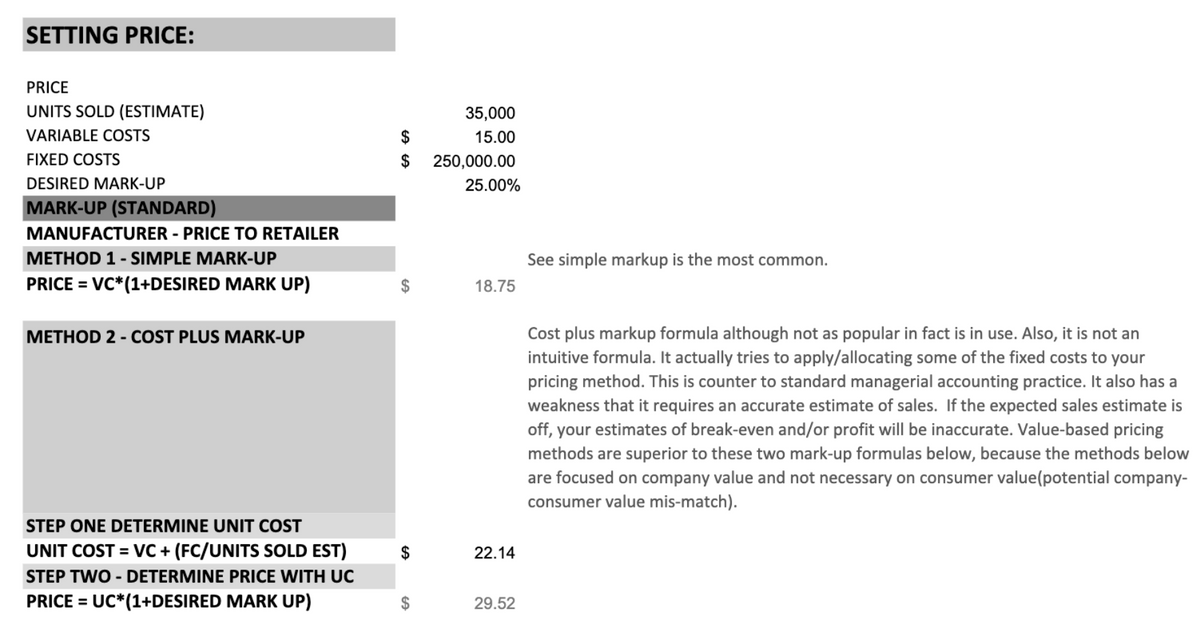

Transcribed Image Text:SETTING PRICE:

PRICE

UNITS SOLD (ESTIMATE)

35,000

VARIABLE COSTS

$

15.00

FIXED COSTS

$

250,000.00

DESIRED MARK-UP

25.00%

MARK-UP (STANDARD)

MANUFACTURER - PRICE TO RETAILER

METHOD 1 - SIMPLE MARK-UP

See simple markup is the most common.

PRICE = VC*(1+DESIRED MARK UP)

2$

18.75

%3D

Cost plus markup formula although not as popular in fact is in use. Also, it is not an

intuitive formula. It actually tries to apply/allocating some of the fixed costs to your

pricing method. This is counter to standard managerial accounting practice. It also has a

weakness that it requires an accurate estimate of sales. If the expected sales estimate is

off, your estimates of break-even and/or profit will be inaccurate. Value-based pricing

methods are superior to these two mark-up formulas below, because the methods below

are focused on company value and not necessary on consumer value(potential company-

METHOD 2 - COST PLUS MARK-UP

consumer value mis-match).

STEP ONE DETERMINE UNIT COST

UNIT COST = VC + (FC/UNITS SOLD EST)

$

22.14

STEP TWO - DETERMINE PRICE WITH UC

PRICE = UC*(1+DESIRED MARK UP)

2$

29.52

%3D

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Recommended textbooks for you

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning