Q: ........ is a link between savers & borrowers, helps to establish a link between savers & investors…

A: The financial market is the place where the savers and the borrowers meet. The borrowers refer to…

Q: nked. The investment returns used are for illustrative The returns are likely to change during the…

A: An annuity that is payable at the start of each period is known as an annuity due.An standard…

Q: Concept or Definition Term A computer-generated probability simulation of the most likely outcome,…

A: Capital budgeting is the technique of evaluating the acceptability of a new project, replacement…

Q: A financial analyst considers three funds. The funds' estimated returns depend on future economic…

A: OUTCOME PROBABILITY FUND M FUND N FUND P A 10.00% -10.00% -25.00% 10.00% B 30.00% 8.00% 10.00%…

Q: When choosing a mutual fund, one of the most important things to consider is your investment…

A: Income Objective: Nick is nearing retirement and is looking to purchase a mutual fund that will…

Q: Which of the following statements is incorrect regarding a fund's size? a.Fund size increases…

A: An investment fund is defined as the investment of the funds with the investors with the purpose of…

Q: c) Calculate Jensen's measure of performance for Wildcat Fund. d) Assuming that the Wildcat fund…

A: Jensen's measure of performance for Wildcat Fund is calculated with the help of following formula…

Q: Open to all investors, can be invested with small sums of money and is less risky are all…

A: Explanation : Hedge funds have the ability to the high-risk tactics, such as the short selling…

Q: The following data is reported for a fund and an appropriate benchmark as well as the risk-free rate…

A: “Hi There, thanks for posting the question. But as per Q&A guidelines, we must answer the first…

Q: When researching fund managers, which of the following statements is CORRECT? A) You would generally…

A: A person who is responsible for managing portfolios for their client and is responsible for all the…

Q: You have been appointed as the new investment manager for Retire-Easy Investments. In your first…

A: Profit maximization- Profit maximization is the short run or long run procedure by which a firm may…

Q: Would you expect a typical open-end fixed-income mutual fund to have higher or lower operating…

A: Mutual funds are of two types, they are, open ended and closed ended. We can explain the operating…

Q: With a decrease in time preference, the supply of loanable funds will increase. Select one: True…

A: Loanable funds includes all forms of credit, such as loans, bonds, or savings deposits. There is an…

Q: In the managed funds market, large institutional investors are positioned: A) in the retail market.…

A: Answer: The correct answer is option (B), Wholesale market.

Q: ____________ is one of the most important function of a finance manager where he/she has to execute…

A: Finance managers have 3 functions:- Investment decisions Financing decisions Dividend decisions

Q: Why is it so hard for actively managed funds to generate higher rates of return than passively…

A: Introduction: Mutual funds are institutions interested in pooling small sums from different…

Q: If a public firm has a high credit rating, the lowest-cost source of funds comes from a(n) _____.

A: Firms and companies with good credit quality and good financials will have high credit rating. High…

Q: Which mutual fund tends to be invested in companies with relatively low P/E ratios and good growth…

A: A high level of PE could mean that the mutual fund investment mainly has shares that quote an…

Q: A friend has confided in you that they have recently inherited a moderately sized investment…

A: A portfolio is the combination of various financial assets (or instruments) that an investor holds…

Q: A life insurance policy is a financial asset, with the premiums paid representing the…

A: According to portfolio concept, investors should invest in securities having negative correlation.…

Q: An investor seeking to invest in one of these three alternatives: Islamic mutual funds, ETFs or…

A: A capital gain is the increase in the value of a capital asset that occurs when the asset is sold.…

Q: Decide whether the following statement makes sense (or is clearly true) or does not make sense…

A: The correct answer is “Statement D”.

Q: It measures how much rate of return the fund manager/fund generates per unit of systematic risk…

A: Financial investments are the methods through which investors park or save their funds and money in…

Q: Advantages of private placeemnts do not include which of the following options? A) investor…

A: private palcement: It is a sale of stock shares or bonds to pre selected investors and institution…

Q: What are the limitations/problems from classifying performance using raw returns? and, What are the…

A: Limitations of classifying performance using raw returns: Raw data may be incomplete and may not…

Q: A more actively managed mutual fund will generally have a expense ratio than a fund that is active.…

A: Mutual funds have various types of expenses

Q: What is the shortcoming of using peer group performance comparisons to judge performance of a fund?…

A: Peer group comparisons are the method of comparing a stock with similar stock in the same sector.…

Q: Compare the funds based on their size, management, risk level, and dividend distributions. Then,…

A: A mutual fund is an investment opportunity whereby allows the investors to buy securities. It is…

Q: weigh up the advantages and disadvantages of Exchanges Traded Funds (ETF) and explain why they are…

A: There are many types of funds available in the market and each fund has own advantages and…

Q: You are a prospective fund manager to a life insurance company. You propose to manage its assets…

A: Liability-driven strategies are those strategies in which assets of the company (Life Insurance…

Q: An individual investor has approached you and wants to understand the two types of fund structures,…

A: Open Ended Fund Structures: It is a scheme of mutual fund in which units are offered for sale…

Q: Select the appropriate term to complete the sentences. A offers investors the opportunity to pool…

A: Mutual fund: A mutual fund is a pool of money from several individuals to invest in securities such…

Q: Based on the Sharpe ratio, which fund displays superior performance?

A: Sharpe Ratio is the excess return per unit of the risk. Sharpe Ratio=Expected Return-Risk Free…

Q: With respect to hedge fund investing, the net return to an investor in a fund of funds would be…

A: The net return to an investor in a fund of funds would be lower than that earned from an individual…

Q: Joan McKay is a portfolio manager for a bank trust department. McKay meets with two clients, Kevin…

A: The different financial assets when grouped together form a portfolio. These assets are in the form…

Q: In the context of evaluating performance of a particular hedge fund for the purpose of determining…

A: A high water mark is used to decide the performance / incentive fees paid to the fund managers. It…

Q: Which of the following theory is applicable to the following situation? A manager needs to raise…

A: In financial management, financing refers to the raising of funds by issue different types of…

Q: Conservative financing strategy provides long-term funds based on the minimum requirements with…

A: Financial strategy means the funding strategy that the company prefers to take to meet its financial…

Q: Determine the decision nature of each of the following issues: What are…

A: There are different types of decision which a firm is required to take which includes investing…

Q: of the factors that can affect the tolerance for risk and investment choices, match each investor to…

A: Conservative investment refer to those investments options that usually bears lower level of risk…

Q: Which one of the following should you most likely recommend for a prospective investor who has an…

A: Aggressive Investors are those investors which have deep knowledge about their market and know very…

Q: What are the two best reasons for considering a load fund? A. Lack of good no-load funds and…

A: Funds are an alternative of making direct investment where investors purchases units of a selected…

Q: n each of the three scenarios below (a, b, and c), choose ONE appropriate measure of performance…

A: Risk-adjusted performance measures, include Sharpe measure, Treynor’s measure, Jensen’s alpha, and…

Q: For example, you are a portfolio manager, and you get to select your pick of clients (individual or…

A: As a portfolio manager, the pick would be individual investor and sub class would be HNWIs. HNWIs or…

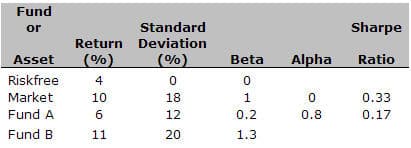

Use the following to answer questions a. – f.

a. What is the alpha for Fund B?

b. Based on alpha, which fund displays superior performance?

c. What is the Sharpe ratio for Fund B?

d. Based on the Sharpe ratio, which fund displays superior performance?

e. Suppose you are an investment counselor with a new client, Jonsey, and that Funds A and B are the only options available in Jonsey's company sponsored retirement account. Jonsey has no other investments. Which fund would you recommend, and why?

f. What additional evidence would make you more confident in your recommendation, that is, more confident that the fund you recommend has the ability to perform in the future? (Hint: The answer has nothing to do with the Treynor Index.)

Trending now

This is a popular solution!

Step by step

Solved in 5 steps

- Consider the following trading and performance data for four different equity mutual funds: Fund W Fund X Fund Y Fund Z Assets Under Management, $ 289.40 $ 653.70 $ 1,298.40 $ 5,567.30 Avg. for Past 12 Months (mil) Security Sales, Past 12 Months (mil) $ 37.20 $ 569.30 $ 1,453.80 $ 437.10 Expense Ratio 0.33% 0.71% 1.13% 0.21% Pretax Return, 3-Year Avg. 9.98% 10.65% 10.12% 9.83% Tax-Adjusted Return, 3-Year Avg. 9.43% 8.87% 9.34% 9.54% a. Calculate the portfolio turnover ratio for each fund. b. Which two funds are most likely to be actively managed and which two are most likely passive funds? Explain. c. Calculate the tax cost ratio for each fund. d. Which funds were the most and least tax efficient in the operations? Why?Consider the following trading and performance data for four different equity mutual funds: Fund W Fund x Fund y Fund z Assets under Management, $284.4 $662.1 $1,286.4 $5,564.6 Avg. for Past 12 months (mil) Security Sales, $44.6 $566.1 $1,455.6 $438.8 Past 12 months (mil) Expense Ratio 0.33% 0.75% 1.19% 0.24% Pretax Return, 3-year avg. 9.85% 10.65% 10.44% 9.73% Tax-adjusted Return, 3-year avg. 8.84% 8.84% 9.10% 9.04% Calculate the portfolio turnover ratio for each fund. Do not round intermediate calculations. Round your answers to two decimal places. Fund W: % Fund X: % Fund Y: % Fund Z: %calculate the following M-squared measureT-squared measure, andAppraisal ratio (information ratio) Fund Average return Standard Deviation Beta coefficient Unsystematic Risk A 0.240 0.220 0.800 0.017 B 0.200 0.170 0.900 0.450 C 0.290 0.380 1.200 0.074 D 0.260 0.290 1.100 0.026 E 0.180 0.400 0.900 0.121 F 0.320 0.460 1.100 0.153 G 0.250 0.190 0.700 0.120 Market 0.220 0.180 1.000 0.000 Risk free return 0.050 0.000 Out of the performance measures you calculated in part a., which one would you use undereach of the following circumstances:i. You want to select one of the funds as your risky portfolio.ii. You want to select one of the funds to be mixed with the rest of your portfolio,currently composed solely of holdings in the market-index fund.iii. You want to select one of the funds to form an actively managed stock portfolio

- Calculate : M-squared measureT-squared measure, andAppraisal ratio (information ratio) Fund Average return Standard Deviation Beta coefficient Unsystematic Risk A 0.240 0.220 0.800 0.017 B 0.200 0.170 0.900 0.450 C 0.290 0.380 1.200 0.074 D 0.260 0.290 1.100 0.026 E 0.180 0.400 0.900 0.121 F 0.320 0.460 1.100 0.153 G 0.250 0.190 0.700 0.120 Market 0.220 0.180 1.000 0.000 Risk free return 0.050 0.000The Layton Growth Fund has an alpha of 2.7 percent. You have determined that Layton’s information ratio is 0.45. What must Layton’s tracking error be relative to its benchmark? (Enter your answer as a percent rounded to 2 decimal places.)The average return, standard deviation, and beta for Fund A is given below along with data for the S&P 500 Index. Fund Average Return Standard Deviation Beta A 14% 24% 1.21 S&P 500 17.4% 19.4% 1 Risk-free 5.1% Calculate the Treynor measure of performance for the S&P 500. Convert percentages to decimal places before calculating your answer. ENTER your answer using FOUR DECIMAL places.Example: 1.2345

- In the table below, expected return and standard deviations are provided for bond and equity funds. If the correlation between the funds is 0.3, find the covariance between these two funds. Bond Equity Expected Return 5% 10% Standard Deviation 8% 20% Group of answer choices 0.0036 0 -0.0036 0.0048The table shows the average returns and betas for the five ETFs, S&P 500, and Treasury. VONF IJT PDP FTA FNY S&P 500 TreasuryAnnualize mean 0.07148 0.11941 0.09613 0.07483 0.10233 0.09637 0.02541Beta 1.01106 1.11377 1.01507 1.02652 1.09928 1.00000 0.00000 Create a SML with the S&P 500 index's and the Treasury's average returns and betas. Determine whether the ETFs have return and beta combinations above or below the line you generated. Explain the arbitrage strategy you would form with one of the ETFs, index, or Treasury.onsider 123 Fund (which is invested in 35% High risk stock and 65% normal bonds). Assume you have the following historical data of annual returns: Return S.D. Normal Stock 8% 20% Risky Bonds 10% 35% High Risk Stock 14% 40% Normal Bonds 6% 10% Assume High Risk Stocks and Normal Bonds have correlation coefficient of 0.24 Find the standard deviation of 123. Please use 5 decimal places in your response. Note: The right answer is 0.1679 Please explain step by step

- Suppose you manage an equity fund with the following securities. Use the following data to calculate the information ratio of each stock. Input Data Vogt Industries Isher Corporation Hedrock, Incorporated Alpha 0.012 0.006 0.016 Beta 0.277 1.015 1.630 Standard Deviation 0.156 0.168 0.181 Residual Standard Deviation 0.117 0.048 0.113 Required: Using the information in the table above, please calculate the information ratio for each stock. (Use cells A5 to D8 from the given information to complete this question.) Vogt Industries Isher Corporation Hedrock, Incorporated Information RatioWhat is the current price per share of the LPEVX mutual fund? 1 2 3 4 5 6 Family/ Fund Symbol NAV Chg YTD % return 3-yr % chg AARP Funds Aggr AAGSX 10.25 0.08 6.2 −1.6 Consrv AACNX 10.55 0.02 4.0 4.0 Mod p AAMDX 10.50 0.05 4.9 1.3 AMF Funds IntMtg ASCPX 4.81 −0.01 0.1 −14.3 LgCpEq IICAX 8.16 0.08 7.5 −2.1 ShtUSGv ASITX 9.36 −0.01 0.2 0.7 UltraShrt p AULTX 5.45 −0.02 3.2 −12.2 UltShrtMtg ASARX 7.39 — 2.4 −4.4 USGvMtg ASMTX 8.64 −0.02 0.2 −0.7 APIEffFrtGrPrim fp APIEffFrtGrPrim fp APITX 8.13 0.10 9.0 −6.5 APIMultIdxPrim APIMultIdxPrim AFMMX 10.98 0.09 4.4 −9.6 AVS LPE Ptf AVS LPE Ptf LPEVX 5.82 −0.01 11.3 NS Aberdeen Fds…Review the table below listing performance metrics for selected assets. The metrics are defined in the same way as in CAPM Return risk beta riskless asset 4% 0% 0 Market Portfolio 9% 24% 1 Fund A 8% 33% 0.4 Fund B 11% 30% 1.5