Chapter3: Financial Statements, Tools, And Budgets

Section: Chapter Questions

Problem 3FPC

Related questions

Question

what is the annual interest that you would warn on a $1200 Treasury Bond with a current yield of 1.5% that is quoted at 98 points ?

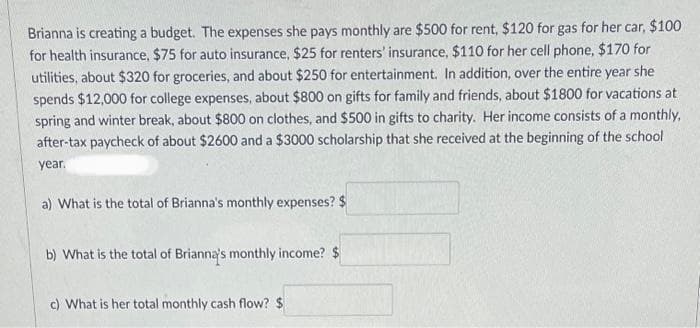

Transcribed Image Text:Brianna is creating a budget. The expenses she pays monthly are $500 for rent, $120 for gas for her car, $100

for health insurance, $75 for auto insurance, $25 for renters' insurance, $110 for her cell phone, $170 for

utilities, about $320 for groceries, and about $250 for entertainment. In addition, over the entire year she

spends $12,000 for college expenses, about $800 on gifts for family and friends, about $1800 for vacations at

spring and winter break, about $800 on clothes, and $500 in gifts to charity. Her income consists of a monthly,

after-tax paycheck of about $2600 and a $3000 scholarship that she received at the beginning of the school

year.

a) What is the total of Brianna's monthly expenses? $

b) What is the total of Brianna's monthly income? $

c) What is her total monthly cash flow? $

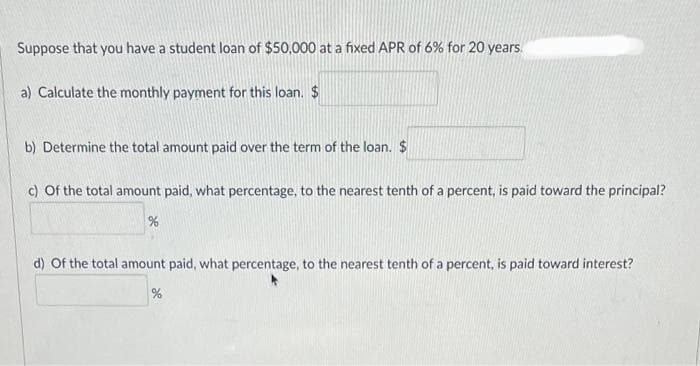

Transcribed Image Text:Suppose that you have a student loan of $50,000 at a fixed APR of 6% for 20 years.

a) Calculate the monthly payment for this loan. $

b) Determine the total amount paid over the term of the loan. $

c) of the total amount paid, what percentage, to the nearest tenth of a percent, is paid toward the principal?

%

d) Of the total amount paid, what percentage, to the nearest tenth of a percent, is paid toward interest?

%

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you