WHAT IS THE COST OF SALES?

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter5: The Income Statement And The Statement Of Cash Flows

Section: Chapter Questions

Problem 7E: Multiple-Step and Single-Step Income Statements, and Statement of Comprehensive Income On December...

Related questions

Question

WHAT IS THE COST OF SALES?

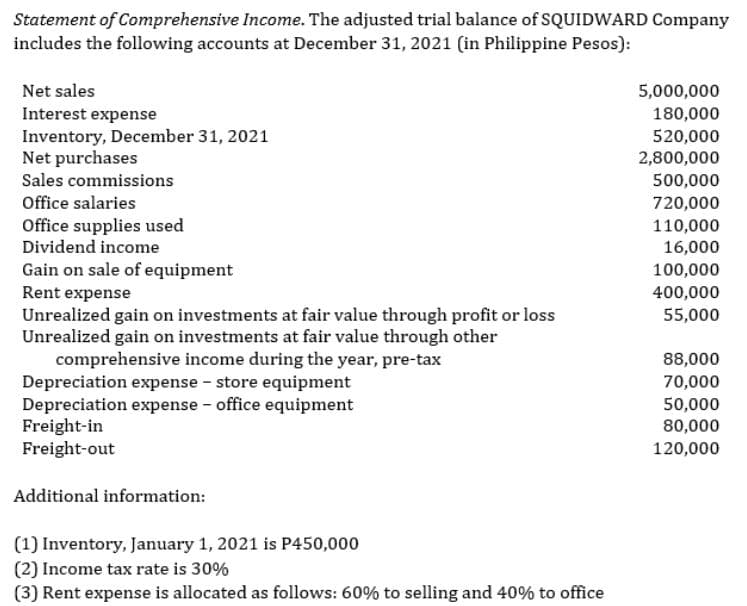

Transcribed Image Text:Statement of Comprehensive Income. The adjusted trial balance of SQUIDWARD Company

includes the following accounts at December 31, 2021 (in Philippine Pesos):

Net sales

5,000,000

Interest expense

180,000

520,000

2,800,000

500,000

Inventory, December 31, 2021

Net purchases

Sales commissions

Office salaries

720,000

Office supplies used

110,000

Dividend income

16,000

Gain on sale of equipment

100,000

Rent expense

Unrealized gain on investments at fair value through profit or loss

Unrealized gain on investments at fair value through other

comprehensive income during the year, pre-tax

Depreciation expense - store equipment

Depreciation expense - office equipment

Freight-in

Freight-out

400,000

55,000

88,000

70,000

50,000

80,000

120,000

Additional information:

(1) Inventory, January 1, 2021 is P450,000

(2) Income tax rate is 30%

(3) Rent expense is allocated as follows: 60% to selling and 40% to office

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 1 images

Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage