What is the gross profit for the year if the net revenue from by-product is treated as additional sales revenue? b. P1,230,000 c. P1,218,000 d. P1,118,000 a. P1,200,000 What is the gross profit for the year if the net revenue from by-product is treated as additional sales revenue? b. P1,230,000 c. P1,218,000 d. P1,118,000 a. P1,200,000

What is the gross profit for the year if the net revenue from by-product is treated as additional sales revenue? b. P1,230,000 c. P1,218,000 d. P1,118,000 a. P1,200,000 What is the gross profit for the year if the net revenue from by-product is treated as additional sales revenue? b. P1,230,000 c. P1,218,000 d. P1,118,000 a. P1,200,000

Survey of Accounting (Accounting I)

8th Edition

ISBN:9781305961883

Author:Carl Warren

Publisher:Carl Warren

Chapter12: Differential Analysis And Product Pricing

Section: Chapter Questions

Problem 12.16E: Product cost concept of product pricing Based on the data presented in Exercise 12-15, assume that...

Related questions

Question

What is the gross profit for the year if the net revenue from by-product is treated as additional sales revenue?

b. P1,230,000

c. P1,218,000

d. P1,118,000

a. P1,200,000

What is the gross profit for the year if the net revenue from by-product is treated as additional sales revenue?

b. P1,230,000

c. P1,218,000

d. P1,118,000

a. P1,200,000

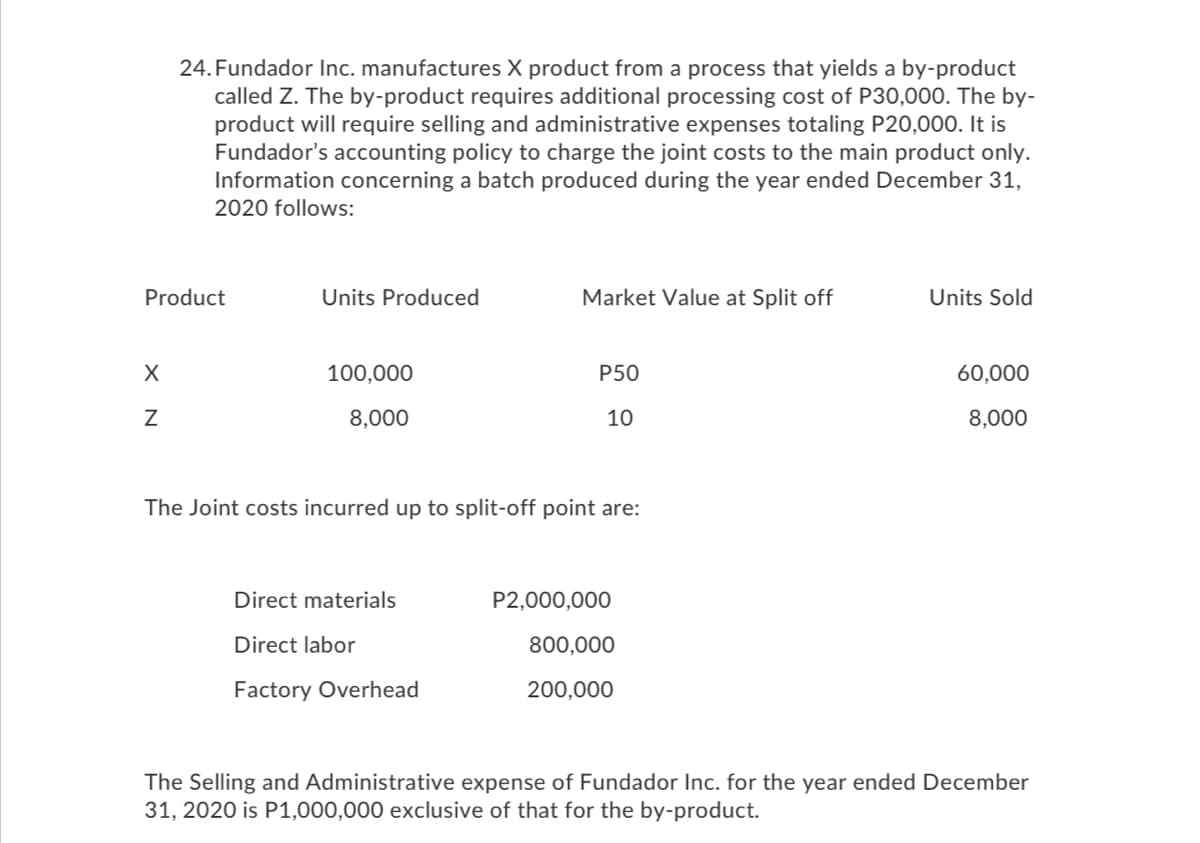

Transcribed Image Text:24. Fundador Inc. manufactures X product from a process that yields a by-product

called Z. The by-product requires additional processing cost of P30,000. The by-

product will require selling and administrative expenses totaling P20,000. It is

Fundador's accounting policy to charge the joint costs to the main product only.

Information concerning a batch produced during the year ended December 31,

2020 follows:

Product

Units Produced

Market Value at Split off

Units Sold

X

100,000

Р50

60,000

8,000

10

8,000

The Joint costs incurred up to split-off point are:

Direct materials

P2,000,000

Direct labor

800,000

Factory Overhead

200,000

The Selling and Administrative expense of Fundador Inc. for the year ended December

31, 2020 is P1,000,000 exclusive of that for the by-product.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning