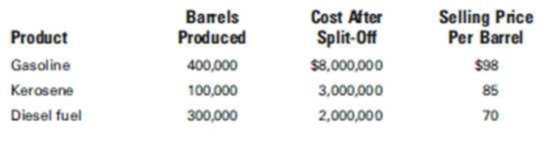

Venezuela Oil Inc. transports crude oil to its refinery where it is processed into main products gasoline, kerosene, and diesel fuel, and by-product base oil. The base oil is sold at the split-off point for $1,000,000 of annual revenue, and the joint

Required:

Determine the allocation of joint costs using the net realizable value method, rounding the sales value percentages to the nearest tenth of a percent. (Hint: Reduce the amount of the joint costs to be allocated by the amount of the by-product revenue.)

Want to see the full answer?

Check out a sample textbook solution

Chapter 6 Solutions

Principles of Cost Accounting

Additional Business Textbook Solutions

Intermediate Accounting

Financial Accounting, Student Value Edition (5th Edition)

Financial Accounting: Information for Decisions

Financial Accounting

Accounting for Governmental & Nonprofit Entities

PRINCIPLES OF TAXATION F/BUS.+INVEST.

- Pacheco, Inc., produces two products, overs and unders, in a single process. The joint costs of this process were 50,000, and 14,000 units of overs and 36,000 units of unders were produced. Separable processing costs beyond the split-off point were as follows: overs, 18,000; unders, 23,040. Overs sell for 2.00 per unit; unders sell for 3.14 per unit. Required: 1. Allocate the 50,000 joint costs using the estimated net realizable value method. 2. Suppose that overs could be sold at the split-off point for 1.80 per unit. Should Pacheco sell overs at split-off or process them further? Show supporting computations.arrow_forwardOakes Inc. manufactured 40,000 gallons of Mononate and 60,000 gallons of Beracyl in a joint production process, incurring 250,000 of joint costs. Oakes allocates joint costs based on the physical volume of each product produced. Mononate and Beracyl can each be sold at the split-off point in a semifinished state or, alternatively, processed further. Additional data about the two products are as follows: An assistant in the companys cost accounting department was overheard saying ...that when both joint and separable costs are considered, the firm has no business processing either product beyond the split-off point. The extra revenue is simply not worth the effort. Which of the following strategies should be recommended for Oakes?arrow_forwardLeMoyne Manufacturing Inc.’s joint cost of producing 2,000 units of Product X, 1,000 units of Product Y, and 1,000 units of Product Z is $50,000. The unit sales values of the three products at the split-off point are Product X–$30, Product Y–$100, and Product Z–$90. Ending inventories include 200 units of Product X, 300 units of Product Y, and 100 units of Product Z. Compute the amount of joint cost that would be included in the ending inventory valuation of the three products on the basis of their sales values at split-off. Assume that Product Z can be sold for $120 a unit if it is processed after split-off at a cost of $10 a unit. Compute the amount of joint cost that would be included in the ending inventory valuation of the three products on the basis of their net realizable values.arrow_forward

- Laramie Industries produces two joint products, H and C. Prior to the split-off point, the company incurred costs of $66,000. Product H weighs 44 pounds and product C weighs 66 pounds. Product H sells for $250 per pound and product C sells for $295 per pound. Based on a physical measure of output, allocate joint costs to products H and C.arrow_forwardTucariz Company processes Duo into two joint products, Big and Mini. Duo is purchased in 1,000-gallon drums for 2.000. Processing costs are 3,000 to process the 1,000 gallons of Duointo 800 gallons of Big and 200 gallons of Mini. The selling price is 9 per gallon for Big and4 per gallon for Mini. If the physical units method is used to allocate joint costs to the finalproducts, the total cost allocated to produce Mini is: a. 500. b. 4,000. c. 1,000. d. 4,500.arrow_forwardMorrill Company produces two different types of gauges: a density gauge and a thickness gauge. The segmented income statement for a typical quarter follows. Includes depreciation. The density gauge uses a subassembly that is purchased from an external supplier for 25 per unit. Each quarter, 2,000 subassemblies are purchased. All units produced are sold, and there are no ending inventories of subassemblies. Morrill is considering making the subassembly rather than buying it. Unit-level variable manufacturing costs are as follows: No significant non-unit-level costs are incurred. Morrill is considering two alternatives to supply the productive capacity for the subassembly. 1. Lease the needed space and equipment at a cost of 27,000 per quarter for the space and 10,000 per quarter for a supervisor. There are no other fixed expenses. 2. Drop the thickness gauge. The equipment could be adapted with virtually no cost and the existing space utilized to produce the subassembly. The direct fixed expenses, including supervision, would be 38,000, 8,000 of which is depreciation on equipment. If the thickness gauge is dropped, sales of the density gauge will not be affected. Required: 1. Should Morrill Company make or buy the subassembly? If it makes the subassembly, which alternative should be chosen? Explain and provide supporting computations. 2. Suppose that dropping the thickness gauge will decrease sales of the density gauge by 10 percent. What effect does this have on the decision? 3. Assume that dropping the thickness gauge decreases sales of the density gauge by 10 percent and that 2,800 subassemblies are required per quarter. As before, assume that there are no ending inventories of subassemblies and that all units produced are sold. Assume also that the per-unit sales price and variable costs are the same as in Requirement 1. Include the leasing alternative in your consideration. Now, what is the correct decision?arrow_forward

- Joint cost allocation-market value at split-off method Toil Oil processes crude oil to jointly produce gasoline, diesel, and kerosene. One batch produces 3,415 gallons of gasoline, 2,732 gallons of diesel, and 1,366 gallons of kerosene at a joint cost of 112,000. After the split-off point, all products are processed further, but the estimated market price for each product at the split-off point is as follows: Using the market value at split-off method, allocate the 12,000 joint cost of production to each product.arrow_forwardClark Kent Inc. buys crypton for $.80 a gallon. At the end of processing in Dept. 1, crypton splits off into products plutonium, tantalum, and xenon. Plutonium is sold at the split-off point with no further processing. Tantalum and xenon require further processing before they can be sold. Tantalum is processed in Dept. 2, and xenon is processed in Dept. 3. Following is a summary of costs and other related data for the year ended December 31: No inventories were on hand at the beginning of the year, and no crypton was on hand at the end of the year. All gallons on hand at the end of the year were complete as to processing. Kent uses the net realizable value method of allocating joint costs. Required: Calculate the allocation of joint costs. Calculate the total cost per unit for each product. In examining the product cost reports, Lois Lane, Vice President—Marketing, notes that the per-unit cost of tantalum is greater than the selling price of $2.75 that can be received in the competitive marketplace. Lane wonders whether they should stop selling tantalum. How did Lane determine that the product was being sold at a loss? What per unit cost should be used in determining whether tantalum should be sold?arrow_forwardMan OFort Inc. produces two different styles of door handles, standard and curved. The door handles go through a joint production molding process costing 29,000 per batch and producing 2,000 standard door handles and 1,000 curved door handles at the split-off point. Both door handles undergo additional production processes after the split-off point, but could be sold at that point: the standard style for 4 per door handle and the curved style for 2 per door handle. Determine the amount of joint production costs allocated to each style of door handle using the market value at split-off method.arrow_forward

- Clarion Industries produces two joint products, Y and Z. Prior to the split-off point, the company incurred costs of $36,000. Product Y weighs 25 pounds and product Z weighs 75 pounds. Product Y sells for $150 per pound and product Z sells for $125 per pound. Based on a physical measure of output, allocate joint costs to products Y and Z.arrow_forwardA company manufactures three products, L-Ten, Triol, and Pioze, from a joint process. Each production run costs 12,900. None of the products can be sold at split-off, but must be processed further. Information on one batch of the three products is as follows: Required: 1. Allocate the joint cost to L-Ten, Triol, and Pioze using the net realizable value method. (Round the percentages to four significant digits. Round all cost allocations to the nearest dollar.) 2. What if it cost 2 to process each gallon of Triol beyond the split-off point? How would that affect the allocation of joint cost to the three products?arrow_forwardMaterials used by the Instrument Division of Ziegler Inc. are currently purchased from outside suppliers at a cost of 1,350 per unit. However, the same materials are available from the Components Division. The Components Division has unused capacity and can produce the materials needed by the Instrument Division at a variable cost of 900 per unit. a. If a transfer price of 1,000 per unit is established and 75,000 units of materials are transferred, with no reduction in the Components Divisions current sales, how much would Ziegler Inc.s total operating income increase? b. How much would the Instrument Divisions operating income increase? c. How much would the Components Divisions operating income increase?arrow_forward

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning