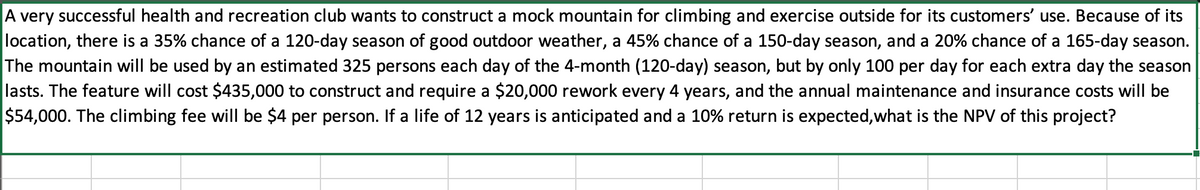

very successful health and recreation club wants to construct mock mountain for Climbing and exercise outside for its customers use. Because of its ocation, there is a 35% chance of a 120-day season of good outdoor weather, a 45% chance of a 150-day season, and a 20% chance of a 165-day season. he mountain will be used by an estimated 325 persons each day of the 4-month (120-day) season, but by only 100 per day for each extra day the season sts. The feature will cost $435,000 to construct and require a $20,000 rework every 4 years, and the annual maintenance and insurance costs will be 54,000. The climbing fee will be $4 per person. If a life of 12 years is anticipated and a 10% return is expected,what is the NPV of this project?

very successful health and recreation club wants to construct mock mountain for Climbing and exercise outside for its customers use. Because of its ocation, there is a 35% chance of a 120-day season of good outdoor weather, a 45% chance of a 150-day season, and a 20% chance of a 165-day season. he mountain will be used by an estimated 325 persons each day of the 4-month (120-day) season, but by only 100 per day for each extra day the season sts. The feature will cost $435,000 to construct and require a $20,000 rework every 4 years, and the annual maintenance and insurance costs will be 54,000. The climbing fee will be $4 per person. If a life of 12 years is anticipated and a 10% return is expected,what is the NPV of this project?

Chapter11: Capital Budgeting Decisions

Section: Chapter Questions

Problem 2TP: Austins cell phone manufacturer wants to upgrade their product mix to encompass an exciting new...

Related questions

Question

100%

Answer Options:

$291,957

$357,210

$433,900

$616,260

Transcribed Image Text:A very successful health and recreation club wants to construct a mock mountain for climbing and exercise outside for its customers' use. Because of its

location, there is a 35% chance of a 120-day season of good outdoor weather, a 45% chance of a 150-day season, and a 20% chance of a 165-day season.

The mountain will be used by an estimated 325 persons each day of the 4-month (120-day) season, but by only 100 per day for each extra day the season

lasts. The feature will cost $435,000 to construct and require a $20,000 rework every 4 years, and the annual maintenance and insurance costs will be

$54,000. The climbing fee will be $4 per person. If a life of 12 years is anticipated and a 10% return is expected,what is the NPV of this project?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning