What is the principal balance on January 1, Year 2? (Round intermediate calculations to the nearest whole dollar amount. Round your answer to the nearest dollar amount.) Required C: What portion of the December 31, Year 2, payment is applied to interest expense and principal? (Round intermediate calculations to nearest whole dollar amount. Round your answers to the nearest dollar amount.) Interest expense:

What is the principal balance on January 1, Year 2? (Round intermediate calculations to the nearest whole dollar amount. Round your answer to the nearest dollar amount.) Required C: What portion of the December 31, Year 2, payment is applied to interest expense and principal? (Round intermediate calculations to nearest whole dollar amount. Round your answers to the nearest dollar amount.) Interest expense:

Chapter12: Current Liabilities

Section: Chapter Questions

Problem 12EA: Scrimiger Paints wants to upgrade its machinery and on September 20 takes out a loan from the bank...

Related questions

Question

Required B:

What is the principal balance on January 1, Year 2? (Round intermediate calculations to the nearest whole dollar amount. Round your answer to the nearest dollar amount.)

Required C: What portion of the December 31, Year 2, payment is applied to interest expense and principal? (Round intermediate calculations to nearest whole dollar amount. Round your answers to the nearest dollar amount.)

Interest expense:

Principle:

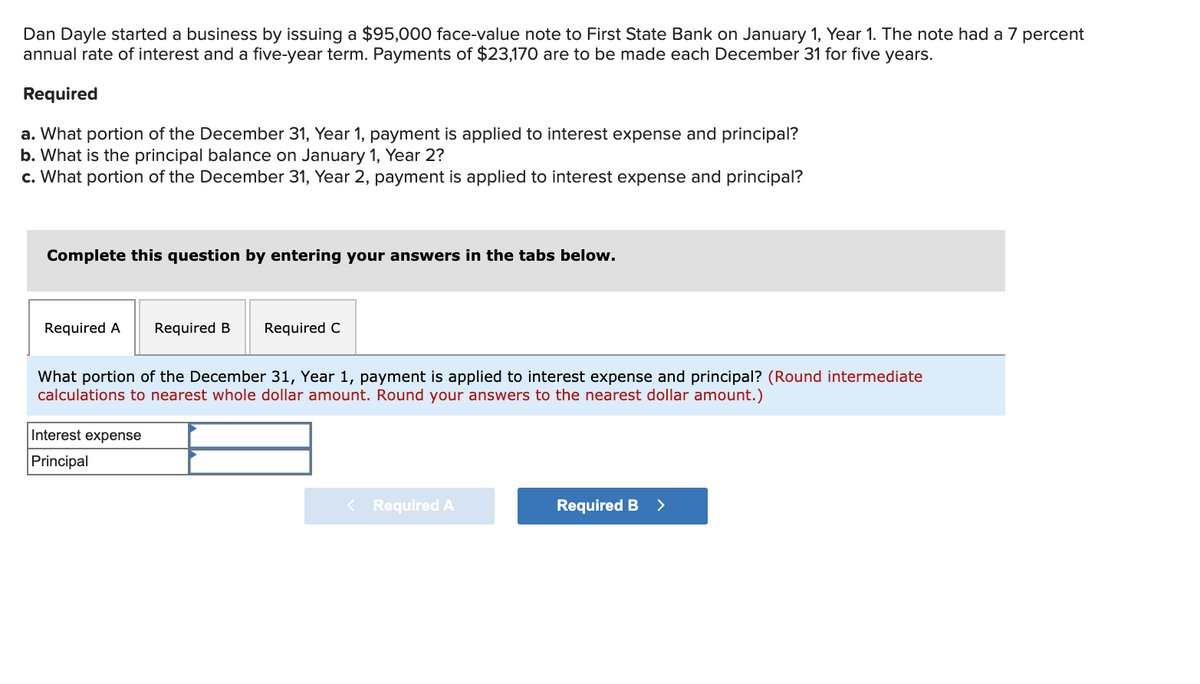

Transcribed Image Text:Dan Dayle started a business by issuing a $95,000 face-value note to First State Bank on January 1, Year 1. The note had a 7 percent

annual rate of interest and a five-year term. Payments of $23,170 are to be made each December 31 for five years.

Required

a. What portion of the December 31, Year 1, payment is applied to interest expense and principal?

b. What is the principal balance on January 1, Year 2?

c. What portion of the December 31, Year 2, payment is applied to interest expense and principal?

Complete this question by entering your answers in the tabs below.

Required A

Required B

Required C

What portion of the December 31, Year 1, payment is applied to interest expense and principal? (Round intermediate

calculations to nearest whole dollar amount. Round your answers to the nearest dollar amount.)

Interest expense

Principal

< Required A

Required B >

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning