Chapter10: The Basics Of Capital Budgeting: Evaluating Cash Flows

Section10.4: Internal Rate Of Return (irr)

Problem 2ST

Related questions

Question

Just Question 5 please

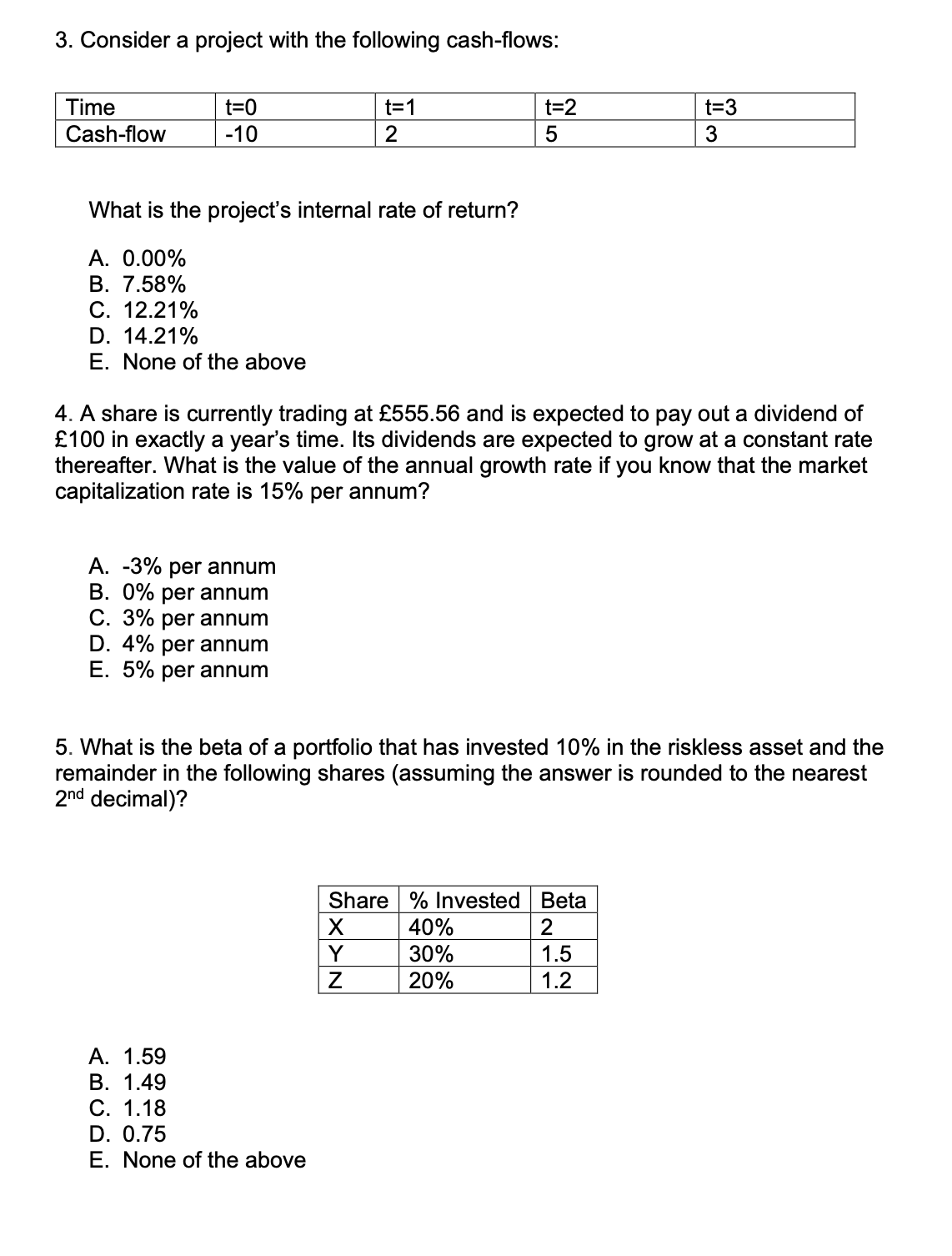

Transcribed Image Text:3. Consider a project with the following cash-flows:

Time

t=0

t=1

t=2

t=3

Cash-flow

-10

2

3

What is the project's internal rate of return?

A. 0.00%

В. 7.58%

C. 12.21%

D. 14.21%

E. None of the above

4. A share is currently trading at £555.56 and is expected to pay out a dividend of

£100 in exactly a year's time. Its dividends are expected to grow at a constant rate

thereafter. What is the value of the annual growth rate if you know that the market

capitalization rate is 15% per annum?

A. -3% per annum

B. 0% per annum

C. 3% per annum

D. 4% per annum

E. 5% per annum

5. What is the beta of a portfolio that has invested 10% in the riskless asset and the

remainder in the following shares (assuming the answer is rounded to the nearest

2nd decimal)?

Share % Invested Beta

X

40%

2

Y

30%

1.5

20%

1.2

A. 1.59

В. 1.49

С. 1.18

D. 0.75

E. None of the above

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you