What is your opinion of the organization's financial strength Do you see any significant financial trends

What is your opinion of the organization's financial strength Do you see any significant financial trends

Chapter1: Financial Statements And Business Decisions

Section: Chapter Questions

Problem 1Q

Related questions

Question

What is your opinion of the organization's financial strength

Do you see any significant financial trends

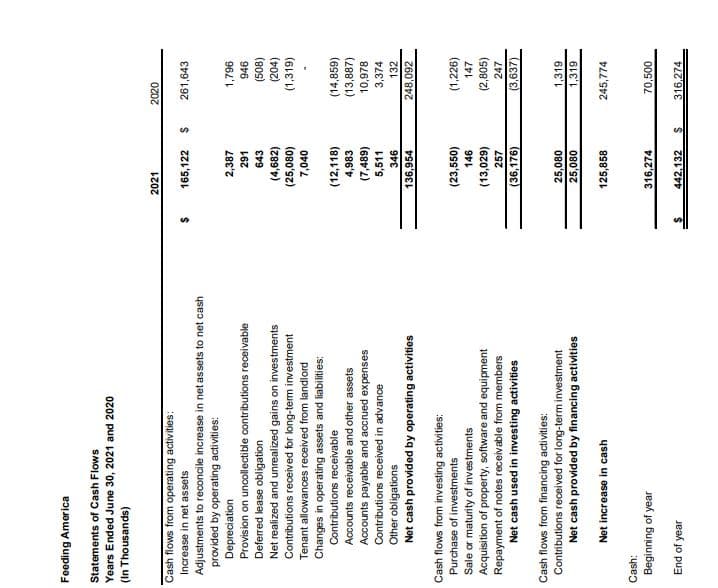

Transcribed Image Text:Feeding America

Statements of Cash Flows

Years Ended June 30, 2021 and 2020

(In Thousands)

2021

2020

Cash flows from operating activities:

Increase in net assets

165,122 $

261,643

Adjustments to reconcile increase in net assets to net cash

provided by operating activities:

Depreciation

2,387

1,796

Provision on uncollectible contributions receivable

291

946

Deferred lease obligation

Net realized and unrealized gains on investments

Contributions received for long-tem investment

Tenant allowances received from landlord

643

(4,682)

(25,080)

(508)

(204)

(1,319)

7,040

Changes in operating assets and liabilities:

Contributions receivable

(14,859)

Accounts receivable and other assets

Accounts payable and accrued expenses

Contributions received in advance

Other obligations

(12,118)

4,983

(7,489)

5,511

(13,887)

10,978

3,374

132

Net cash provided by operating activities

136,954

248,092

Cash flows from investing activities:

Purchase of investments

(23,550)

(1,226)

Sale or maturity of investments

Acquisition of property, software and equipment

Repayment of notes receivable from members

146

147

(2,805)

(6z0'EL)

257

247

Net cash used in investing activities

(36,176)

(3,637)

Cash flows from financing activities:

Contributions received for long-term investment

25,080

1,319

1,319

Not cash provided by financing activities

25,080

Not increase in cash

125,858

245,774

Cash:

Beginning of year

316,274

70,500

End of year

442,132

316,274

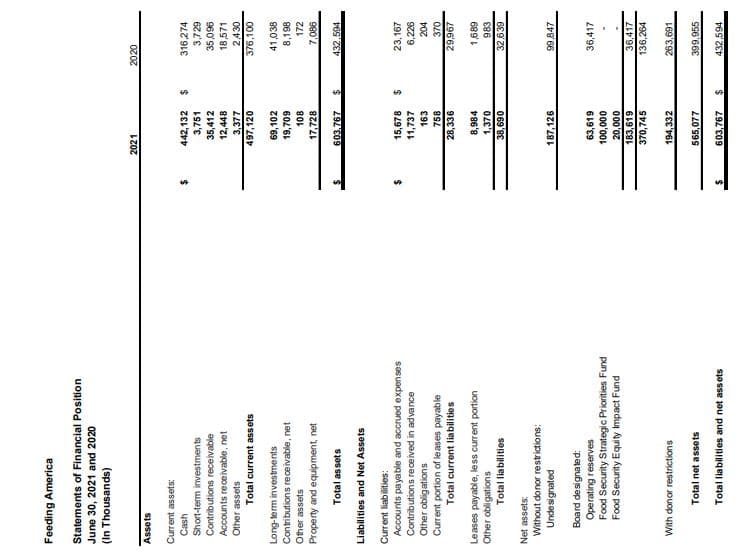

Transcribed Image Text:Feeding America

Statements of Financial Position

June 30, 2021 and 2020

(In Thousands)

2021

2020

Assets

Current assets:

316,274

Cash

Short-term investments

442,132

3,751

35,412

12,448

24

3,729

Contributions receivable

960'SE

Accounts receivable, net

Other assets

18,571

2430

376,100

3,377

Total current assets

497,120

Long-term investments

Contributions receivable, net

Other assets

69,102

41,038

60L'6L

108

8,198

172

Property and equipment, net

17,728

7,086

Total as sets

603.767

432,594

Liabilities and Net Assets

Current liabilities:

Accounts payable and accrued expenses

Contributions re ceived in advance

15,678

23,167

24

11,737

6,226

Other obligations

Current portion of leases payable

163

758

Total current liabilities

28,336

Leases payable, less current portion

Other obligations

8,984

1,370

689'

Total liabilities

32,639

069'8€

Net assets:

Without donor restrictions:

Undesignated

187,126

99,847

Board designated:

Operating reserves

Food Security Strategic Priorities Fund

Food Security Equity Impact Fund

63,619

36,417

000'00L

000'0z

183,619

370,745

36,417

36,26

With donor restrictions

194,332

263,691

Total net assets

565,077

399,955

Total liabilities and net assets

603,767

432,594

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Recommended textbooks for you

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,

Accounting Information Systems

Accounting

ISBN:

9781337619202

Author:

Hall, James A.

Publisher:

Cengage Learning,

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,

Accounting Information Systems

Accounting

ISBN:

9781337619202

Author:

Hall, James A.

Publisher:

Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis…

Accounting

ISBN:

9780134475585

Author:

Srikant M. Datar, Madhav V. Rajan

Publisher:

PEARSON

Intermediate Accounting

Accounting

ISBN:

9781259722660

Author:

J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:

McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:

9781259726705

Author:

John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:

McGraw-Hill Education