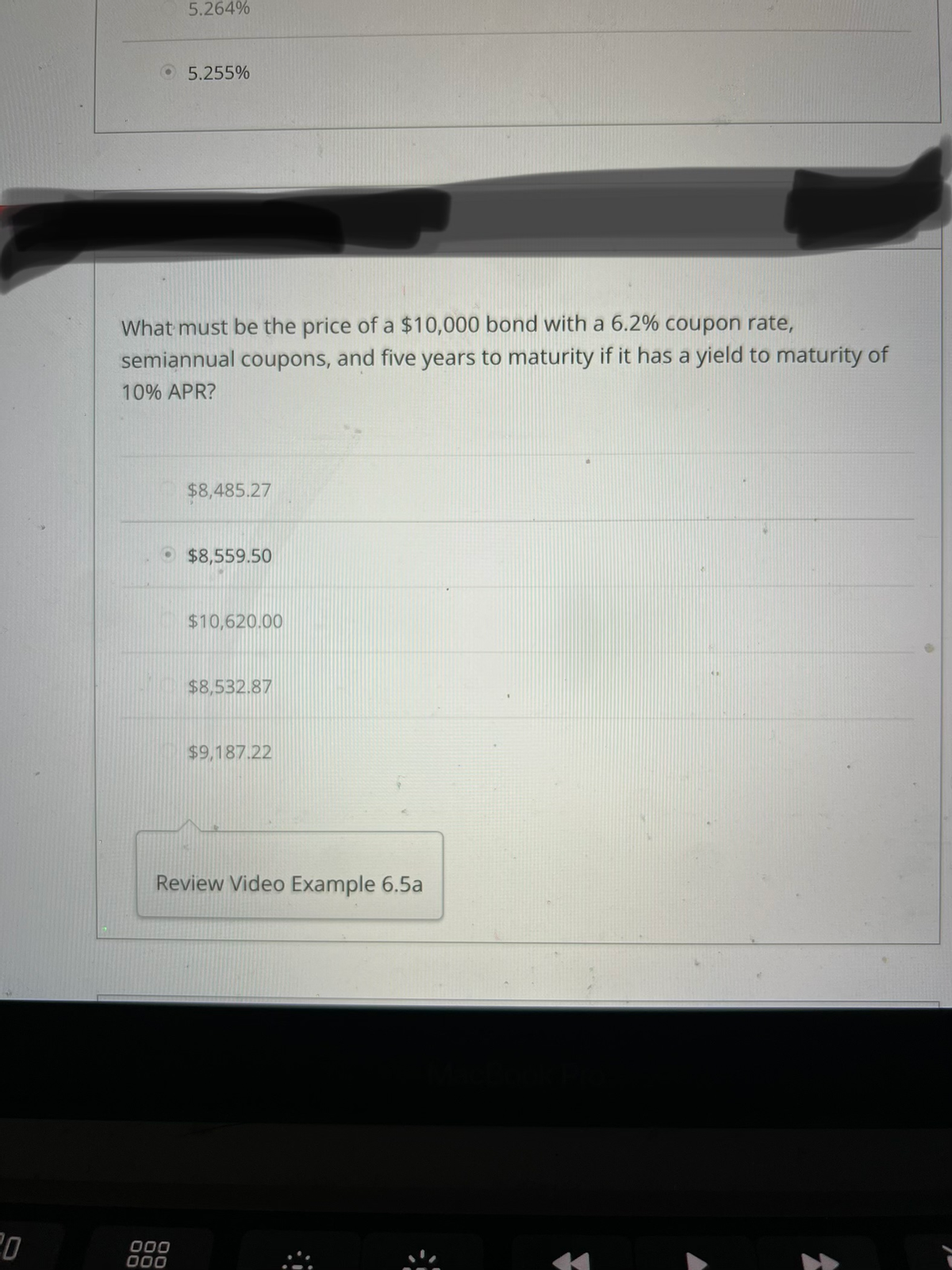

What must be the price of a $10,000 bond with a 6.2% coupon rate, semiannual coupons, and five years to maturity if it has a yield to maturity of 10% APR?

What must be the price of a $10,000 bond with a 6.2% coupon rate, semiannual coupons, and five years to maturity if it has a yield to maturity of 10% APR?

Chapter14: Investing In Stocks And Bonds

Section: Chapter Questions

Problem 6DTM

Related questions

Question

Transcribed Image Text:20

5.264%

5.255%

What must be the price of a $10,000 bond with a 6.2% coupon rate,

semiannual coupons, and five years to maturity if it has a yield to maturity of

10% APR?

000

000

$8,485.27

$8,559.50

$10,620.00

$8,532.87

$9,187.22

Review Video Example 6.5a

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you