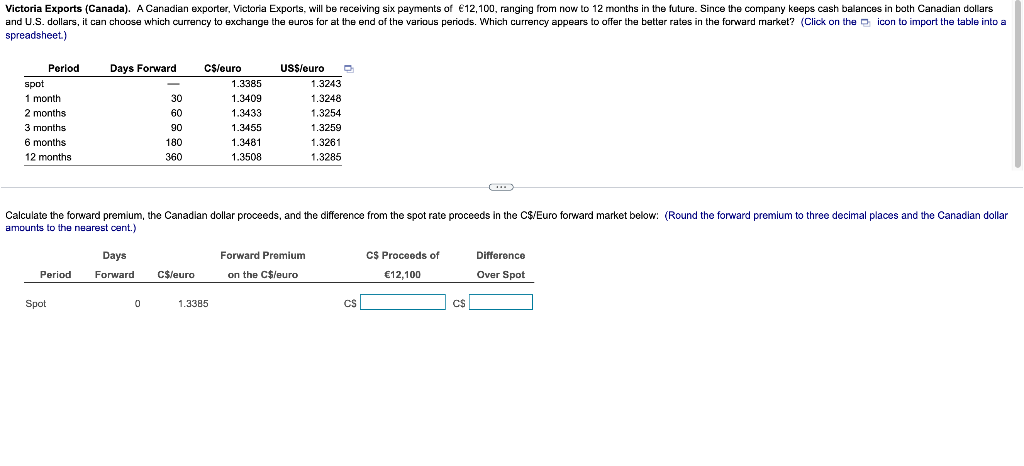

in both Can and U.S. dollars, it can choose which currency to exchange the euros for at the end of the various periods. Which currency appears to offer the better rates in the forward market? (Click on the icon to impor spreadsheet.) Period spot 1 month 2 months 3 months 6 months 12 months Days Forward 30 60 90 180 360 C$/euro 1.3385 1.3409 1.3433 1.3455 1.3481 1.3508 US$/euro 1.3243 1.3248 1.3254 1.3259 1.3261 1.3285 Calculate the forward premium, the Canadian dollar proceeds, and the difference from the spot rate proceeds in the C$/Euro forward market below: (Round the forward premium to three decimal places and the amounts to the nearest cent.)

in both Can and U.S. dollars, it can choose which currency to exchange the euros for at the end of the various periods. Which currency appears to offer the better rates in the forward market? (Click on the icon to impor spreadsheet.) Period spot 1 month 2 months 3 months 6 months 12 months Days Forward 30 60 90 180 360 C$/euro 1.3385 1.3409 1.3433 1.3455 1.3481 1.3508 US$/euro 1.3243 1.3248 1.3254 1.3259 1.3261 1.3285 Calculate the forward premium, the Canadian dollar proceeds, and the difference from the spot rate proceeds in the C$/Euro forward market below: (Round the forward premium to three decimal places and the amounts to the nearest cent.)

Chapter11: Managing Transaction Exposure

Section: Chapter Questions

Problem 1ST

Related questions

Question

Answer in typing

Transcribed Image Text:Victoria Exports (Canada). A Canadian exporter, Victoria Exports, will be receiving six payments of €12,100, ranging from now to 12 months in the future. Since the company keeps cash balances in both Canadian dollars

and U.S. dollars, it can choose which currency to exchange the euros for at the end of the various periods. Which currency appears to offer the better rates in the forward market? (Click on the icon to import the table into a

spreadsheet.)

Period

spot

1 month

2 months

3 months

6 months

12 months

Period

Spot

Days Forward

Days

Forward

-

0

30

60

90

180

360

C$/euro

C$/euro

Calculate the forward premium, the Canadian dollar proceeds, and the difference from the spot rate proceeds in the C$/Euro forward market below: (Round the forward premium to three decimal places and the Canadian dollar

amounts to the nearest cent.)

1.3385

1.3409

1.3433

1.3455

1.3481

1.3508

1.3385

US$/euro

1.3243

1.3248

1.3254

1.3259

1.3261

1.3285

Forward Premium

on the C$/euro

D

CS

C$ Proceeds of

€12,100

(…)

C$

Difference

Over Spot

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning