What the answer for 22 The first time I had put 950,000 The second time I had put 5,930,000 both was WRONG

What the answer for 22 The first time I had put 950,000 The second time I had put 5,930,000 both was WRONG

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter5: The Income Statement And The Statement Of Cash Flows

Section: Chapter Questions

Problem 2MC: The following information is available for Cooke Company for the current year: The gross margin is...

Related questions

Question

What the answer for 22

The first time I had put 950,000

The second time I had put 5,930,000

both was WRONG

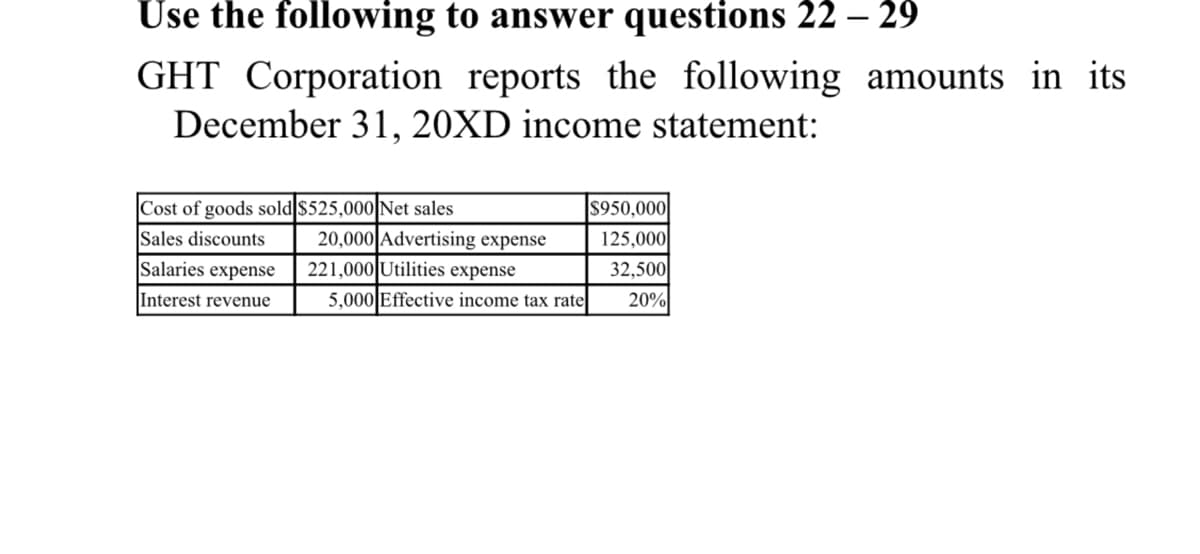

Transcribed Image Text:Use the following to answer questions 22 – 29

GHT Corporation reports the following amounts in its

December 31, 20XD income statement:

Cost of goods sold $525,000 Net sales

Sales discounts

Salaries expense

$950,000

20,000 Advertising expense

221,000 Utilities expense

125,000

32,500

Interest revenue

5,000|Effective income tax rate

20%

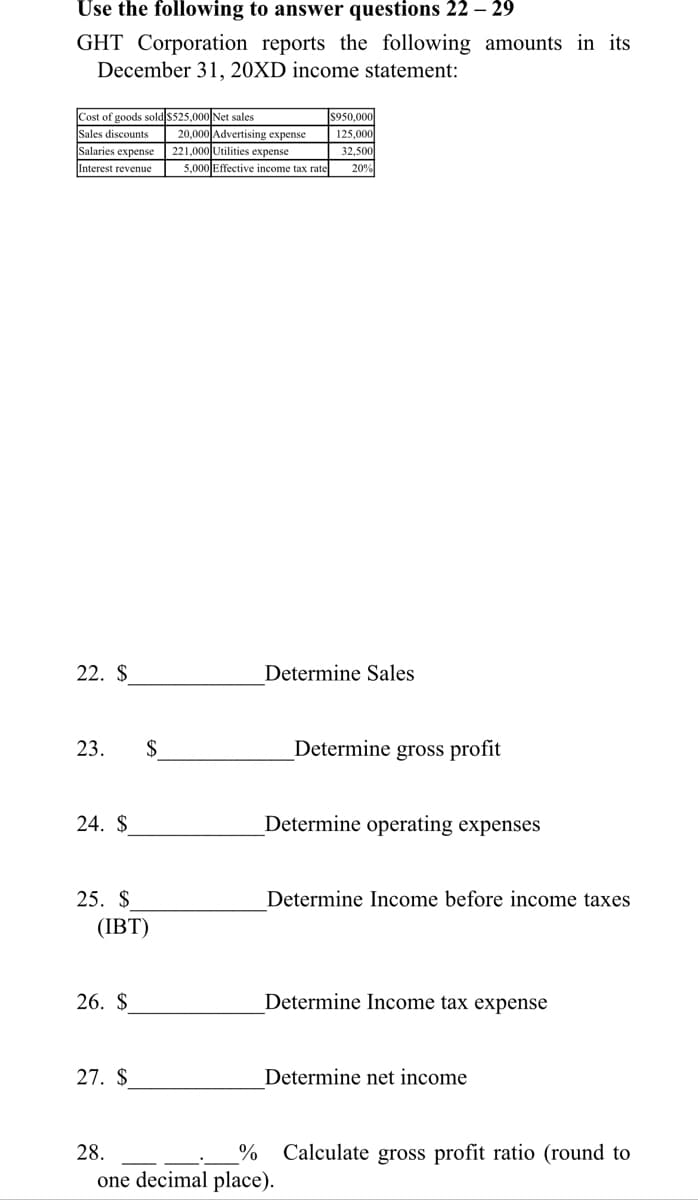

Transcribed Image Text:Use the following to answer questions 22 – 29

GHT Corporation reports the following amounts in its

December 31, 20XD income statement:

Cost of goods sold $525,000 Net sales

Sales discounts

Salaries expense 221,000 Utilities expense

$950,000

125,000

20,000 Advertising expense

32,500

Interest revenue

5,000 Effective income tax rate

20%

22. $

Determine Sales

23.

$

Determine gross profit

24. $

Determine operating expenses

25. $

Determine Income before income taxes

(IBT)

26. $

Determine Income tax expense

27. $

Determine net income

28.

Calculate gross profit ratio (round to

one decimal place).

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Fundamentals of Financial Management (MindTap Cou…

Finance

ISBN:

9781337395250

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Fundamentals of Financial Management (MindTap Cou…

Finance

ISBN:

9781337395250

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning