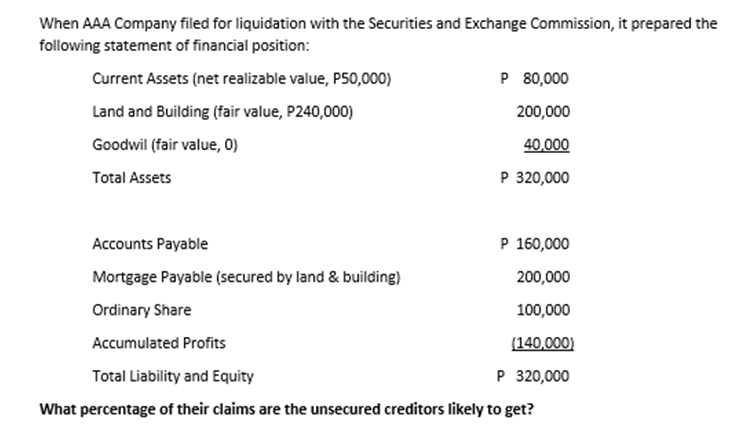

When AAA Company filed for liquidation with the Securities and Exchange Commission, it prepared the following statement of financial position: Current Assets (net realizable value, P50,000) P 80,000 Land and Building (fair value, P240,000) 200,000 Goodwil (fair value, 0) 40,000 Total Assets P 320,000 Accounts Payable P 160,000 Mortgage Payable (secured by land & building) 200,000 Ordinary Share 100,000 Accumulated Profits (140,000) Total Liability and Equity P 320,000 What percentage of their claims are the unsecured creditors likely to get?

When AAA Company filed for liquidation with the Securities and Exchange Commission, it prepared the following statement of financial position: Current Assets (net realizable value, P50,000) P 80,000 Land and Building (fair value, P240,000) 200,000 Goodwil (fair value, 0) 40,000 Total Assets P 320,000 Accounts Payable P 160,000 Mortgage Payable (secured by land & building) 200,000 Ordinary Share 100,000 Accumulated Profits (140,000) Total Liability and Equity P 320,000 What percentage of their claims are the unsecured creditors likely to get?

Auditing: A Risk Based-Approach to Conducting a Quality Audit

10th Edition

ISBN:9781305080577

Author:Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Chapter16: Advanced Topics Concerning Complex Auditing Judgments

Section: Chapter Questions

Problem 55RSCQ

Related questions

Question

Transcribed Image Text:When AAA Company filed for liquidation with the Securities and Exchange Commission, it prepared the

following statement of financial position:

Current Assets (net realizable value, P50,000)

P 80,000

Land and Building (fair value, P240,000)

200,000

Goodwil (fair value, 0)

40,000

Total Assets

P 320,000

Accounts Payable

P 160,000

Mortgage Payable (secured by land & building)

200,000

Ordinary Share

100,000

Accumulated Profits

(140,000)

Total Liability and Equity

P 320,000

What percentage of their claims are the unsecured creditors likely to get?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Auditing: A Risk Based-Approach to Conducting a Q…

Accounting

ISBN:

9781305080577

Author:

Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:

South-Western College Pub

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Auditing: A Risk Based-Approach (MindTap Course L…

Accounting

ISBN:

9781337619455

Author:

Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:

Cengage Learning

Auditing: A Risk Based-Approach to Conducting a Q…

Accounting

ISBN:

9781305080577

Author:

Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:

South-Western College Pub

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Auditing: A Risk Based-Approach (MindTap Course L…

Accounting

ISBN:

9781337619455

Author:

Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College