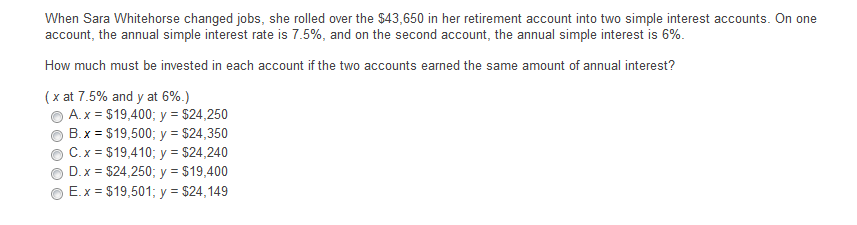

When Sara Whitehorse changed jobs, she rolled over the $43,650 in her retirement account into two simple interest accounts. On one account, the annual simple interest rate is 7.5%, and on the second account, the annual simple interest is 6%. How much must be invested in each account if the two accounts earned the same amount of annual interest? (x at 7.5% and y at 6%.) A.x = $19,400; y = $24,250 B.x = $19,500; y = $24,350 C.x = $19,410; y = $24,240 D. x = $24,250; y = $19,400 E.x = $19,501; y = $24,149

When Sara Whitehorse changed jobs, she rolled over the $43,650 in her retirement account into two simple interest accounts. On one account, the annual simple interest rate is 7.5%, and on the second account, the annual simple interest is 6%. How much must be invested in each account if the two accounts earned the same amount of annual interest? (x at 7.5% and y at 6%.) A.x = $19,400; y = $24,250 B.x = $19,500; y = $24,350 C.x = $19,410; y = $24,240 D. x = $24,250; y = $19,400 E.x = $19,501; y = $24,149

Chapter3: Income Sources

Section: Chapter Questions

Problem 79P

Related questions

Question

100%

Transcribed Image Text:When Sara Whitehorse changed jobs, she rolled over the $43,650 in her retirement account into two simple interest accounts. On one

account, the annual simple interest rate is 7.5%, and on the second account, the annual simple interest is 6%.

How much must be invested in each account if the two accounts earned the same amount of annual interest?

(x at 7.5% and y at 6%.)

A.x = $19,400; y = $24,250

B.x = $19,500; y = $24,350

C.x = $19,410; y = $24,240

D.x = $24,250; y = $19,400

E.x = $19,501; y = $24,149

Expert Solution

Introduction

The interest calculated only on the principal portion of an investment is called as the simple interest. Simple interest is the product of principal amount, interest rate and time.

Sara has deposited the sum of $43,650 for her retirement in two separate simple interest rate accounts of 7.5% and 6% respectively.

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781305084087

Author:

Cathy J. Scott

Publisher:

Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781305084087

Author:

Cathy J. Scott

Publisher:

Cengage Learning

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning

College Accounting, Chapters 1-27 (New in Account…

Accounting

ISBN:

9781305666160

Author:

James A. Heintz, Robert W. Parry

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning