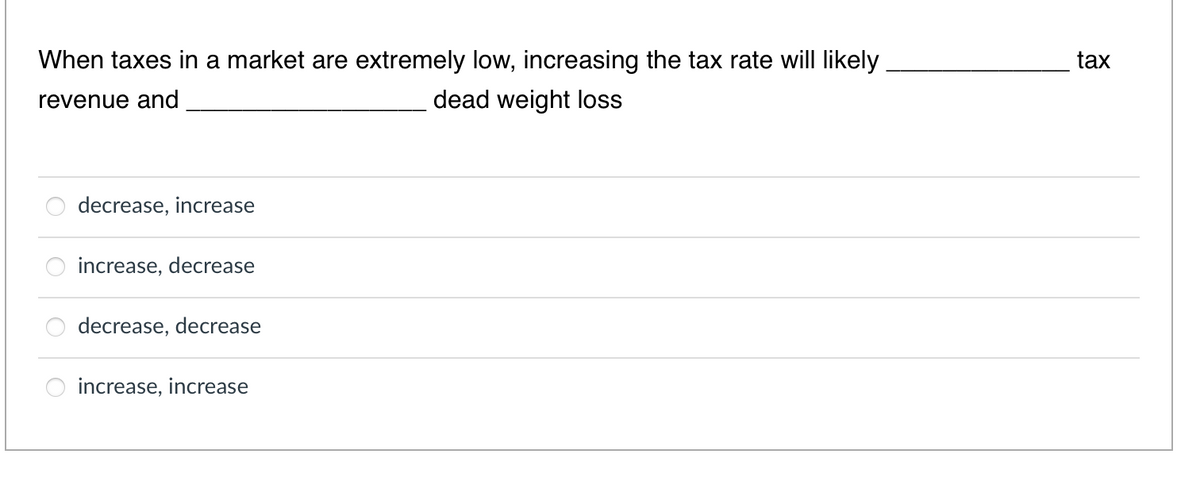

When taxes in a market are extremely low, increasing the tax rate will likely tax revenue and dead weight loss decrease, increase increase, decrease decrease, decrease O increase, increase

Q: (а) You are given the following information. Consumption (C) = 400 + 0.8Yd Government Expenditure…

A: Equilibrium takes place where AE = Y

Q: Assume the vitamin industry is perfectly competitive. When a new medical study shows that taking…

A: The perfectly competitive market exists where the many firms are there in the market and each firm…

Q: Consider a competitive industry. Every firm in this industry has a total cost function C (y) = y² +1…

A: C(y) = y2 + 1 AC = y + (1/y) d(AC)/dy = 1 - (1/y2) To minimize AC 1 - (1/y2) = 0 1/y2 = 1 y2 = 1 y…

Q: ong-run equilibrium, the monopolistic competitor will mo- a) Be earning zero economic profit, unless…

A: Monopolistic competition is a sort of market structure where many organizations are available in an…

Q: How does the stock market affect consumption according to the permanent-income hypothesis? Is this…

A: Answer -

Q: Average propensity Average propensity income ($) Consumption ($) Savings ($) to consume (APC) to…

A: All Blanks answers given below,

Q: How will the Russian-Ukraine war affect European union ? and what actions should be taken by…

A: On February 24, 2022, Russia attacked Ukraine. The invasion, which is widely regarded as an act of…

Q: Which of the following would shift aggregate demand to the left? O a) Stock market values increase…

A: Aggregate demand is the sum of consumption, investment, government spending, and net exports. An…

Q: For the country of Murray, GDP = $2,000, M = $300, and X = $400. What is Murray's level of trade?…

A: Given: Data for the country of Murray : GDP = $2000, Exports= $400 Imports=$300

Q: What actions should be taken by 'European Central Bank' to counter the negative affects of the…

A: There are many reasons behind the Russian-Ukraine war, the main reason behind it can be considered…

Q: What does it mean by global governance? What is its most important principle? Why?

A: Global governance refers to the provision of global public goods to maximize the welfare of all the…

Q: (a) You are given the following information. Consumption (C) = 400 + 0.8Yd Government Expenditure…

A: (i) Consumption function: C = 400 + 0.8Yd Relationship between Yd, C and S Yd = C + S => Yd =…

Q: What is meant by “excess sensitivity” of consumption? Is this view of consumption consistent with…

A: Hi! Thank you for the question As per the honor code, We’ll answer the first question since the…

Q: suppose for commodity X, the price elasticity of demand is 3 and the marginal cost is RM200. compute…

A: Given the price elasticity of demand (3) and marginal cost (200), the optimal price could be…

Q: The major reason the United States does not have a national health care program is because its…

A: Meaning of Health Economics: Here, the term health economics refers to the scenario under which…

Q: .Why the calculated Black Scholes Call price is different to the NASDQ quoted bid and ask price, the…

A: The black Scholes price and bid & ask price, are the term used in the stock market.

Q: Why is the United States and Iran conflict in the strait of hormuz important? and why does it…

A: A series of naval encounters between the US and Iran in the Strait of Hormuz occurred in December…

Q: Budget constraints provide a visual image the represents what a person can afford, given the price…

A: All individuals in the economy can purchase goods and services by the means of income that the earn…

Q: The table below shows the costs of a firm that produces handmade pottery vases in a competitive…

A: Competitive market: - it is a market condition where there are many buyers and many sellers in the…

Q: By 2050, the population pyramid of the United States isexpected to resemblea. a triangle.b. a…

A: Answer is given below

Q: LAW OF DEMAND Apply this Scenario on IKEA COMPANY Scenario 2: a. If the company decides to earn more…

A: It states an inverse relationship between the price and demand of a commodity; as the price rises,…

Q: A certain copier machine cost P150,000 with a trade-in value of P15,000 after making 800,000 copies.…

A: Depreciation = [[Cost - Salvage value] / Life time production] * Units produced Book value = Cost -…

Q: how has inflation in Zimbabwe affected it Bilateral, Regional and Multilateral Trade Agreements

A: Inflation: When there is an increment in price level seen in a regular manner then it can be…

Q: Identify the problem on consumerism, especially on ideological background of consumerism

A: Concept Consumerism is a socioeconomic philosophy and system that promotes the continuous…

Q: Domestic Supply $10 $8 ALB $6 World P Domestic D 20 30 35 40 50 Q (millions of towels) Consider the…

A: When the government allows free trade the world price is $6. The imposition of tax will increase the…

Q: Consider a closed economy to which the Keynesian-cross analysis applies. Consumption is given by the…

A: Given: C=100+0.6(Y-T) Note: Due to multiple subparts being posted, the first three subparts have…

Q: Tandra's grandparents would like to sell her their second home in 10 years for the present market…

A:

Q: Asap... Suppose you found $10 000 while digging in your backyard and you deposited it in the bank.…

A: Required reserve rate: - reserve rate is the percentage of total reserves that commercial banks have…

Q: A company uses a type of truck which costs P2M, with life of 3 years and a final salvage value of…

A: Salvage value is the assessed book worth of a resource after deterioration is finished, in view of…

Q: A company uses a type of truck which costs P2M, with life of 3 years and a final salvage value of…

A: AC1 = Annual cost of old motortruck, and AC2 = Cost of new motortruck We know that, AC1 = (C1)i +…

Q: Identify the four phases of U.S. governmentregulation of business. What is the newestfrontier?

A: Regulations are frequently promulgated without respect for the unforeseen repercussions,…

Q: Question 1 Scenario 14-1 Assume a certain firm in a competitive market is producing Q = 1,000 units…

A: In a competitive market, it can be said that the market price will be the marginal revenue of a firm…

Q: Examine the Lorenz Curves for Japan and Portugal shown in Figure 5. Which of the following…

A: The X axis represents the percentage of households in the society and the Y axis represents the…

Q: b. An increase in both demand and supply. c. A decrease in supply only. d. A decrease in both demand…

A: The equilibrium price is the only price where the plans of consumers and the plans of producers…

Q: Domestic Supply $10 AIB $8 C $6 G DEF World P Domestic D 20 30 35 40 50 Q (millions of towels)…

A: A country becomes an importer when quantity supplied is less than quantity demanded. This happens…

Q: Marginal Cost to Eliminate (Dollars) First Unit Second Unit Third Unit Fourth Unit Firm A 54 67 82…

A: The upper table show the marginal cost(MC) for each of four firm (A,B,C and D) to eliminate units of…

Q: A decrease in proportional consumption tax makes the budget constraint A. flatter…

A: Budget constraint is combination of consumption which someone can afford with given prices and…

Q: What is the distinction between government purchases and transfer payments? What is the relative…

A: If we consider the gross domestic product (GDP) formula then it can be written as: GDP =…

Q: Superior Trading Co. operates in a competitive market, and decides which price to charge their…

A: Here, it is given that the Superior Trading Co. Make economic activities in the competitive market.

Q: What is economics

A: Economics is divided into two main scopes which are micro and macroeconomics. Microeconomics deals…

Q: The computer market in recent years has seen many more computers sell at much lower prices. What…

A: Supply: - Supply is the relationship between the quantity supplied and the price of a good. There is…

Q: Consider a competitive industry. Every firm in this industry has a total cost function C (y) = y² +…

A: C(y) = y2 + 1 AC =y2+1y =y+1yMinimize avarage cost∂AC∂y=1-1y2=01y2=1y2=1y=1Hence, each firm…

Q: Question 2 The following information reveals the market condition of shampoo: Price ($)/ bottle…

A: Price elasticity of demand is the ratio of the percentage change in quantity demanded of a product…

Q: 20. Assume that to produce 5 cars, a firm can use one of the production methods below. If the cost…

A: When it comes to economic efficiency, it is a state of things in which every resource is distributed…

Q: B) In a closed economy, the functions for consumption, investment, government expenditure and…

A: Given; Consumption function; C=500+0.75YdInvestment function; I=800Government expenditure;…

Q: Profit maximizing perfectly competitive firm produces at a quantity where its price quals to…

A: In perfect competition there are large number of firms selling identical goods.

Q: What can cause a shift in the long-range aggregate supply (LRAS)? a) a change in foreign spending O…

A: In economics, aggregate supply refers to the total amount of goods and services that businesses in a…

Q: Consumers are fully aware of their preferences All consumers have the same preferences Consumers…

A: Hi! Thank you for the question As per the honor code, We’ll answer the first question since the…

Q: The Qatari government is increasing government purchases to finish the construction of 2022 World…

A: In short-run:- When Qatari government increases its purchases to finish the construction of 2022…

Q: . Saudi Post can sell envelopes for $0.2 per envelope. These envelopes are made using that cost…

A: We have, Machine cost = $100,000 i = 12% n = 10 year

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

- Hi may explain to me how to solve the question step by step? TQ Sally Henin has a price elasticity of demand for gasoline of -0.8. Her income elasticity for gasoline is 0.5. Sally's current income is $40,000 per year. Sally currently spends $800 per year on gasoline. The price of gasoline is currently $1.00 per gallon. a. A contemplated excise tax on gasoline will cause the price of gasoline to rise to $1.40. What impact will the tax have on Sally's consumption of gasoline? b. Since the purpose of the tax is only to discourage gasoline consumption, Congress is considering a $200 income tax rebate to lessen the burden of the gasoline tax. What impact will the rebates have on Sally's consumption of gasoline? 3. Assume that both the tax and rebate are implemented. Will Sally be worse off or better off?In the market for cars, the price elasticity of supply is +1.5, and the price elasticity ofdemand is -0.8. The equilibrium price is $ 30 thousand, and quantity is 120 million.(a) Assuming supply and demand are linear, reconstruct and draw the supply and demandcurves. Label the intercepts.(b) To reduce traffic, the government imposes a $400 tax on cars. What are PB and PS after thetax? What is the new equilibrium quantity? Illustrate them on the same graph.(c) How big is the change in consumer surplus, producer surplus, government revenue, anddeadweight loss?Suppose Jolene buys apples weekly. If the price of apples were to drop, Jolene would experience in . a decrease an increase a decrease an increase a decrease total revenue consumer surplus her budget constraint marginal utility willingness to pay Suppose the government levies a tax of $0.50 per pack on the buyers of cigarettes. Suppose also that the price elastic- ity of demand for cigarettes is 1.2 and the price elasticity of supply is 0.7. Because this tax is levied on the sale of a specifi c good, it is an excise tax. a progressive tax. a regressive tax. a proportional tax. a lump-sum tax. After this tax is levied, total surplus will , and the price received by producers (not including the tax) will . increase decrease increase decrease increase increase by exactly $0.50 fall by exactly $0.50 fall by less than $0.50 fall by less than $0.50 increase by more than $0.50 If economists were to study the tax incidence in this cigarette market, they would…

- Country Z produces and consumes only two products: milk and bread. The price elasticity of demand ofbread is Ed = −0.1 = 0.1 and the price elasticity of demand of wheat is Ed = −2 = 2The government of country Z needs a significant amount of fund to tackle the current coronavirussituation. To obtain the fund, they have decided to impose a $ 5 tax on either the sellers of rice or thesellers of wheat. Currently, both the equilibrium prices of wheat and rice are $20 per unit respectively.The equilibrium quantities of wheat and rice are 10,000 units (per day) respectively.As the economic advisor of country Z, what would you advise the government of country Z. Whichproduct should they tax to obtain the fund to tackle the coronavirus situation? Discuss in detail using theModel of Demand and Supply (your answer should include two well labeled graphs).The supply of wigits is pefectly elastic and the demand for wigits has a price elasticity of 2 and an income elasticity of 1 (a) If income increases by 25 percent then the equilibrium quantity will_____(increase, decrease, not change) by_____percent and the equilibrium price will ____ (increase, decrease, not change) (b) If a 25 percent tax is imposed on wigits then the quantity consumed will_____(increase, decrease, not change) by____percent and the equilibrium price, inclusive of the tax, will increase by____ percent.If the purpose of a tax is to decrease the amount of a harmful activity, then the taxwould be most effective when the supply is ________ and the demand is ________A) elastic; elasticB) inelastic; inelasticC) elastic; inelasticD) inelastic; elastic

- The demand for salt is price inelastic and the supply of salt is price elastic. The demand for caviar is price elastic and the supply of caviar is price inelastic. Suppose that a tax of $1 per kilogram is levied on the sellers of salt and a tax of $1 per kilogram is levied on the buyers of caviar. Who would we expect to have to pay most of these taxes? Question 29Answer a. the sellers of salt and the sellers of caviar b. the buyers of salt and the buyers of caviar c. the sellers of salt and the buyers of caviar d. the buyers of salt and the sellers of caviarUse the concept of Price Elasticity of Demand to explain why the public policy recommendation of raising taxes on cigarettes causes State revenues to rise while also effectively deterring smoking among young people. Be sure to consider availability of substitutes and the effect of the percentage spent of each buyer’s budget when formulating a response. Who bears the brunt of the tax – the consumer or the producer? Are there any potential negative side effects of increasing taxes on cigarettes?Sally Henin has a price elasticity of demand for gasoline of -0.8. Her income elasticity for gasoline is 0.5. Sally's current income is $40,000 per year. Sally currently spends $800 per year on gasoline. The price of gasoline is currently $1.00 per gallon. a. A contemplated excise tax on gasoline will cause the price of gasoline to rise to $1.40. What impact will the tax have on Sally's consumption of gasoline? b. Since the purpose of the tax is only to discourage gasoline consumption, Congress is considering a $200 income tax rebate to lessen the burden of the gasoline tax. What impact will the rebates have on Sally's consumption of gasoline? c. Assume that both the tax and rebate are implemented. Will Sally be worse off or better off?

- based on the attached equation find:(a) Equilbrium price before the tax(b) Equilbrium quanity before tax1 Francesca buys pencils and erasers at 10$ and 9$ per amount. Francesca has an income of 90$. There is a 20% ad valorem tax. a)If Francesca’s utility is U(P, E) = P^(1/3)E^(2) find the ordinary demand without tax imposition. b) If Francesca’s utility is U(P, E) = P^(1/3)E^(2), Please find the ordinary demand with 20% ad valorem tax .Given: Qd = 800 - 4P Qs = 8P - 400 What is the equilibrium Quantity of good x