Financial And Managerial Accounting

15th Edition

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:WARREN, Carl S.

Chapter26: Capital Investment Analysis

Section: Chapter Questions

Problem 3CMA

Related questions

Question

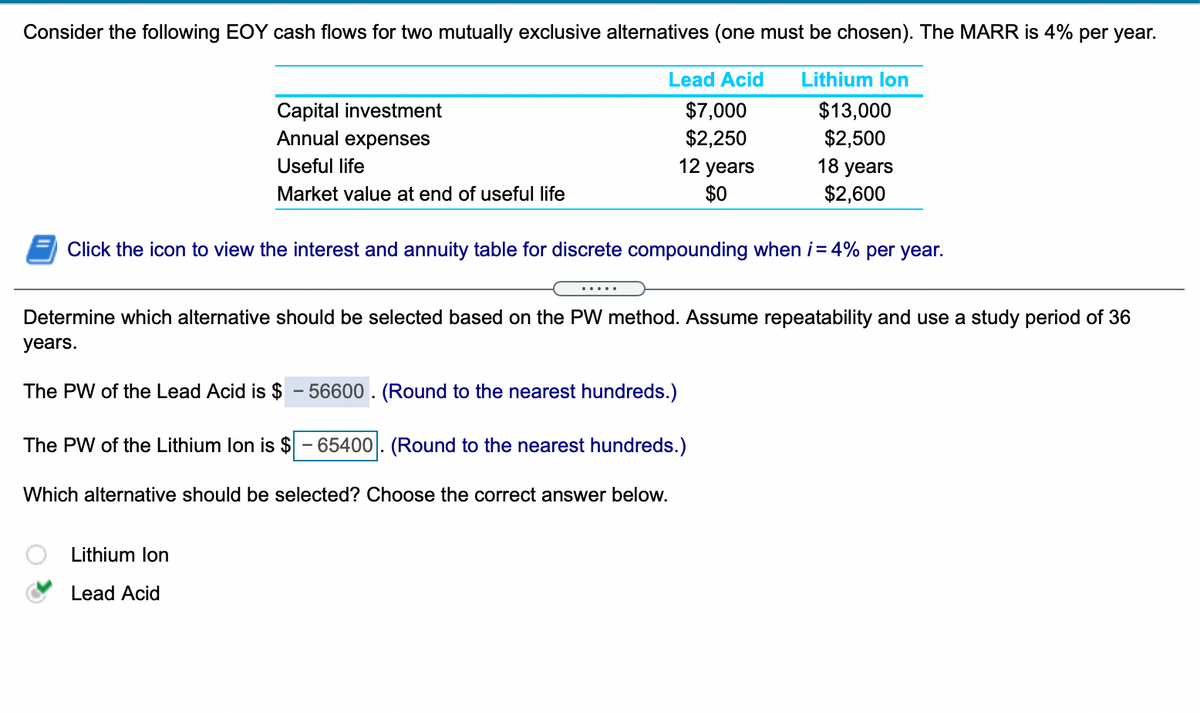

Transcribed Image Text:Consider the following EOY cash flows for two mutually exclusive alternatives (one must be chosen). The MARR is 4% per year.

Lead Acid

Lithium lon

Capital investment

Annual expenses

$7,000

$2,250

12 years

$0

$13,000

$2,500

18 years

$2,600

Useful life

Market value at end of useful life

Click the icon to view the interest and annuity table for discrete compounding when i= 4% per year.

Determine which alternative should be selected based on the PW method. Assume repeatability and use a study period of 36

years.

The PW of the Lead Acid is $ - 56600 . (Round to the nearest hundreds.)

The PW of the Lithium lon is $

65400. (Round to the nearest hundreds.)

Which alternative should be selected? Choose the correct answer below.

Lithium lon

Lead Acid

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Recommended textbooks for you

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning