Q: Should the project be accepted or rejected?

A: Payback Period: It is the period in which the project/investment initial cost is recovered. The…

Q: Is the project viable or not? Suggest reasons

A: The viability of a project is examined in a feasibility study to ascertain the likelihood of…

Q: Is Evaluating Design Alternatives essential to achieve the goals?

A: Design alternative is referred as when the underlying project, product is designed in different…

Q: What is meant by a “real option”?

A: Real option: It may be a selection made open to a firm's managers about the prospects for trade…

Q: What is the best-case scenario?

A: When companies are uncertain about the details of a project such as costs, inflows, interest rate…

Q: What are risk assessments?

A: Risk assessment means identification of risk faced by a business organization that hampers it from…

Q: Describe the Project selection rules under the IRR criterion?

A: IRR (Internal rate of return) is one of capital budgeting techniques which is used to evaluate the…

Q: How does the decision-maker use the scenario analysis?

A: Scenario analysis helps investors and analysts in making better decisions.

Q: What exactly does the term "FMS option" imply and what is its significance?

A: A flexible manufacturing system (FMS) can boost productivity and minimize production costs. Flexible…

Q: If you were given complete authority in the matter, how would you propose that GAAP should be…

A: Generally Accepted Accounting Principles (GAAP): A set of accounting principles, practices and…

Q: Define strategic options

A: Strategic option: Strategic option is referred as those chances of investment which is capitalized…

Q: What are the goals of the SEC?

A: Securities and Exchange Commission (SEC): SEC is a governmental agency that has the legal power, for…

Q: What are the Monroe plans?

A: Munroe Plan is a health care service organization that meets the needs of low-income as well as…

Q: What techniques can be used to analyze real options?

A: A choice accessible to the organization's managers related to the investment opportunities is known…

Q: What are threats and safeguards to independence?

A: American Institute of Certified Public Accountants (AICPA): It is an association of certified…

Q: key parties who can influence, or will be affected by, your decision?

A: All items that may be material to affect the true state of affairs of the financial statements…

Q: this project acceptable?

A: The return is the profit or loss that an investor anticipated on an investment. It is to be…

Q: What is the definition of "FMS option"?

A: Stock Option: An investor who purchases a stock option has the right, but not the responsibility, to…

Q: What is a strategic plan?

A: The question is based on the concept of Accounting Theory.

Q: What are Subsequent Events and what do they require?

A: Auditing: It is a systematic verification of the books of accounts of an organization by an…

Q: Is a good strategic plan detail-oriented?

A:

Q: What types of proposals might a reorganization plan include?

A: 1) Changes in the company's operations as a proposed plan: New product lines introduced,…

Q: What are the sources of pressure that change and influence the development of GAAP?

A: Generally Accepted Accounting Principles (GAAP): A set of accounting principles, practices and…

Q: What are some types of real options?

A: Real options is defined as a capital budgeting decision with which the management may make a future…

Q: What exactly does "FMS option" mean?

A: A flexible manufacturing system (FMS) is a production process that is designed from the ground up to…

Q: Explain Institutional Review Boards?

A: Under bureau tips, associate bunch assigned to audit and screen medicine exploration as well as…

Q: When does a project deny the merit consideration?

A: Project is assessed on the basis of various important considerations such as profitability, social…

Q: What is NBBO (National Best Bid and Offer)?

A: National Best Bid and Offer refers to regulation related to the Securities Exchange Commission (SEC)…

Q: Define the Make-or-Buy Decision?

A: A make or buy decision is to choose whether to manufacture the produce in-house or purchase it from…

Q: What is the make or buy decision?

A: Managerial accounting: Managerial accounting is more focused towards analyzing information and…

Q: Why might recognizing the existence of a real option raise, but not lower, a project’sNPV as found…

A: Real Options are rights which enable the management to take decisions regarding business…

Q: -which plan would you recommend?

A: A B 0-7 8 COST 200000 COST 140000 160000…

Q: What is frequency regarding the make or buy decision?

A: Make or Buy: Make or Buy decision are normal condition arises in front of management due to…

Q: What steps would be involved?

A: Arbitrage is the strategy applied by the investor to take the benefit of mispricing, at various…

Q: the future. Under these conditions, which of the following statements is most correct?

A: Answer :- option 4 The value of the stock can be found using DCF procedures by finding the present…

Q: isk with practical example

A: Political risk Political risk is the risk an investment's returns could suffer as a result of…

Q: . What is the economic and political environment in which standard setting occurs?

A: Definition: Accounting is primarily concerned with identifying, recording, measuring, summarizing…

Q: Define Conservatism.

A: Conservatism: Conservatism is an accounting assumption, it is as an approach used by the accountants…

Q: who is responsible for selecting and prioritising projects?

A: There is need to select the projects among all available projects because all projects can not be…

Q: What is plan sponsor?

A: A plan sponsor is an employer or a designated employee or organization or a designated party that…

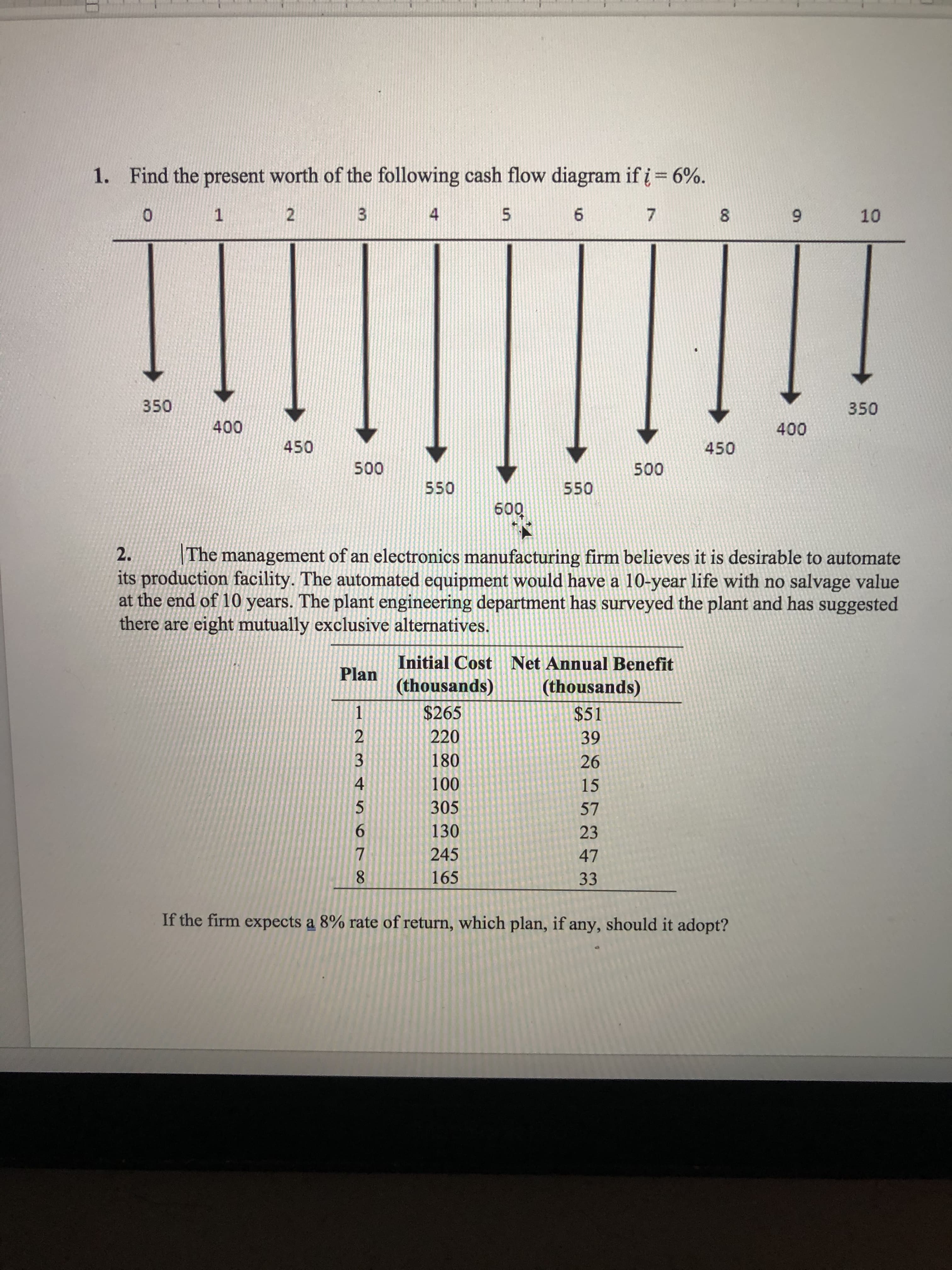

Question #2 please.

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 2 images

- "It is estimated that a certain piece of equipment can save $16820 per year in labor and materials costs. The equipment has an expected life of 6 years and no market value. If the company must earn a 4.77% annual return on such investments, how much could be justified now for the purchase of this piece of equipment? Draw a cash-flow diagram from the company s viewpoint." A) 157789.82 B 86004.7 C 154892.87 D 128687.86 E 178326.02Sunland, Inc. management is considering purchasing a new machine at a cost of $4,390,000. They expect this equipment to produce cash flows of $845,890, $819,250, $917,830, $1,103,400, $1,093,260, and $1,306,800 over the next six years. If the appropriate discount rate is 15 percent, what is the NPV of this investment? (Enter negative amounts using negative sign e.g. -45.25. Do not round discount factors. Round other intermediate calculations and final answer to 0 decimal places, e.g. 1,525.) The NPV is $enter the NPV in dollars rounded to 0 decimal placesKingston, Inc. management is considering purchasing a new machine at a cost of $4,150,315. They expect this equipment to produce cash flows of $756,424, $834,614, $932,657, $1,071,731, $1,298,352, and $1,243,375 over the next six years. If the appropriate discount rate is 15 percent, what is the NPV of this investment? (Enter negative amounts using negative sign e.g. -45.25. Round answer to 2 decimal places, e.g. 15.25.) The NPV is $ _____________

- 2. Clayton Corporation recently purchased a new machine for $307,890 with an eight-year life. The old equipment has a remaining life of eight years and no disposal value at the time of replacement. Net cash flows will be $90,000 per year. What is the internal rate of return? a) 24% b) 29%c) 33%d) None of the aboveLast year, company Z invested £10m to develop a new software. However, all of its customers have now switched to a different operative system that is incompatible with Z's software. It is estimated that upgrading the software to make it compatible will cost £5m. The company should upgrade the software if the present value of the future stream of cash flows generated by the project is larger than (in £m) A. 15(1+r) B. 10(1+r) C. 10(1+r)+5 D. 5Bunnings Ltd is considering to invest in one of the two following projects to buy a newequipment. Each equipment will last 5 years and have no salvage value at the end. Thecompany’s required rate of return for all investment projects is 8%. The cash flows of theprojects are provided below.Equipment 1 Equipment 2Cost $186,000 $195,000Future Cash FlowsYear 1Year 2Year 3Year 4Year 586 00093 00083 00075 00055 00097 00084 00086 00075 00063 000Required:a) Identify which option of equipment should the company accept based onProfitability Index? b) Identify which option of equipment should the company accept based ondiscounted pay back method if the payback criterion is maximum 2 years? Do not use excel calculations

- A management company is considering purchasing a $27,000 machine that would reduce operating costs by $7,000 per year. At the end of the 5 years of the machine's useful life, it will be zero salvage value. The company requires a rate of return of 12%. 1. Determine the net present value of the investment of the machine? 2.What is the difference between the total, undiscounted cash inflows and cash outflows over the entire life of the machine?Barry Inc. is considering a project that has the following cash flow and WACC data. What is the project's MIRR? WACC = 11.85% Year 0 1 2 3 4 5 CFs -$52,300 8,290 16,580 24,870 33,160 41,450 A. 21.40% B. 22.76% C. 20.71% D. 28.00% E. 18.89%E7.7 (LO 3, 4), AP Shruti Shrills is considering an expansion of one of its existing buildings to add more manufacturing space for its kid-friendly noisemakers. Several possible scenarios exist for future cash flows, as follows. 1. Construction costs of $500,000; steady sales and costs each year, netting to an annual operating cash inflow of $70,000; the expansion would have no salvage value at the end of its 10-year useful life (the building would be repurposed for a different product).2. Construction costs of $500,000; rising and then falling net cash flows each year for 10 years, as follows: $50,000 for the first 2 and last 2 years, $175,000 for years 3–5, and $100,000 for years 6–8.3. Construction costs of $700,000; no cash flows in year 1, $75,000 in years 2 and 3, $150,000 in year 4, $100,000 in years 5–8, and $50,000 in the last 2 years.Required 1. Calculate the simple payback period for all three scenarios.2. Assume that Shruti will only accept investments with a payback period…